- Deal alert: KPMG US & UK shelled out a whopping $210 million (almost ₹1,800 crore) to acquire a 33% stake in KPMG Global Services (KGS) from KPMG India.

- This marks the first-ever time a Big Four firm has sold off its captive (in-house) operations in India.

- Sale could reshape outsourcing models and impact the Big Four’s global strategy.

What is KPMG Global Services (KGS)?

KPMG India is a member firm of KPMG International, providing audit, tax, and advisory services directly to clients within India.

Engages in client-facing roles, offering services tailored to the Indian market. Operates as a traditional professional services firm, similar to KPMG firms in other countries.

KPMG Global Services (KGS), on the other hand, is a strategic global delivery organisation that functions as a shared services centre. It primarily serves KPMG firms in the US, UK, and other countries and not direct clients in India.

KGS was established in 2008 and supports more than 50 KPMG member firms worldwide.

Think of KGS as the backbone of KPMG’s global operations—handling a huge volume of work quietly, efficiently, and mostly from India.

KGS has been a major asset for KPMG India, enabling global exposure, cross-border collaboration, and steady revenue from international projects.

With a workforce of over 14,000 professionals, KGS is based primarily in India and plays a crucial role in KPMG’s global delivery model.

Services KGS provides

It offers a wide range of services, including:

- Audit – support for statutory and internal audits

- Tax – global tax compliance and advisory assistance

- Consulting – research, analytics, and advisory support

- Technology – tech solutions, automation, and digital innovation

Who owns KPMG Global Services?

Until now, ownership was split three ways:

- KPMG India

- KPMG US

- KPMG UK

But it was KPMG India that managed and operated KGS, making key decisions, hiring leadership, and driving its strategy.

