- KPMG LLP has announced layoffs within its U.S. audit workforce, cutting about 330 positions.

- Why? Over-staffing caused by an unexpected twist: low employee turnover!

- And people are refusing to resign voluntarily!

- Or can we call it unstructured hiring?

KPMG US’s layoff spree

KPMG announced a reduction of roughly 4% of its 9,000 U.S. audit division workforce, a Bloomberg report.

KPMG generated $3.7 billion in audit revenue in 2023. This decision was not about declining revenues in the audit segment, as one might think.

Instead, it is KPMG’s response to an unusual situation; a historically low employee turnover.

Yes, people are refusing to resign voluntarily!

Who is getting the pink slip?

The cuts target associate and manager-level positions. However, Partners remain unaffected.

Not the first layoff in 2024

These layoffs come after a prior round of job reductions in March, focused on advisory staff.

KPMG is not the only Big 4 to hand out these pink slips. PwC’s U.S. division cut 1,800 positions across various service lines, in response to shifting client demands.

Why cut jobs in a growing division?

One can blame this lower attrition on the hiring surges during the pandemic, causing overstaffing.

KPMG emphasized that these adjustments are necessary to “align the size, shape, and skills” of its workforce with current market conditions.

A broader trend: Layoffs in Big 4

KPMG is not alone in facing these staffing challenges.

Other Big 4 firms, like PwC, have also recently implemented workforce reductions.

Why?

- Deloitte, Ernst & Young, and PwC have all reported slower growth this year, mirroring the pressures felt across the Big Four.

- The slowdown in demand is particularly acute in advisory services, as corporate clients reduce spending on deal-related services.

Impact of AI and technology

- The role of AI is expected to reshape the workforce, including divisions like auditing and accounting practices.

- A survey from Source Global Research found that 59% of U.S. and U.K. companies believe AI will reduce the number of accounting graduates needed.

- AI tools promise efficiency but may lead to fewer traditional audit roles.

- Audit firms see AI as an opportunity for employees to acquire new skills, although the technology is likely to replace some of the routine work.

KPMG US leadership

Chair and Chief Executive Officer: Paul Knopp

Chief Marketing Officer: Lauren Wagner Boyman

Chief Data Officer for KPMG US Advisory: Robert Parr

Chief Diversity Equity & Inclusion Officer: Elena Richards

KPMG US audit team

Tim Walsh, National Managing Partner – Audit Operations

Scott Flynn, Vice Chair – Audit

Dana Foote, Audit Head of Markets

Thomas Mackenzie, Audit Chief Technology Officer

Christian Peo, National Managing Partner-Audit Quality & Professional Practice

Rebecca P Sproul, Audit Talent and Culture Leader

KPMG International leadership

Bill Thomas, Global Chairman and CEO

Larry Bradley, Global Head of Audit

Gary Wingrove, Chief Operating Officer

Carl Carande, Global Head of Advisory

Nhlamu Dlomu, Global Head of People

Lisa Heneghan, Global Chief Digital Officer

Jane Lawrie, Global Head of Corporate Affairs

Global Head of Clients & Markets: Regina Mayor

David Linke, Global Head of Tax & Legal Services

Paul Korolkiewicz, Global Head of Quality, Risk & Regulatory

Melissa Hardaway, Global Chief Administrative Officer & Global Chief Financial Officer

