- Grant Thornton UAE’s 2026 CFO Report says 54% of CFOs (300 surveyed) are now directly calling the shots on technology strategy.

- Not just asking, “What’s the budget?” but deciding where the tech ship sails.

- And they’re not stopping there. Today’s CFOs are constantly looking to upskill in industry trends, succession planning, and stakeholder communication.

- Here’s what is happening.

The CFO’s job has changed… a lot!

CFOs in the UAE are way past the “number-crunchers” phase.

They have evolved to work at the intersection of innovation, risk, enterprise integrators, and board advisors.

Over 50% of UAE CFOs are now taking direct responsibility in areas that were once “non-finance”:

- ESG and Digital Transformation (57%)

- Strategy and High-Level Decision Making (56%)

- Technology and Data-Driven Insights (54%)

Well, Risk management is in overdrive

Suddenly, Cyber resilience and AI governance are now financial problems…Not IT problems.

CFOs need to understand exactly:

- Where data lives

- How it’s secured

- Who governs it

Big focus on Digital Transformation

CFOs aren’t just approving IT budgets anymore; they are deciding which technologies get built.

This “tech-heavy” focus is evident with 54% of CFOs taking a direct role in digital strategy, ensuring that every dollar spent on innovation translates into a tangible Return on Investment (ROI).

A staggering 98% of CFOs have transformation initiatives underway or in the pipeline. However, the focus has narrowed to three core pillars:

- Reporting and Analytics (44%): Moving from monthly snapshots to real-time visibility.

- Risk Management (39%): Building resilience against increasingly volatile markets.

- Forecasting (38%): Utilising AI-enabled scenario planning to predict the unpredictable.

They are investing heavily in:

- Cloud computing power

- Cloud adoption is being pushed hard by regulators and national initiatives.

- Digital budgets are shifting from heavy capex to ongoing opex.

What about AI?

The report highlights that 40% of CFOs are specifically targeting AI and automation.

In the UAE, this isn’t just about efficiency; it’s a response to a maturing regulatory landscape that demands greater transparency and speed.

Fundraising just got brutal

Yes, 83% of CFOs plan to raise funding in the next six months.

But money isn’t flowing as easily as it used to. Banks are stricter, rates are higher, and approvals take longer.

So finance leaders are getting creative.

- 51% are strengthening lender relationships

- 49% are exploring innovative financing models

- 48% are diversifying funding sources

ESG is climbing boards’ agendas

But execution lags behind intent.

- Only 37% have dedicated ESG processes in place.

- 41% are still building capabilities.

- Another 19% want to act but don’t know where to start.

Meanwhile, ISSB-aligned reporting (International Sustainability Standards Board) is becoming mandatory. So the clock’s ticking!

Golden opportunity: Family Businesses

Family-owned businesses make up a big part of the UAE economy.

But many of them face structural roadblocks due to informal processes and ownership ambiguity.

That’s where CFOs can help them navigate modern governance by:

- Formalising ownership structures

- Planning succession

- Prepping for IPOs

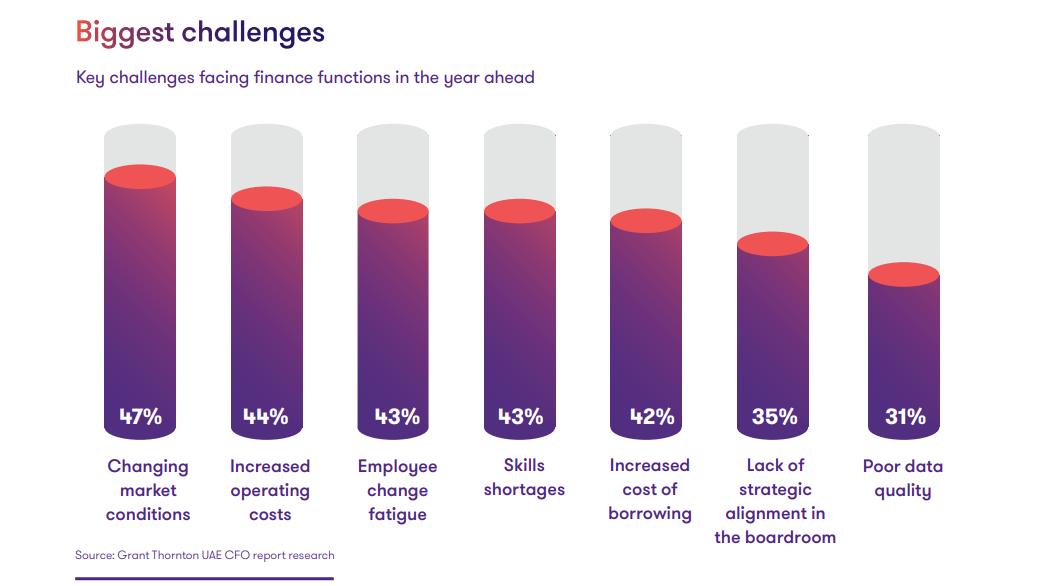

Biggest headaches for CFOs

CFOs are under pressure from every direction. This is no exaggeration!

Economic pressure

- Changing market conditions (47%)

- Increased operating costs (44%)

- Higher borrowing costs (42%)

- Economic instability (37%)

Tech Threats

- Cybersecurity (43%)

- AI-related threats (37%)

- Regulatory compliance (35%)

- Supply chain disruption (35%)

The same data powering AI models is also a prime cyber target. One weak link can break everything.

Talent pressures intensifying

Skills shortages (43%): Finance teams now need hybrid skills, data literacy, automation oversight, ESG knowledge, and systems thinking.

- Finding the right people? Even harder. Teams need hybrid skills (finance + tech + data).

- Tax technology professionals and finance people with hybrid capabilities (finance + tech + data) are in serious demand.

- Tax digitisation through e-invoicing, new tax implementations, and alignment with global frameworks has accelerated the demand.

Rising talent costs (46%): And everyone, from government entities to energy giants, is chasing the same talent.

Motivation issues sit at 47%. There are changing employee expectations. People want faster growth, meaningful work, and flexibility. Traditional structures aren’t cutting it anymore.

Lack of strategic alignment in the boardroom (35%)

The response? CFOs are investing in training, automation, mentorship, better compensation, and flexible work models.

What CFOs are going after?

Modern CFOs need to be fluent in:

- Data fluency

- AI literacy

- ESG competency

- Digital governance.

And to stay credible with boards, regulators, and investors…They have to keep learning. That’s why peer-learning platforms are taking off.

CFOs are looking to acquire more soft skills:

- Better access to industry trends

- Help with succession planning

- Change management support

- Stronger leadership presence

- More effective stakeholder communication

Wrapping up…

The CFO role today looks nothing like it did a few years ago.

With tighter regulation, faster technology disruption, and higher stakeholder expectations, finance leaders are running two businesses at once: the core business and the transformation of the business.

As Kabir Dhawan, Partner, Head of Consulting, Grant Thornton UAE, puts it in the report,

“UAE financial leaders are very busy trying to both change the business and run the business at the same time…These are two different skill sets.”

And that’s exactly the challenge and opportunity for the CFOs who can pull it off.