- Figma, the cloud-native design darling, is knocking on the IPO door.

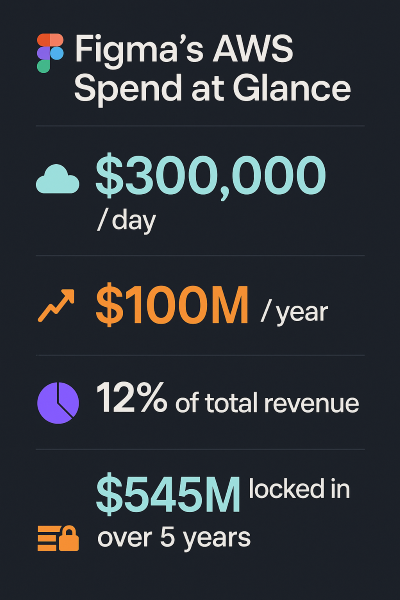

- But what’s caught the eye of CFOs worldwide isn’t just its meteoric growth — it’s the staggering $100Mn a year bill Figma pays to Amazon Web Services (AWS).

- That’s nearly 12% of its total revenue.

- If Figma’s $100M AWS bill teaches us anything, it’s this: cloud spending is no longer “just a tech problem”.

Cloud’s Flexibility comes at a steep price

Figma made headlines in 2022, when Adobe attempted to acquire it for $20 billion (a deal later called off).

Its S-1 filing revealed:

- $300,000 spent per day on AWS

- $100 million annually — almost 12% of its $821 million revenue

And it doesn’t stop there.

Figma is now contractually locked into spending $545 million on AWS over the next five years.

Yes, total cloud dependency

Figma’s business runs entirely on AWS.

According to its IPO filing, it relies on Amazon for:

- Compute power

- Storage and bandwidth

- Security infrastructure

- Product delivery

The company also admitted in its filing:

A major outage or policy change at AWS could severely impact its operations

Their tech stack is so deeply integrated into AWS that switching providers is not realistic

In short, they’re all in on cloud — and exposed. With No Plan B.

Related Articles: Most CFOs have their head in the cloud and are finding ways to utilize the cloud effectively

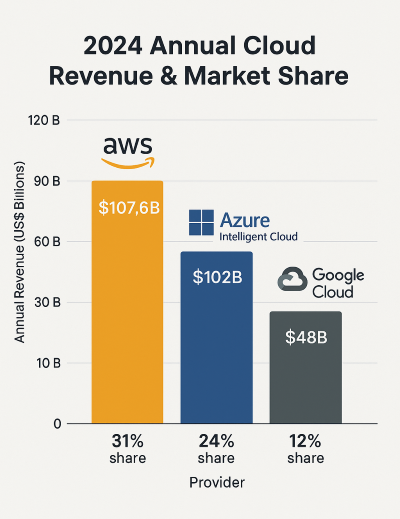

It’s not just Figma: Cloud costs are rising

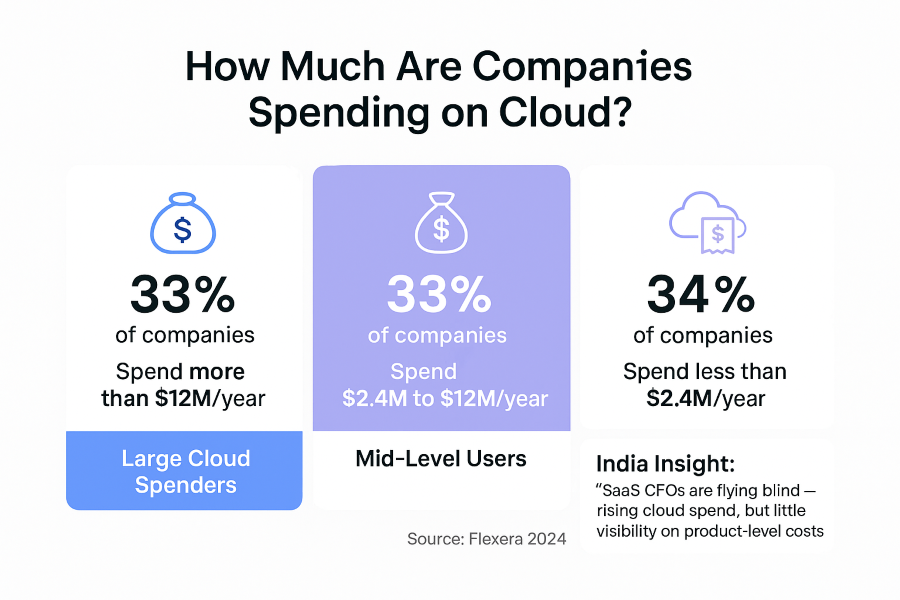

According to Flexera’s 2024 State of the Cloud Report:

33% US companies (1 in 3) now spend $12 million+ per year on cloud platforms like AWS, Microsoft Azure, and Google Cloud.

And this trend isn’t limited to the US.

Indian SaaS and tech-enabled companies are increasingly cloud-dependent, often without clear visibility into who owns what spend.

The consequence? A creeping erosion of margins buried in complex cloud bills few truly understand.

The Great “Cloud Reversal” is already underway

- 37signals (Basecamp) left the cloud in 2022, cutting $2 million annually by shifting to its own servers, and plans to ditch AWS S3 to save even more.

- Dropbox built its own “Magic Pocket” data infrastructure between 2016 and 2018, slashing AWS spend by tens of millions. They still use AWS for spikes but own most of their data.

- Giants like Meta and Apple operate massive private data centers, blending cloud services selectively rather than relying fully on public cloud.

- Even Zoom is shifting gears — expanding its own data centres while continuing limited cloud use — a hybrid strategy to optimise costs and margins.

The India Angle: What CFOs need to know about Cloud

If you think, “We’re not Figma or Dropbox, this isn’t our problem,” think again.

Many Indian mid-market companies — especially in SaaS, fintech, and D2C — are heavily reliant on cloud infrastructure, often “without granular visibility into usage, pricing tiers, or overprovisioning”.

Worse? The finance team is rarely in those conversations.

Here’s what that leads to:

- Surprise renewals with huge jumps

- No tracking of unit economics per product or client

- Hidden margin erosion due to a lack of cloud cost control

- Long-term vendor lock-in with no easy exit path

- Underutilised tools that are still billing monthly

- No accountability for cloud usage by teams

Wrapping up…

Cloud flexibility is real, but so is its price tag.

And cloud bills aren’t going down anytime soon.

- Get your cloud spend under the microscope.

- Talk to your tech teams.

- Demand transparency.

- Negotiate hard.

- And consider whether owning infrastructure or a hybrid approach might better protect your margins in the long run.

Yes, Cloud economics must now be part of every CFO’s toolkit.

FAQ

Q: What is Cloud Migration Reversal?

It’s when a company moves some or all of its IT workloads, applications, or data from public cloud platforms (like AWS, Azure, Google Cloud) back to on-premises infrastructure or private/hybrid cloud environments.

37signals (parent of Basecamp and HEY) moved off the cloud in 2022 and claimed to have saved over $1 million/year.

Even though “moving to the cloud” was a major trend, now some companies are going backwards, due to:

1. Cost overruns

2. Performance needs

3. Vendor lock-in

4. Data sovereignty & security

5. Customization and control