- ICAI proposes mandatory certification for forensic auditors.

- To become a forensic or fraud investigation professional in India, you need: a CA qualification from ICAI + Completion of the Forensic Standards Course!

- In short, excluding professionals from fields like IT, law, management, human resources, management accounting, and company secretaries!

What’s happening?

ICAI’s compulsory qualifications & training framework

Until now, you didn’t need formal qualifications like a CA or CPA to be called a forensic auditor in India.

However, ICAI, in collaboration with the Ministry of Corporate Affairs (MCA) and the Securities and Exchange Board of India (SEBI), is refining guidelines to align with global best practices.

If the proposal is approved, here’s what you’ll need to do:

- Acquire a CA Membership from ICAI: Ensures auditors are recognized by a professional accounting body.

- Complete the Forensic Standards Course: This will cover essential topics like:

- Fraud detection techniques

- Digital forensics and data analysis

- Early warning indicators

- Investigative interviewing methods

Without these qualifications, you won’t be able to call yourself a forensic auditor.

What people on social media are saying

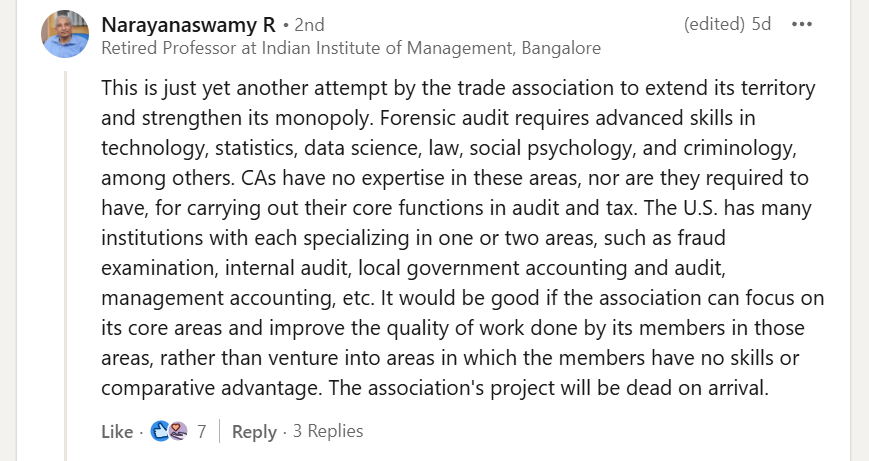

Narayanaswamy R, Retired Professor at IIM, Bangalore

“This is just yet another attempt by the trade association to extend its territory and strengthen its monopoly.

Forensic audit requires advanced skills in technology, statistics, data science, law, social psychology, and criminology, among others. CAs have no expertise in these areas, nor are they required to have, for carrying out their core functions in audit and tax.

The U.S. has many institutions each specializing in one or two areas such as

- fraud examination

- internal audit

- local government accounting and audit, management accounting, etc.

It would be good if the association could focus on its core areas and improve the quality of work done by its members in those areas, rather than venture into areas in which the members have no skills or comparative advantage. The association’s project will be dead on arrival.”

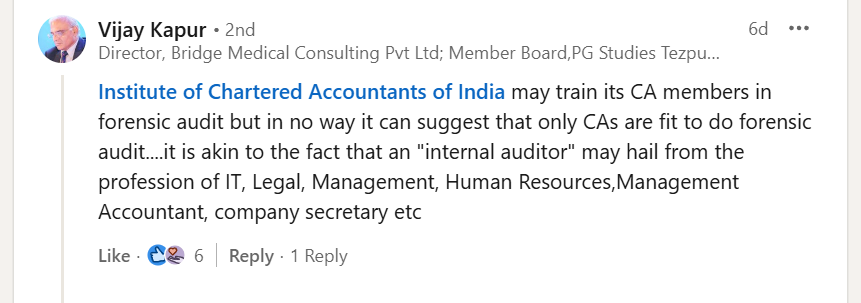

Vijay Kapur – Director, Bridge Medical Consulting

“Institute of Chartered Accountants of India may train its CA members in forensic audit but in no way it can suggest that only CAs are fit to do forensic audit….it is akin to the fact that an ‘internal auditor/ may hail from the profession of IT, Legal, Management, Human Resources, Management Accountant, company secretary etc”

Another person also mentioned,

“Similar to CISA, CIA etc. CFE is a globally recognised and reputed certification for forensic audit.

