- In January 2023, Hindenburg Research accused the Adani Group of massive stock manipulation, causing a stir in the Indian stock market.

- Now, Hindenburg is back with a new explosive claim, this time involving Madhabi Puri Buch, SEBI’s Chairperson.

- Here’s the latest update.

24th January, 2023. Here is where it started

Hindenburg, the US-based short seller released an investigation report on the Adani Group.

It claimed that,

Stock manipulation: The Adani Group artificially inflated its stock prices through a network of offshore entities.

Tax havens: The Adani family used offshore tax havens to evade taxes.

Debt levels: The Group had high debt levels and questioned its ability to service them.

Following the report, Adani’s stock prices tumbled, losing $150 billion in value.

Now Hindenburg is back with another bang

Hindenburg’s claim: 18 months have passed, and the Securities and Exchange Board of India (SEBI) has displayed minimal interest in probing the Adani Group’s alleged use of offshore shell entities in Mauritius.

Could it be because…SEBI Chief Madhabi Puri Buch was involved?

On 10th August 2024, they released yet another investigation leading to SEBI Chairperson Madhabi Puri Buch’s Controversy.

Here are the details:

- Investments: Buch and her husband, Dhaval Buch had stakes in obscure offshore funds (IPE Plus Fund, Global Dynamic Opportunities Fund) controlled by Vinod Adani, allegedly linked to the Adani Group scandal.

- Consulting firm ownership: Hindenburg claims Buch owned 100% of Singapore-based Agora Partners while at SEBI and transferred it to her husband shortly after becoming the Chairperson.

- Undisclosed wealth: Buch reportedly holds a 99% stake in the Indian firm Agora Advisory, which earned $261,000 in 2022, far exceeding her declared salary at SEBI.

- SEBI’s actions and Blackstone: Madhabi Buch’s husband became a Senior Advisor at Blackstone during her appointment at SEBI. During this time SEBI approved significant regulatory changes for Real estate investment trusts (REITs). In that course of time, Blackstone invested in Mindspace and Nexus Select Trust, which were among the first REITs approved by SEBI for public IPOs.

Also read: BYJU’S Crisis: Insolvency Plea Admitted for Unpaid ₹158 Cr to BCCI

SEBI Chief Buch’s response

Hold on! The saga doesn’t end here.

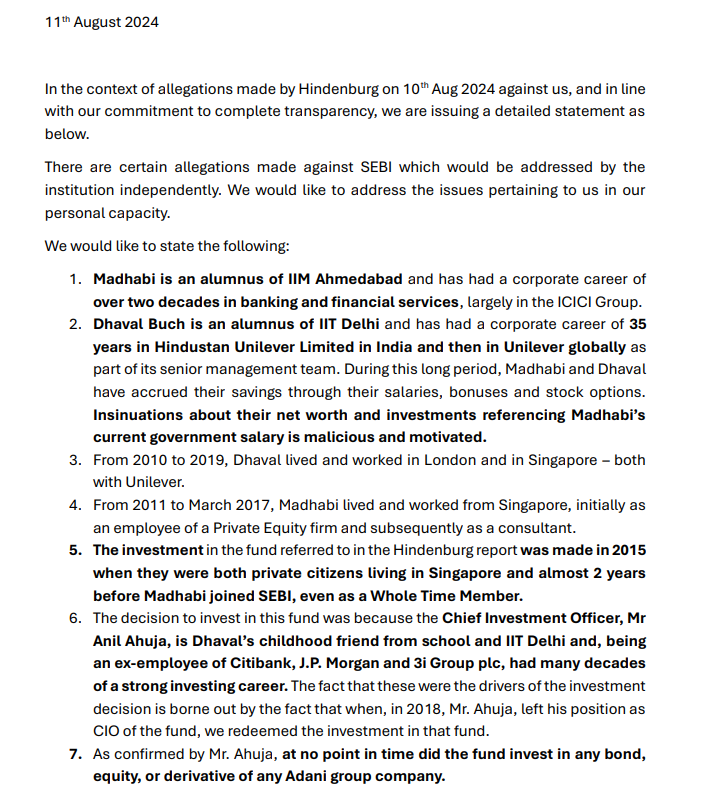

Shortly thereafter, on 11th August, the Buchs issued an official statement addressing the allegations.

In response to the claims that Madhabi Puri Buch and her husband had stakes in a Bermuda/Mauritius fund, they replied,

- Timeline: Investment was made in 2015 before Buch joined SEBI.

- Influence: The investment decision was influenced by Anil Ahuja, a childhood friend and experienced investor.

- Clarification: Ahuja confirmed the fund was never invested in any Adani group companies.

Madhabi Puri Buch’s career highlights

| Position | Organization | Years |

|---|---|---|

| Executive Director | ICICI Bank | 2006 – 2009 |

| CEO | ICICI Securities | 2009 – 2011 |

| Head, Business Development | Greater Pacific Capital | 2011 – 2013 |

| Consultant | New Development Bank | Sep – Dec 2016 |

| Non-Executive Director | Idea Cellular, Max Healthcare | Various Dates |

| Whole-Time Member | SEBI | 2017 – 2021 |

| Chairperson | SEBI | 2022 – Present |

About Hindenburg

Hindenburg Research is a US-based investment research firm known for its aggressive short-selling tactics.

Founded by Nathan Anderson in 2017, the firm has gained notoriety for its highly critical reports on publicly traded companies.

About The Adani Group

The Adani Group, an Indian multinational conglomerate based in Ahmedabad, was established by Gautam Adani in 1988 as a commodity trading business.

Over the years, the Group has diversified its operations to include sea and airport management, electricity generation and transmission, mining, natural gas, food production, weapons manufacturing, and infrastructure development.

Employees: Adani Group employs more than 43,000 people across the globe.

Listed subsidiaries:

- Adani Total Gas

- Adani Power

- Adani Enterprises

- Adani Wilmar

- Adani Green Energy

- Adani Energy Solutions

- Adani Ports and SEZ

- ACC

- Ambuja Cements

- NDTV

Adani Group’s market cap rose to Rs 17.5 trillion in March 2024.

Also read: Zerodha Asset Management without a CFO

Wrapping up…

Will SEBI investigate Adani Group and internal conflicts? How will India’s regulatory landscape respond?

Does the Adani-Hindenburg saga reveal major vulnerabilities in India’s financial regulatory system?

Only time will tell.