- Meet Sathya Pramod: from Deloitte and AOL to CFO at Tally.

- In 2017, he left the corporate world and, along with Shivadutt Bannanje (former Tally Legal Head), co-founded KayEss Square Consulting—a Bengaluru-based consulting firm focused on early-stage and mid-sized businesses.

- Soon after, Aparna Sambasivan, a former Deloitte consultant, joined to lead finance.

- They quietly grew to 70+ professionals with strong expertise in finance, legal, risk, IB, and compliance. The missing piece: Tax!

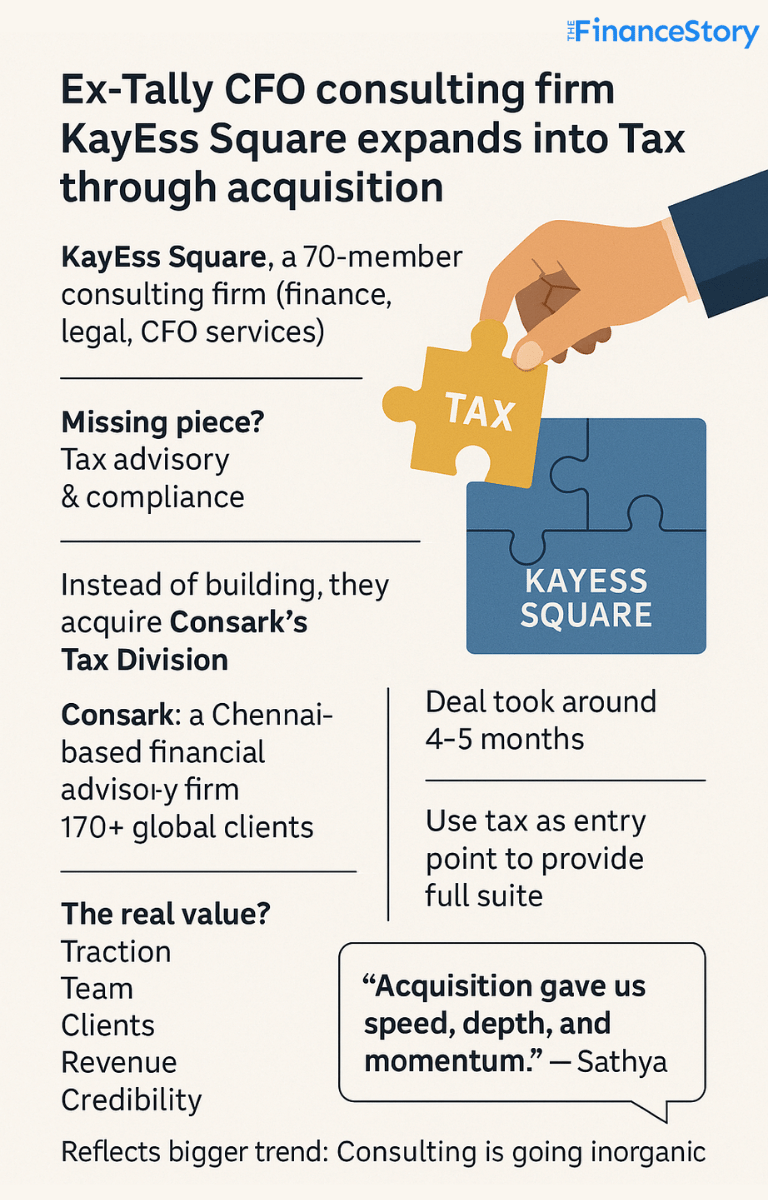

- Their next move: acquiring Consark Advisory’s Tax Compliance & Advisory Division.

Why tax, why now?

By 2025, KayEss Square had grown into a 70-member team of Chartered Accountants, lawyers, Company Secretaries, and CFAs.

“We were thriving across finance, legal, and accounting,” says Sathya.

“But we knew Tax—especially advisory and compliance—was the next big unlock.”

The rationale was clear:

-

CFOs are exhausted managing five different firms for direct tax, GST, transfer pricing, and litigation. KayEss’s pitch? One firm to handle it all—end to end.

-

Most of Kayess’s clients—whom we have supported for 5–6 years—are now entering a new phase of maturity. They need tax advisory and even litigation.

- Additionally, Advisory services offer stronger margins than traditional accounting and financial reporting.

Why acquire Consark?

“Simple,” says Sathya.

“They had exactly what we were looking for:

- Experienced team

- Trusted enterprise client base

- Credibility.

For KayEss, this was the entry point to fast-track tax dominance without spending years building from scratch.”

Founded in 2013 by ex-Deloitte professionals, Consark (aka Consark.ai) is a Chennai-based financial advisory firm.

-

They serve 170+ clients across the US, India, UK, EMEA, and APAC, including Fortune 500 companies, listed firms, and private equity-backed businesses.

-

In 2025, Consark made a strategic shift from services to “developing financial products.

Why acquire instead of build?

Why acquire instead of build?

“We always wanted to build a strong tax practice,” says Sathya.

“We tried doing it organically—nothing stuck.

Then came this opportunity.

It just made sense. You can hire a senior leader and build slow, or acquire and get instant traction—team, clients, revenue, credibility.

But it wasn’t just about tax.

The real value is the cross-sell flywheel. Once a client comes in for tax, we can offer legal, compliance, and secretarial too.

And yes, acquisitions cost upfront money.

But when you’re buying both capability and cash flow—it’s a smart play.

Behind the deal

“Acquisitions aren’t easy—it’s like a marriage,” says Sathya.

“Both sides come with their anxieties. You have to let go of something to gain something bigger.”

He adds, “Even a small deal takes 4–5 months. Diligence is key—not just numbers, but understanding the real picture. And unless leadership is fully aligned and involved, it’s hard to make it work.”

What next?

We will continue to grow the same way we’re growing…Maybe a little faster!

Now that both teams are under one roof? We’re focused on integration, collaboration, and unlocking new value together.

And KayEss Square is just getting started.

Bigger Picture: consulting is changing

According to Sathya, the consulting world is in the middle of a major shift:

- Inorganic growth is the name of the game. “M&As and roll-ups will dominate the next decade,” he says.

- Veterans are breaking out to build. People who have spent decades in large firms are stepping out, launching niche consultancies, and scaling rapidly.

- More and more firms are coming together to build something bigger, and more valuable. The trend now is about inorganic growth.

- Value is in partnerships—whether it’s acquiring or being acquired—you’ve got to be ready.