- In February 2024, Citigroup announced Viswas Raghavan as its new Head of Banking.

- This is part of CEO Jane Fraser’s massive overhaul plan.

- Raghavan is originally from India and is a Chartered Accountant with the Institute of Chartered Accountants in England and Wales.

Raghavan, JPMorgan’s top dealmaker joins Citi

In February 2024 Citigroup’s announcement of Viswas Raghavan’s appointment as the Head of Banking has stirred excitement in the banking sphere.

This is CEO Jane Fraser’s massive overhaul of the struggling bank.

As reported by Reuters, most of the layoffs (initial 5,000 job cuts of the 20k) were concluded in the first quarter, generating an expected $1.5 billion of cost savings, Fraser told analysts on a conference call.

Additional cuts could save as much as $2.5 billion a year in the medium term.

Raghavan, JPMorgan’s top dealmaker, will bring a wealth of experience to his new role.

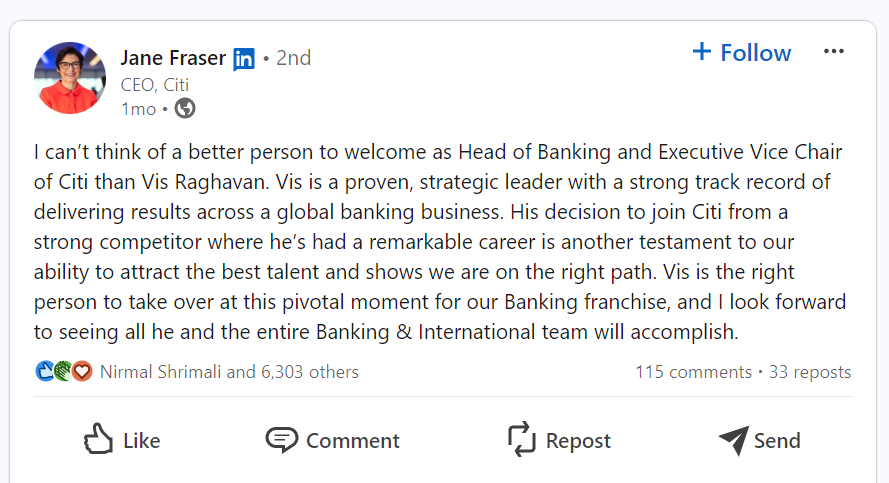

Now, turning our attention to Raghavan’s appointment, an internal memo from CEO Jane Fraser sheds light on the significance of this move.

Here’s a summary of what to expect

Leadership Role: Raghavan will take the reins of Citigroup’s core businesses in Investment, Corporate, and Commercial Banking.

Commencement and Reporting: Scheduled to join Citi’s executive team in June 2024, Raghavan will assume the position of Executive Vice Chair and Head of all Banking, directly reporting to CEO Jane Fraser.

Strategic Responsibilities: As the Executive Vice Chair, Raghavan will play a pivotal role in shaping Citigroup’s firm-wide strategy.

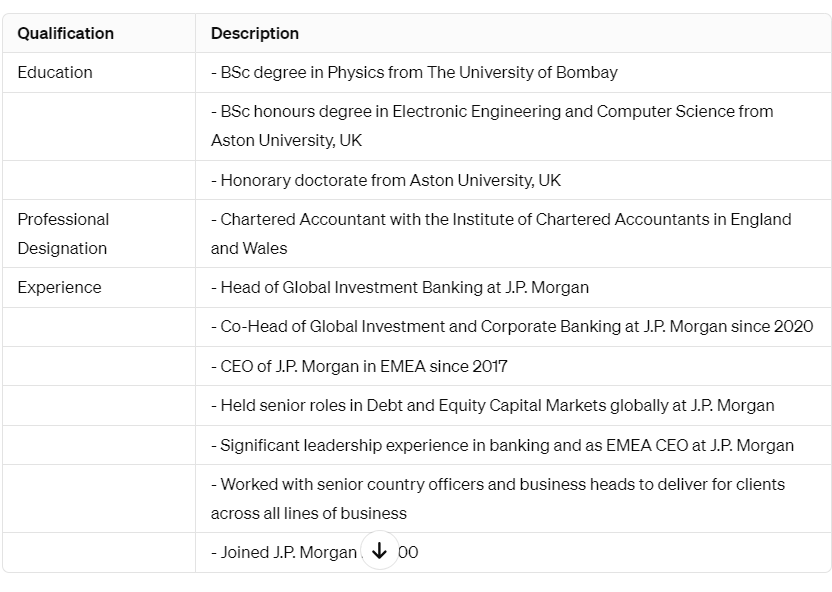

Previous Experience: Raghavan’s impressive tenure at JPMorgan, where he held key leadership positions including Head of Global Investment Banking and CEO of JPMorgan in EMEA, speaks to his strategic acumen and global banking expertise.

