- Party’s over, unregistered “Finfluencers”!

- The Securities and Exchange Board of India (SEBI) has introduced stringent regulations.

- This is SEBI’s approach to limiting the spread of misleading and biased financial advice.

What’s the issue with Finfluencers?

Financial influencers (aka influencers) Influencers have significantly shaped how individuals make financial decisions!

These modern-day money gurus are reshaping how people make financial decisions, offering tips on everything from stock picks to savings strategies.

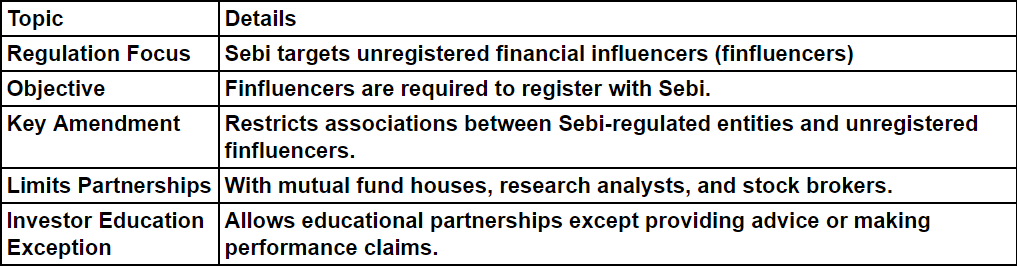

SEBI’s new regulations for Finfluencers

- SEBI headed by Madhabi Puri Buch, introduces stringent regulations to control unregistered financial influencers (influencers).

- Registered entities like mutual fund houses, investment advisors, and stock brokers are now prohibited from partnering with unregistered influencers.

- The move aims to curb the spread of misleading and biased financial advice online.

Action against unregistered Finfluencers

- In the past three months, SEBI has already taken down over 15,000 content sites operated by unregistered finfluencers.

- SEBI’s crackdown sends a clear message: play by the rules or face consequences.

Why? To prevent misinformation

- SEBI’s regulations address concerns about the risks posed by unregulated influencers.

- Many influencers operate on commission-based models, leading to potential conflicts of interest.

- SEBI’s focus is on protecting investors from financial losses due to biased or inaccurate advice.

Exceptions for investor education

SEBI allows partnerships focused solely on investor education, with strict conditions:

- No financial recommendations.

- No return claims.

- Pure educational content only.

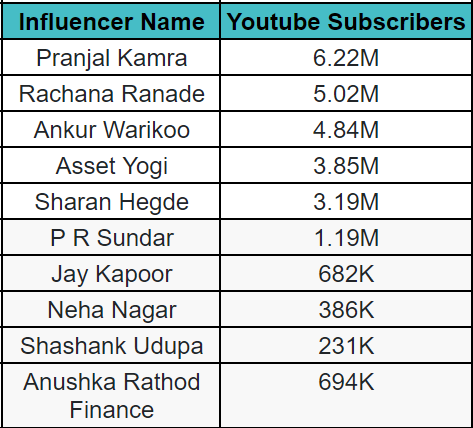

Who are the Top 10 Finfluencers in India?

How do I register as a Finfluencer?

- Before applying for SEBI registration, make sure you meet the eligibility criteria to become an Investment Adviser (Here’s how), including the necessary qualifications, experience, and infrastructure.

- Prepare and submit the SEBI registration application along with all required documents. Ensure the application is complete and accurate to speed up the approval process.

- Pay the required fees for SEBI registration according to regulatory guidelines, and keep records of the payment for future reference.

- Familiarize yourself with SEBI’s code of conduct for Investment Advisers and strictly adhere to it in your practice.

- Implement thorough client onboarding procedures, including risk profiling, to provide customized investment advice.

- Set up a comprehensive record-keeping system to maintain client records, advice given, and transaction details in line with SEBI regulations.

- Conduct an annual review of your compliance with SEBI guidelines and adjust your practices as necessary.

Looking ahead

- SEBI received over 1,000 responses to its proposal to relax restrictions on registered investment advisers (RIAs) and research analysts (RAs).

- The feedback will help shape SEBI’s future policies, with discussions expected at the next board meeting.

- SEBI aims to balance innovation in financial markets with robust investor protection measures.