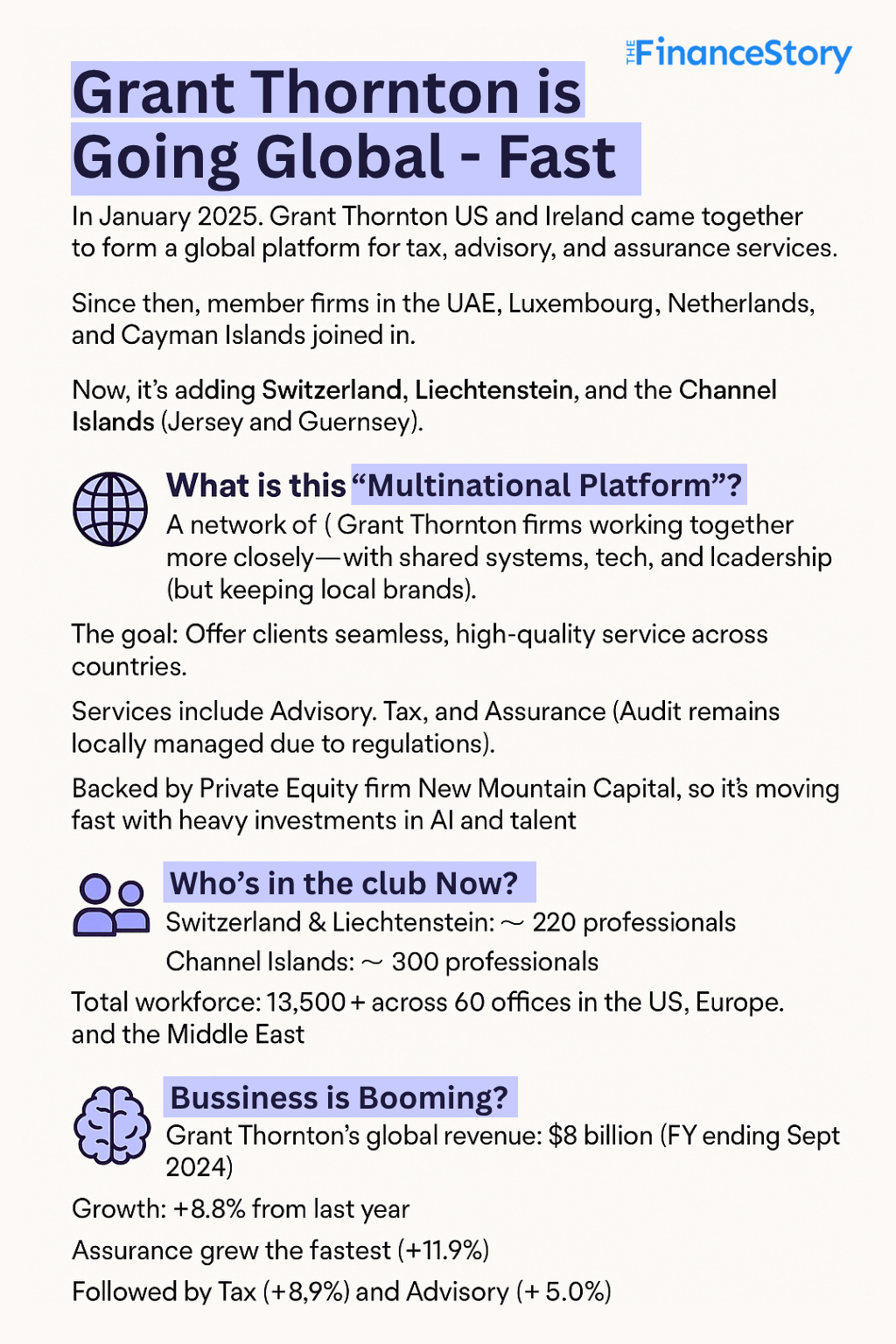

- In January 2025, Grant Thornton US quietly launched a “Multinational Platform “— and it’s growing faster than anyone expected.

- Backed by private equity, Grant Thornton (US) and Grant Thornton Ireland kicked it off.

- Since then, Grant Thornton UAE, Luxembourg, the Netherlands, and the Cayman Islands have come on board.

- And now, with Switzerland, Liechtenstein, and the Channel Islands joining, the platform is gaining serious global momentum.

The story starts in the U.S.