CEO Endorsement: Fraser lauds Raghavan’s strategic leadership and international banking experience, expressing enthusiasm about his appointment.

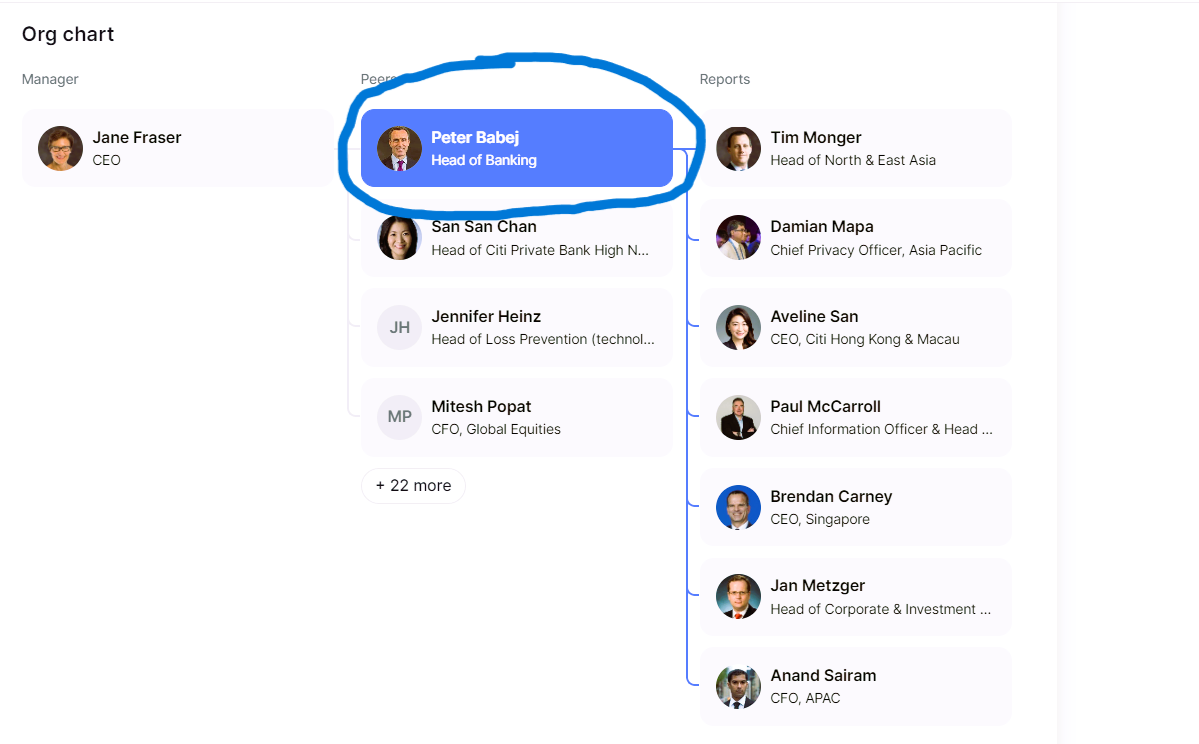

Leadership Transition: Raghavan succeeds Peter Babej, who served as interim head of banking and will aid in the transition before retiring from Citi.

Restructuring at Citi: Citi has recently restructured its investment bank, dividing it into a banking division (led by Raghavan) and a markets division. This new structure gives Raghavan a pivotal role in shaping Citi’s future.

Raghavan’s educational background is impressive

He grew up in India and holds a B.Sc degree in Physics from the University of Bombay, as well as a B.Sc Honors degree in Electronic Engineering and Computer Science from Aston University in Birmingham, UK, where he also received an honorary doctorate.

Additionally, he is a Chartered Accountant with the Institute of Chartered Accountants in England and Wales.

About Citigroup

Citigroup Inc., or Citi, is a multinational investment bank and financial services corporation based in New York City.

It is the 3rd largest bank in the USA amassing a total asset of US$2.3 trillion as of 2023.

Citi has an on-the-ground presence in over 144 countries.

Citi’s top management comprises of,

CEO – Jane Fraser

CFO – Mark Mason

COO – Anand Selva

Head of Banking – Peter Babej, soon to be replaced by Viswas Raghavan.

Head of Wealth Management – Andy Sieg (He was previously the president of Merrill Wealth Management, where he oversaw a team of more than 25,000 people providing investment and wealth management services to individuals and businesses across the U.S.)

Head of Operations & Technology – Mike Whitaker

Closing…

Raghavan’s entry into Citigroup marks a significant milestone in the banking industry, with high expectations pinned on his leadership during this crucial juncture for the company.

As he assumes his role, attention will be focused on how he navigates Citigroup’s future course and the potential transformative changes he may bring.