- “We need 30 lakh new CAs by 2047.” A bold vision made by former ICAI President Ranjeet Kumar Agarwal in 2024.

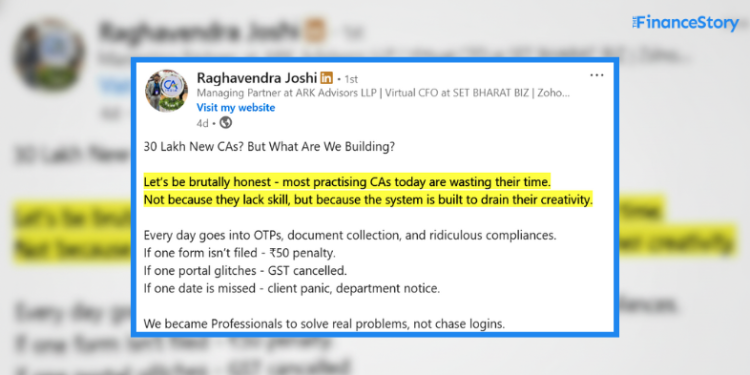

- But CA Raghavendra Joshi, Managing Partner at ARK Advisors, isn’t convinced.

- In a viral LinkedIn post, he asked a simple but piercing question: “What exactly are we (CAs in Practice) building?”

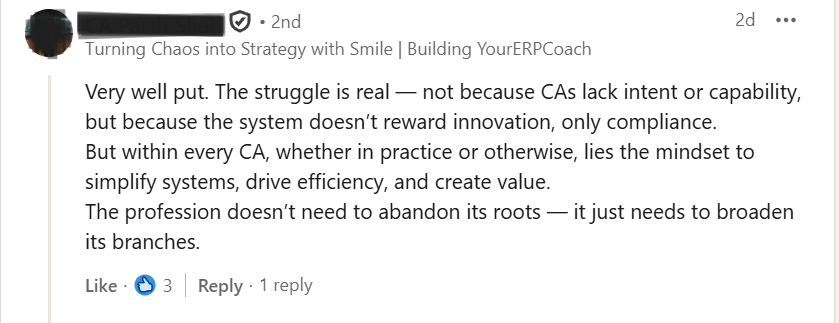

- According to him, most practising CAs today are wasting their time because the system kills creativity.