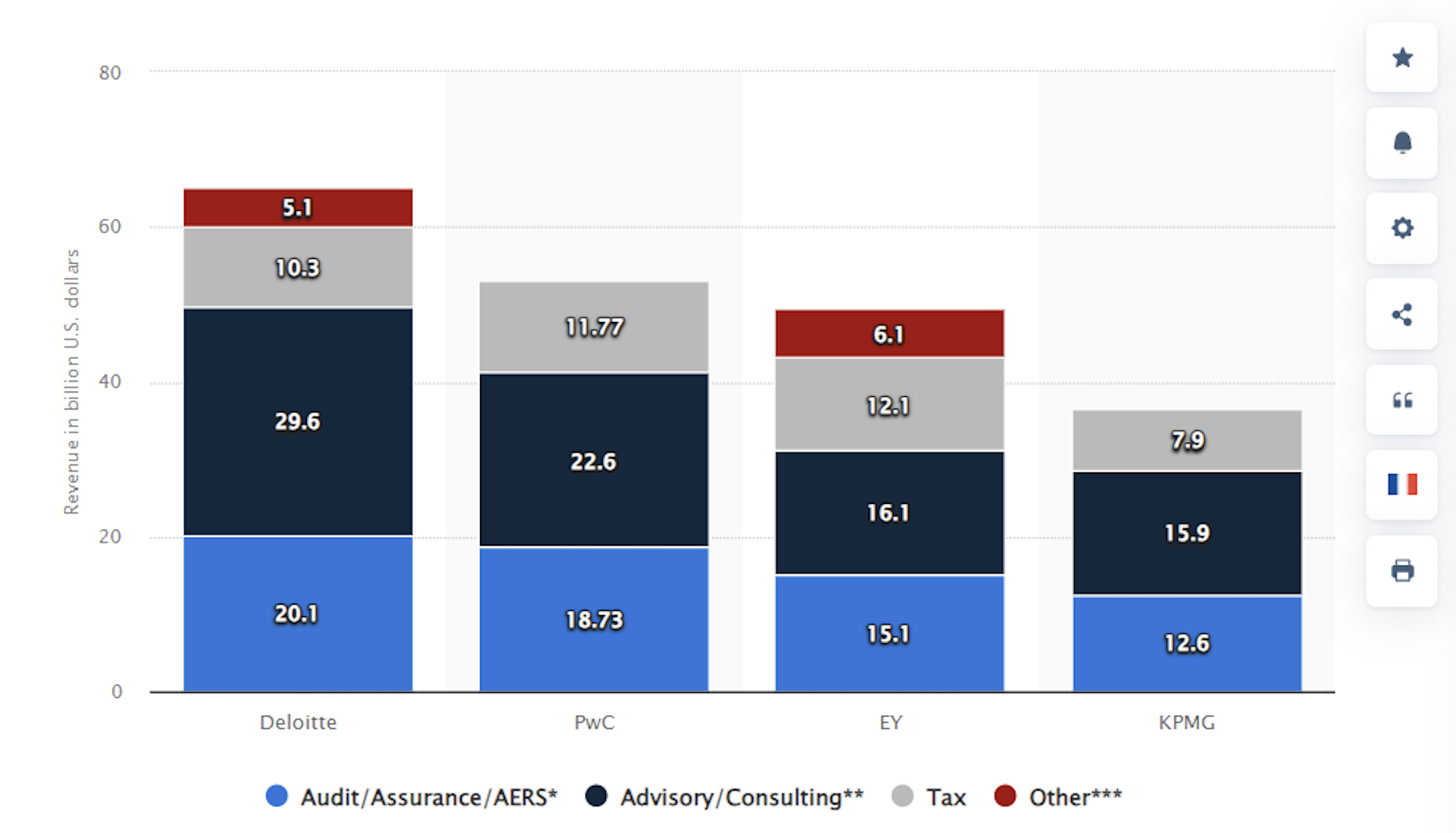

Big 4 global revenue FY2022-FY2023

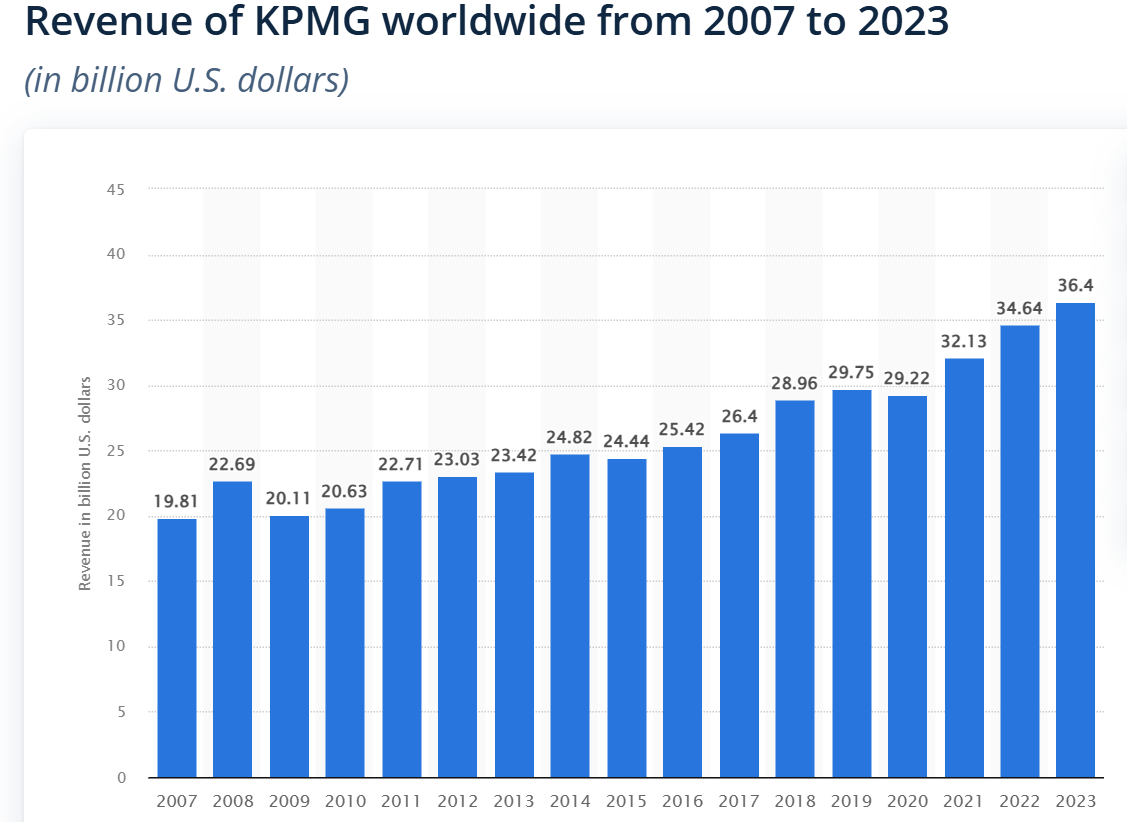

KPMG

- FY23: $36 billion

- FY22: US$35 billion

EY

- FY23: US$49.4 billion

- FY22: US$45.4 billion

PwC

- FY22: US$50.3 billion

- FY23: US$53.1 billion

Deloitte

- FY22: $59.3 billion

- FY23: US$64.9 billion

What next?

The firm remains committed to investing in its people to grow its business with quality, even as it adapts to a rapidly changing landscape.

Looking ahead audit firms may increasingly rely on:

- Advanced analytics

- Automation

- Workforce flexibility to meet evolving client needs.

As AI transforms audit tasks, staying current with technology can offer a competitive edge.