You don’t need ICAI’s blessings to become a forensic / fraud investigation professional.

Just join a Big4 and complete CFE, and you’ll have a globally rewarding career.”

Before that, what is a forensic auditor?

A forensic auditor is a financial expert who studies records to help with criminal investigations, focusing on crimes like fraud, extortion, and embezzlement.

Forensic Auditing vs. Forensic Accounting

Forensic Auditing

- Investigative work where we dive deep into processes to identify flaws and fraud-prone areas.

- Focuses on uncovering irregularities, making it more about investigation.

Forensic Accounting

- More about validation and presentation – such as preparing reports for courts of law or stakeholders.

- Deals with financial statements, ensuring their accuracy and providing an opinion on whether they give a true and fair view of the business.

- Accounting aims to validate compliance and identify any discrepancies in financial practices.

Challenges in the Forensic Auditing Landscape

- Forensic auditing in India faces several challenges, including the lack of a dedicated regulatory framework, judicial delays, and a shortage of skilled professionals proficient in advanced technological tools.

- These hurdles have led to reliance on broader legal mandates under the Companies Act, SEBI regulations, and RBI guidelines, making it essential for the ICAI to step in with clearer standards.

What is the qualification for a forensic auditor in the US or UK?

- A bachelor’s degree in accounting, finance, or a related field is essential.

- Forensic Accounting degrees are available in the US, South Africa, and the UK.

- Key certifications for forensic accountants in the US:

- Certified Fraud Examiner (CFE) from ACFE

- Certified in Financial Forensics (CFF) from AICPA

- Additional certifications that may be required:

- CPA (Certified Public Accountant)

- Chartered Accountant

- Certified Anti-Money Laundering Specialist (CAMS)

- Certified forensic accountants earn 25% more on average than their uncertified peers.

Also read: EY Partner’s return to India paid off. Growing demand for Forensic Accountants

What is a CFE?

The Certified Fraud Examiner (CFE) credential is the gold standard for forensic professionals. It is offered by the Association of Certified Fraud Examiners (ACFE), a U.S.-based institution.

How do I pursue it?

- You don’t need to have a CA, CPA, or ACCA qualification to pursue CFE.

- It is open to individuals from diverse backgrounds and is globally recognized, making it accessible to anyone interested in building expertise in fraud detection and prevention.

Wrapping up…

With ICAI seeking to make becoming a CA mandatory for practising forensic audits in the country, questions arise about the inclusivity of this approach.

The Institute wants to establish its authority within the Indian forensics field, much like its role in statutory audits and tax practices.

However, the question that many people are still asking is,

“Is ICAI’s plan to grant exclusive authority to CAs – while excluding professionals from fields like IT, law, management, human resources, management accounting, and company secretaries – a step in the right direction?”

Why don’t the Post graduate Commerce graduates and mba qualified in Accounts can be allowed to do the auditing of private concerns on par with CA. This will create lakhs and lakhs of self employment opportunities for Post Graduate Commerce Graduates. In addition, the aim of providing Higher education by the Government at huge cost through UGC in Commerce can be achieved.

But both won’t have same level of knowledge

For Certified Forensic Accountant it is necessary to be a student from a recognized institution/university, should have three years professional experience and has passed Certixfied Forensic Accounting Professional (CFAP) Exams of Indiaforensic Center of Studies with minimum 75% of marks.