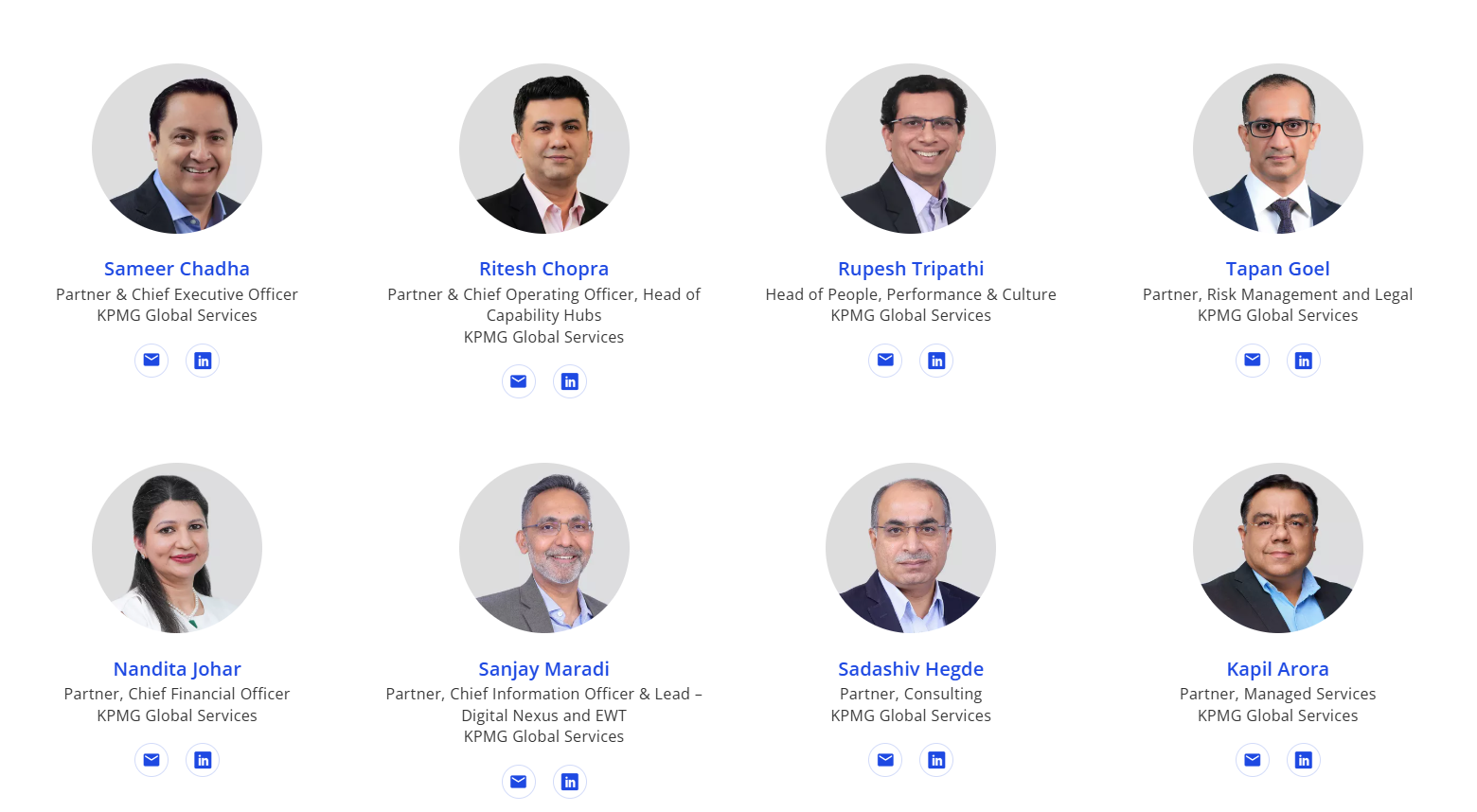

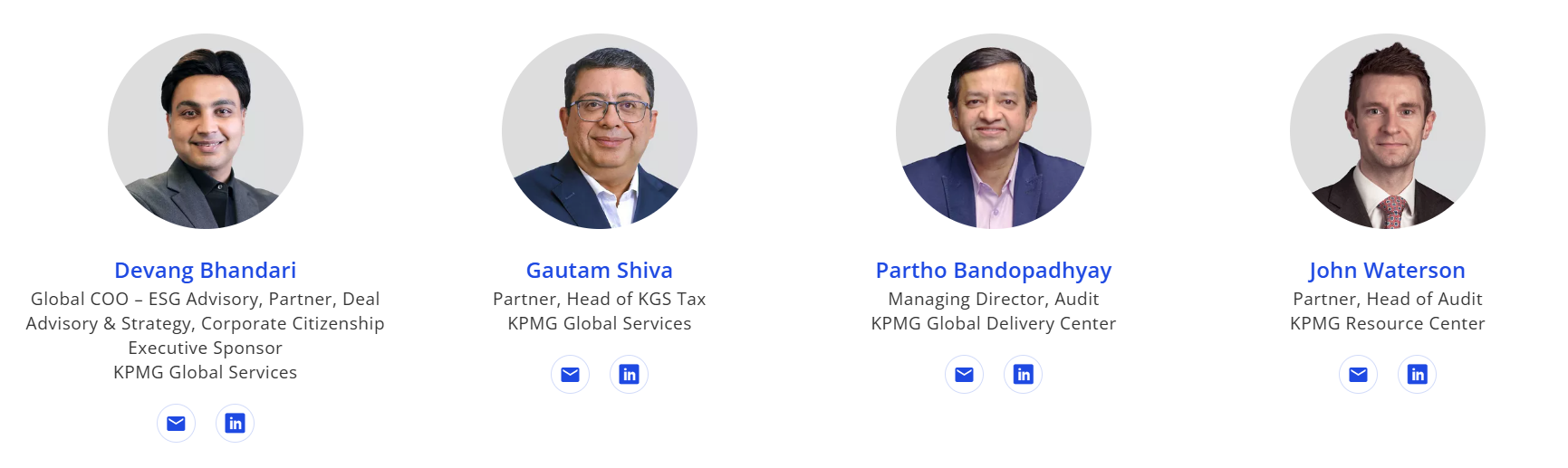

KPMG KGS leadership

The leadership of KGS India includes:

- Sameer Chadha as the Partner & CEO

- Ritesh Chopra, COO & Head of Capability Hubs

What next?

What next?

KPMG KGS India has officially handed over its management rights to KPMG US and UK by selling a 33% stake.

Now, with this buyout, the operational control shifts fully to KPMG US and UK.

While it means losing control over a major delivery hub, it also gives KPMG India the money and flexibility to reinvent itself.

A big bet, big bucks, and big changes. Let’s see how it plays out.

Why sell it?

Insiders say the move sparked a lot of discussion among KPMG India partners.

On the one hand, the sale brings in instant cash—hello, ₹1,800 crore!

On the other hand, India loses a major asset and its regular share of revenue from global projects run via KGS.

KPMG India is planning to:

- Boost partner salaries to match what competitors are offering

- Expand the number of partners – more people, more growth

- Upgrade their internal operations – better tools, better service

It’s all part of their strategy to level up and stay competitive with bigger rivals like EY, PwC, and Deloitte.

Also read: KPMG hiring just got smarter — thanks to ‘Kai’, their AI recruiting assistant

Big 4 global revenue

In 2024, the Big Four firms earned a record $212 billion! That’s an $8 billion jump in just a year!

However, KPMG has had its challenges, especially with high attrition rates and being the smallest Big Four firm ($38.4 billion in FY2024).