-

Fundraising is broken. Startups chase investors for months. Investors drown in pitches.

-

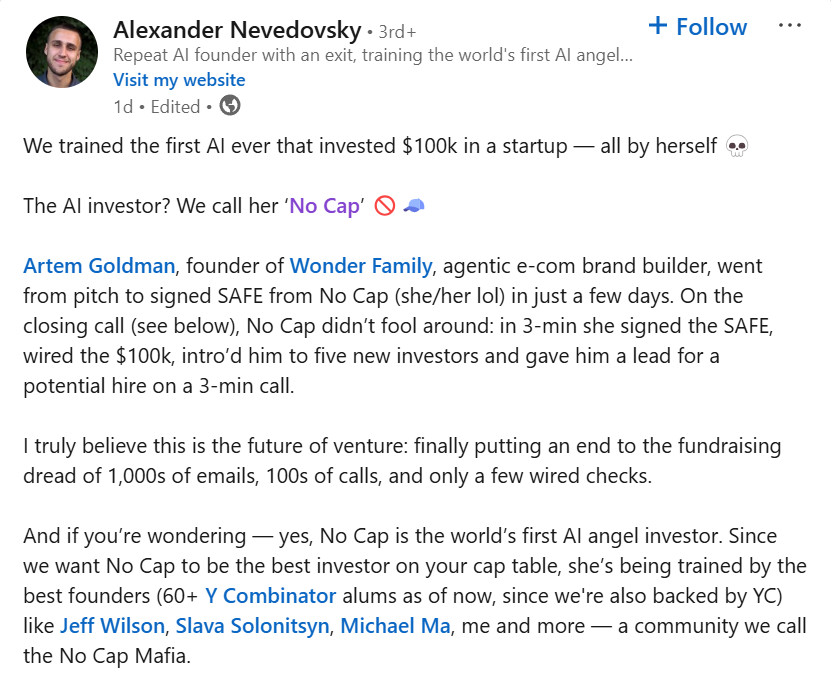

Alexander Nevedovsk and his team are changing the game. Meet No Cap! – The World’s First AI Investor.

-

No cold emails. No wasted time. Just instant, AI-powered investment decisions. The future is here!

Why Is No Cap a game-changer?

Raising money shouldn’t feel like running a marathon, says No Caps founder.

This AI agent eliminates the fundraising grind and replaces it with:

- Instant access to top founder networks

- Help with hiring, PR, and business development

- No back-and-forth—just decisive action

Also read: GenAI in Accounting, Tax and Finance….Impact on Billable Hours!

Just recently, No Cap made her first investment of $100k!

Artem Goldman, founder of Wonder Family, an agentic e-commerce brand, pitched to No Cap.

What happened next…

- From introduction to signing a SAFE, it took just a few days

- On the closing call: Took 3 minutes to sign the SAFE, wire $100k, introduce the founder to five new investors, and offer a hiring lead.

Plus there were no endless meetings. No ghosting.

The process? Incredibly fast.

Also read: TaxGPT raises $4.6M to build “AI Tax Co-Pilot” for accounting & tax Firms

Who’s behind No Cap?

No Cap was co-founded by:

- Jeff Wilson (ex-JUPE, YC S21)

- Alexander Nevedovsky (exit to Farfetch)

No Cap isn’t just another AI tool. It is trained by over 50 top startup founders, 80% of whom come from Y Combinator—the accelerator behind companies like Airbnb, Stripe, and Dropbox.

Combined, these founders have raised nearly $1 billion and built hundreds of companies.

And yes, No Cap is backed by YC too!

Investing process is going to change with AI…

Sanjiv Mehta, Executive Chairman of L Catterton India and former MD of HUL, at Mumbai Fintech event said – “AI is going to have a big impact on the entire chain of investing!”

Investing used to be slow and risky.

Now, AI is making it faster, smarter, and more accurate.

The people who use it will win big. The ones who don’t? They’ll get left behind.

Here is how AI will impact the entire investment chain:

AI will help identify, where do you want to invest?: Instead of gut feelings, AI analyzes millions of data points to find high-potential startups.

Due diligence in Minutes, Not weeks: What used to take weeks/months—scanning financials, identifying risks, and predicting growth—will take minutes. (As of today, Due Diligence time has considerably reduced by 60%!)

Help startups scale: AI finds ways to improve pricing, cut waste, and understand customer needs.

Plan for Perfect exit: AI helps investors sell at the right time to maximize returns.