- KPMG Australia made further job cuts in FY 2024–25, eliminating 635 jobs, including 21 partners.

- Meanwhile, equity partners enjoyed a 10.3% pay bump, pushing their average past $715,000.

- According to The Australian, CEO Andrew Yates got a $790,000 raise.

- In FY 2025, KPMG Australia’s revenue did face a slight drop of 4%.

The layoff story

In 2024, KPMG Australia laid off about 200 senior consulting roles, roughly 5% of its 4,000-strong advisory crew.

About 50 of those professionals dodged the exit by landing new roles inside the firm.

The reason? The leaders called it part of an $80 million cost-cutting and tech overhaul.

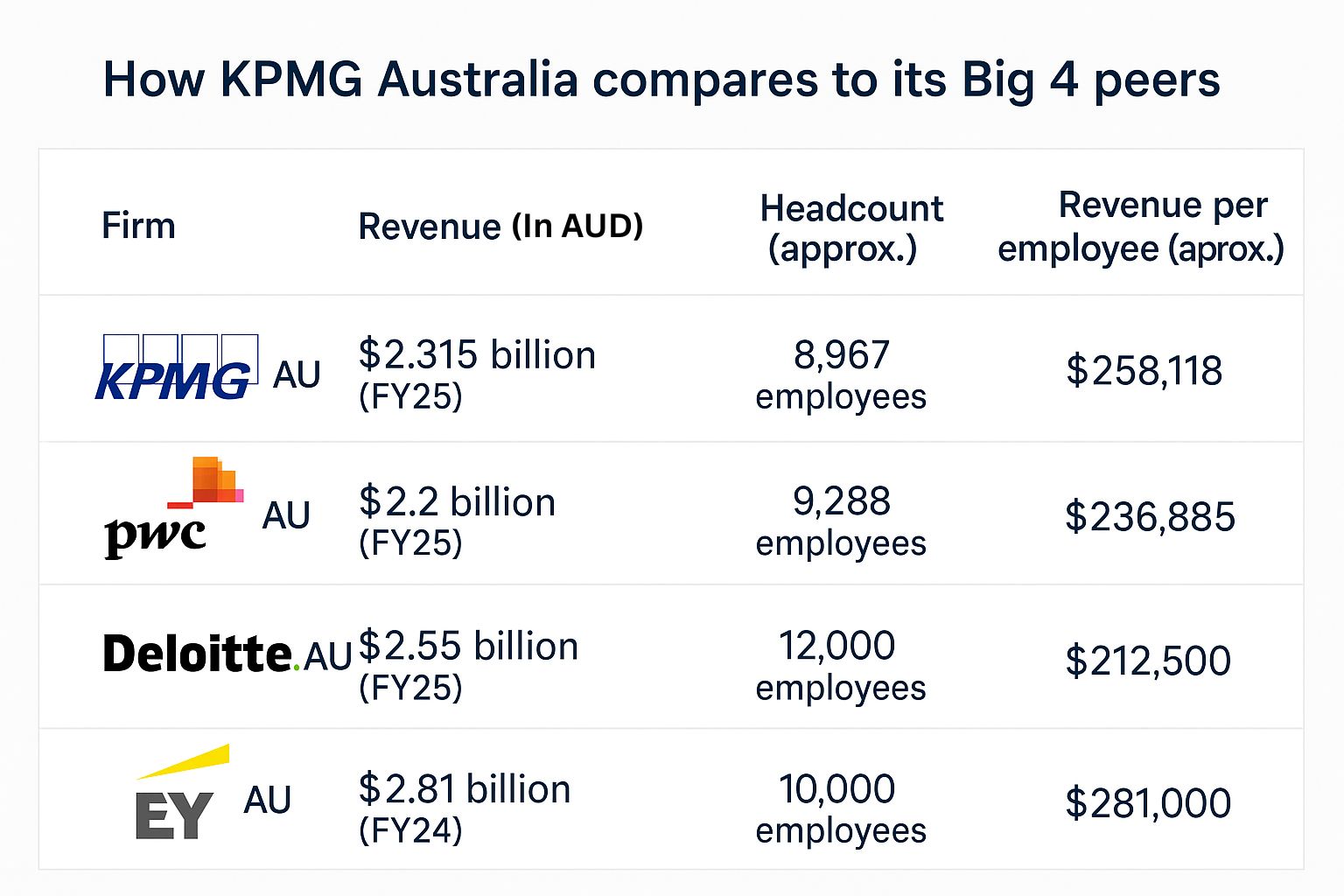

But FY25 saw the firm going deeper: 635 roles cut, reducing headcount to about 8,967.

Yet, it’s not all bad news

KPMG Australia also welcomed:

- 637 fresh graduates

- 71 newly minted Partners (now total Partners is 684)

So the firm is still investing in fresh talent and leadership.

Also read: Big 4 replace graduate roles with AI & Offshoring?

But why the KPMG Australia layoff?

KPMG Australia saw a small drop in revenue from AUD 2.386 billion in FY24 to AUD 2.315 billion in FY25 (around 4%)

FY25 Revenue breakdown

- Audit & Assurance: $365 million

- Consulting: $749 million

- Deal Advisory & Infrastructure: $332 million

- Enterprise: $434 million

- Tax & Legal: $240 million

- Other (including KPMG Futures): $11 million

Slump in consulting demand: With fewer organisations seeking large-scale advisory work, the firm has been forced to streamline operations for a tougher market environment.

Weaker government consulting budgets and sector-wide scrutiny (particularly following the PwC tax leak scandal) have intensified pressure on the advisory pipeline.

AI at the core: In the FY25 Impact Report, the firm also mentioned that it’s adapting to fast-changing market conditions with a refreshed, firmwide strategy…With none other than AI at its core.

And let’s not forget Offshoring: KPMG, like other Big 4s, are leaning more on offshore teams and tech-powered efficiency.

A key driver of this shift is KPMG Global Services (KGS) India. KGS’s talent pool helps KPMG’s global member firms by delivering consistent, high-quality work at competitive costs.

Wrapping up…

KPMG Australia’s layoffs highlight the mounting challenges facing consulting firms worldwide.

A cooling market, rising cost pressures, and the “urgent push toward AI and offshoring” are forcing a complete rethink of the playbook.

Also read: KPMG US & UK acquire 33% stake in KPMG Global Services (KGS) for $210Mn!

Q: How much revenue did KPMG Australia generate in 2025?

KPMG Australia reported an annual revenue of $2.315 billion in FY25. That was a slight decline from last year’s revenue ($2.386 billion), as demand for advisory services weakened in both the private and public sectors.

Q: What is KPMG KGS?

KPMG Global Services (KGS) is a strategic global delivery organisation providing services to KPMG member firms across the world. KGS has a significant presence in India, with offices in multiple cities like Bengaluru, Gurugram, Hyderabad, Mumbai, Kochi, Noida, Kolkata, and Pune.

Q: Does KPMG KGS cater to KPMG Australia, too?

Yes. KGS, specifically KPMG Global Services India, provides support to over 50 KPMG firms globally, including those in Australia. They offer a range of services, including Deal Advisory & Strategy, and other advisory, tax, and audit support.

(Source: The Australian, via the internet)