Number of CAs keeps rising…

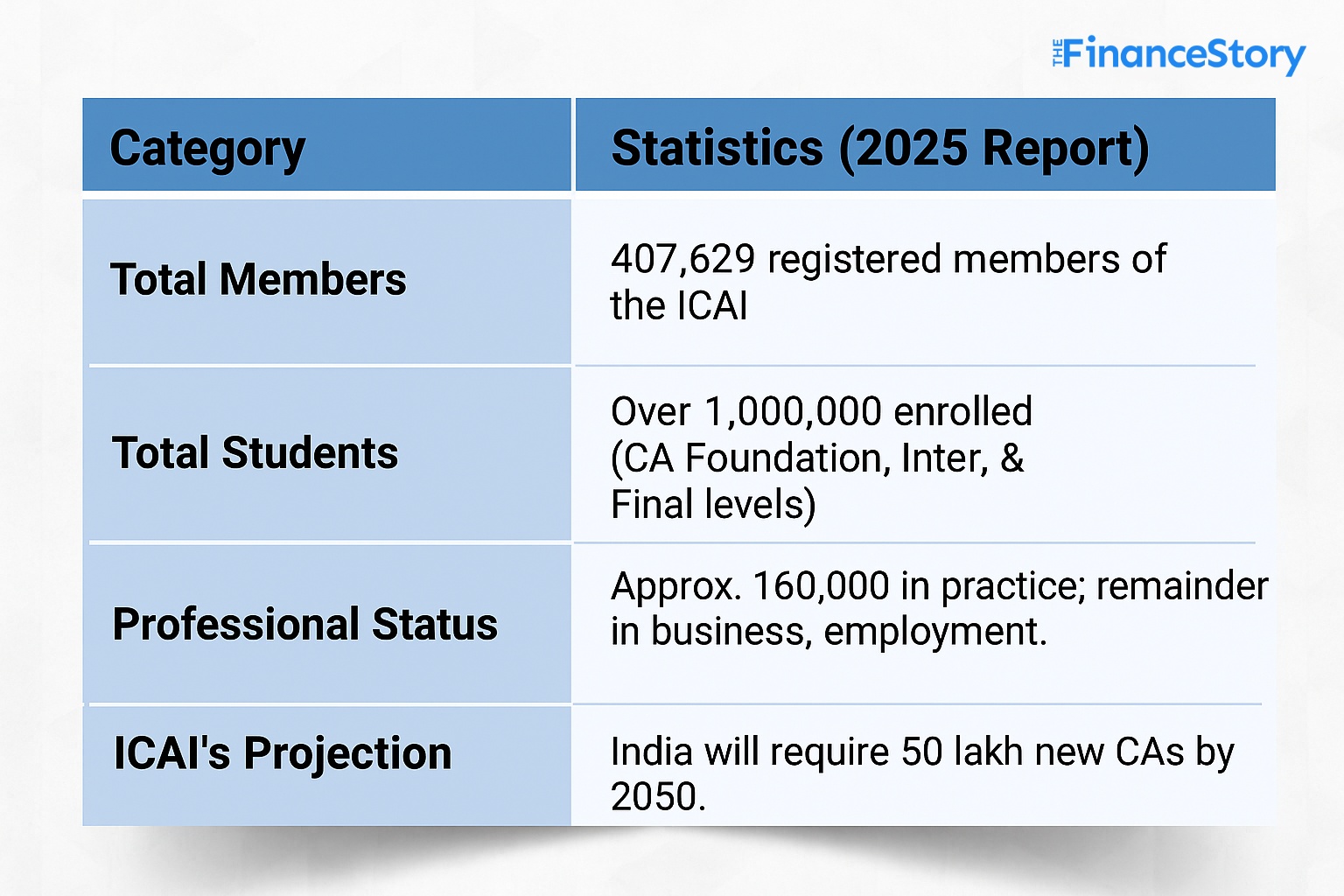

Did you know? Back in 1994, the total number of Chartered Accountants in India stood at around 60,000 – 70,000.

It was primarily due to the low pass percentage and the limited economic demand at the time.

Fast forward to 2025, there are 407,629 total members of the Institute of Chartered Accountants of India (ICAI)…Of this total, 159,557 hold a valid Certificate of Practice (COP).

This is great….

But for most CAs, work hasn’t evolved!

Raghavendra argues quantity ≠ progress.

“We became professionals to solve real business problems. But for many, CA practice has become a loop of deadlines, emails, and approvals.”

He pointed out that the system, as it stands, is built to drain creativity from practising chartered accountants.

Every CA knows the grind:

- Collecting documents. Chasing clients. Uploading attachments.

Only to watch the portal crash seconds before submission.

- Miss one form? ₹50 penalty.

- One glitch? GST registration cancelled.

- One missed date? Panic and notices.

It’s the kind of work, he says, that “kills innovation before it even starts.”

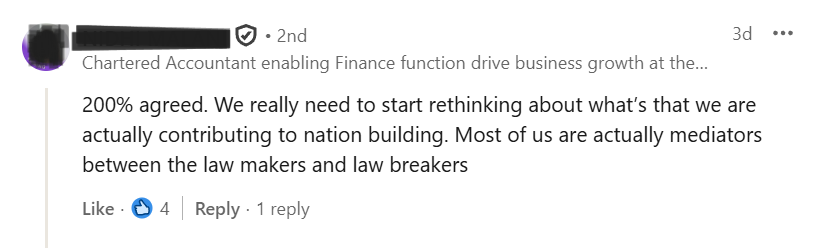

Is ICAI’s monopoly keeping firms afloat?

Remember, a few months ago, the ICMAI President publicly called for “Cost Accountants” (CMAs) to be included in the definition of “accountant” under the draft Income‑Tax Bill, 2025.

The CA community pushed back and eventually won!

But Joshi asks two uncomfortable questions:

- Was that really a victory?

- Or a warning bell for the profession?

He further added that a CA friend who transitioned into business once said something that really hit me hard:

“We’re surviving because of MONOPOLY.”

He was referring to how CA signatures remain mandatory for audits, UDINs, and certifications; a regulatory safeguard that keeps much of the profession relevant.

“Remove that, and many will be jobless,” he added.

Also read: Forensic Auditors in India may soon need to be Chartered Accountants?

The way forward?

CAs must move up the value chain!

How many CA firms have 100+ people doing work beyond filings?

He challenges CAs to focus on value creation, not form submission.

Be it,

- Advisory

- Audit

- Financial Due Diligence

- Tax

- Valuation

- Fund administration

- Outsourced CFO services

- M&A restructuring expertise

- Family office services

Also read: 31,946 New CAs qualified in 2024: ICAI aims for 30 lakh CAs!

Wrapping up…

Raghavendra’s post struck a chord because it wasn’t anti-CA. It was brutally honest.

Without statutory protection, large sections of the profession could collapse.

And while no one understands audits better than CAs, the world outside compliance is moving faster than ever.

FAQs

Q: What is the 2025 pass percentage for the CA Final examination in India?

The pass rate for the Institute of Chartered Accountants of India (ICAI) May 2025 session was:

- Group I: 22.38%

- Group II: 26.43%

- Both groups: 18.75%

For the November 2025 session:

- Group I: 24.66%

- Group II: 25.26%

- Both Groups: 16.23%

Q: What is the current distribution of CA firms in India by size and structure?

Sole proprietorship firms: There are 72,696 such firms in India, employing approximately 73,365 people.

Partnership firms/LLPs (2–3 partners): Around 21,750 firms operate under this category, employing 51,868 professionals.

Partnership firms/LLPs (4–5 partners): This segment includes 3,563 firms with a combined workforce of 16,931 people.

Partnership firms/LLPs (6+ partners): As of October 2025, there are 2,129 firms in this group, employing about 41,478 individuals.

Sole practitioners: As of early 2025, there are 3,791 sole practitioners registered across India.

Many CA are with working conspiring with gst govt peoples and providing irrelevant notices to businesses and threating them to freeze account and asking for money. What should a business people should do.

As a Chartered Accountant, I completely agree that our profession needs to move beyond routine compliance and focus more on value-driven advisory work. This article rightly highlights the need for innovation if we want the CA profession to stay relevant in the coming years.