Back in March 2024, Grant Thornton US made a surprising move….they sold a significant stake to private equity firm New Mountain Capital.

This wasn’t just about money—it was a clear sign Grant Thornton US wanted to GO GLOBAL and FAST by:

- Speeding up cross-border growth (Acquiring GT sister firms)

- Investing in AI and automation

And this is exactly what they did!

By January 2025, they took the next big step — Grant Thornton US acquired the advisory and tax business of Grant Thornton Ireland. (FYI, Grant Thornton UK sold a majority stake to private equity firm Cinven)

This deal, backed by New Mountain, gave birth to something new — Grant Thornton Advisors LLC — a powerful transatlantic advisory and tax platform, aka Grant Thornton Multinational Platform.

Since then, the platform has been growing quickly.

In just six months, the platform added:

- Grant Thornton UAE

- Grant Thornton Netherlands

- Luxembourg

- Cayman Islands

And in June 2025:

- Switzerland & Liechtenstein (220 professionals)

- Channel Islands (Jersey & Guernsey) 300 professionals

So… what’s GT Multinational Platform all about?

So… what’s GT Multinational Platform all about?

Grant Thornton’s multinational platform (launched in 2025) brings together independent member firms under one umbrella.

The goal? Make clients’ lives easier with one smooth, global experience — no vendor headaches.

Grant Thornton member firms get:

- Seamless client experience across jurisdictions

- Technology investments that allow faster, smarter service

- Integrated cross-border tax and advisory services, while audit remains regulated locally

This isn’t a traditional merger:

- Only advisory and tax services are combined

- Audit remains independent and local due to regulations

- Member firms keep their own brands and leadership

- They operate with shared governance, technology, and strategy

Right now, the platform is packing a punch with:

- 13,500+ professionals

- 60 offices

- A footprint that’s booming across the Americas, Europe, and the Middle East

Facts and stats

Grant Thornton now operates in 147 markets with a global team of over 73,000 professionals.

In FY24 (ending Sept 2024), GT International hit $8 billion in global revenue, growing +8.8% YoY — the fastest among the top mid-tier firms.

They were closely followed by BDO (+7%) and RSM (+6%), showing strong momentum across the board.

Nearly two-thirds of GT firms (102 firms) crushed it with double-digit growth.

Top markets?

- India: +25%

- Germany: +17.6%

- Canada: +11.5%

- Netherlands: +10.8%

- Ireland: +10.3%

And in the US…

Grant Thornton US pulled in $2.4 billion in FY23 revenue.

FY24 numbers are awaited, but across the Americas, they brought in $3.6 billion — a solid 7% YoY growth across 30+ markets.

Top global accounting networks by revenue (2023–24)

| Rank | Network | Fiscal Year | Global Revenue | YoY Growth |

|---|---|---|---|---|

| 1️⃣ | Deloitte | FY to May 2024 | $67.2 B | +3.6% |

| 2️⃣ | PwC | FY to June 2024 | $55.4 B | +3.7% |

| 3️⃣ | EY | FY to June 2024 | $51.2 B | +3.9% |

| 4️⃣ | KPMG | FY to Sept 2024 | $38.4 B | +5.4% |

| 5️⃣ | BDO | FY to Sept 2024 | $15 B | +7% |

| 6️⃣ | RSM | FY to Dec 2024 | $10 B | +6% |

| 7️⃣ | Grant Thornton | FY to Sept 2024 | $8 B | +8.8% |

| 8️⃣ | Crowe Global | (2023 data) | $5.8 B | — |

| 9️⃣ | Baker Tilly Int’l | (2024 data) | $5.6 B | — |

| 🔟 | Forvis Mazars | FY to Aug 2024 | $5.2 B | — |

Wrapping up…

The Big 4 accounting firms still dominate (67% market share), but they face growing challenges: tighter regulation, pressure to innovate, and clients seeking more cost-effective solutions.

This opens a door for mid-tier firms like Grant Thornton, BDO, and RSM to step up with tech-enabled, flexible services.

The message is clear: Mid-tier isn’t just rising, it’s reshaping the future of global accounting.

Meanwhile, the Big 4 aren’t standing still. Rumours of KPMG’s “Project Himalaya”, a major merger of advisory units across the US, UK, and India, signal more big moves ahead.

The accounting world is in motion, and we can’t wait to see how the next chapter unfolds!