- The United Arab Emirates (UAE) offers a plethora of job opportunities for Chartered Accountants (CAs).

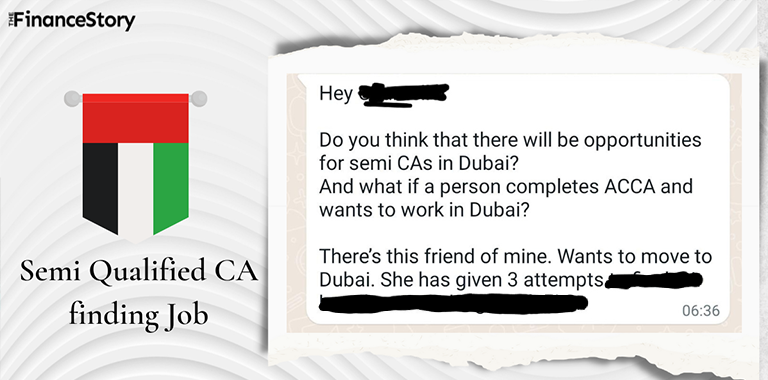

- But what about semi-qualified CAs?

- The good news is that with article experience and the right skill sets, success is within reach.

The United Arab Emirates (UAE) is a land of opportunity, drawing in professionals who seek to advance their careers.

For many Chartered Accountants (CAs), the UAE is a particularly attractive destination, offering a range of job opportunities in a variety of industries.

However, if you are a semi-qualified CA, the question remains: “Can I too find success in the UAE?”

The answer is Yes.

There are many opportunities available in the UAE for semi-qualified CAs.

The UAE is a hub for various industries and businesses, and there is a high demand for Accounting/Finance, and Sales/Business Development.

Is it tough to get a job in UAE from India?

It is hard to land a job in the UAE without applying from within the country.

There are a lot more candidates than jobs in the UAE currently, especially in Dubai. This means that if a company needs to hire a finance professional they don’t need to look outside the UAE.

For the most part, the talent is already here. That is why it is suggested that you come to the country on a 30 or 90-day tourist visa (costs Approx. ₹15,000- ₹ 18,000), and search for jobs.

In India, Visa is issued by many agencies like VFS, BLS, Musafir.com, etc.

You need to enter UAE within 60 days from the date of issuance of the visa. A return ticket is mandatory for visiting UAE.

Ensure that you have 3 months of savings to survive in the UAE as per the UAE cost of living, which comes to approximately 2 -3 lakh rupees in Indian currency.

How can I get a job offer from India to UAE?

There are several ways for a semi-qualified Chartered Accountant (CA) to find opportunities in the UAE.

Once you come to the UAE, consider the job search as a job itself. Spend 8-10 hours a day sending applications to your preferred companies.

Having a LinkedIn profile is a must. Target companies based on your previous employer’s industry and apply to them.

Online Job Portals: Many online job portals list job vacancies in the UAE. Some popular job portals in the UAE include LinkedIn, Michael Page, Bayt, Naukrigulf, Gulf talent, Indeed, and Monstergulf.

Company Websites: You can also search for job vacancies on the websites of companies operating in the UAE. Many companies in the UAE post their job openings on their official websites’ careers section.

Recruitment Agencies: Many recruitment agencies in the UAE specialize in placing accounting and finance professionals in jobs. Semi-qualified CAs can register with these agencies and get assistance in finding job openings that match their skills and experience.

Professional Networking: Building a professional network in the UAE can help semi-qualified CAs learn about job openings and connect with potential employers.

Connect with other accounting and finance professionals, and hiring managers/ex-managers on LinkedIn and get the interview scheduled.

You can attend industry events with your CV or join professional associations. This method is quite effective.

Direct Applications: You may directly apply to companies that you are interested in, even if there are no current job openings. Send a well-written cover letter and resume to a company, and they may be considered for future job openings.

It is important to tailor your job applications to the specific requirements of the job description.

What finance qualifications do companies in the UAE look for?

The specific qualifications required for finance jobs in UAE companies may vary depending on the job position and the company’s industry.

However, some common qualifications and skills that are often required for finance jobs in the UAE include:

- A relevant bachelor’s or master’s degree (e.g., accounting, finance, economics)

- Professional certifications like CPA, CFA, ACCA, and CA (Semi-qualified CAs with article experience are also valued.)

- Experience in a similar role

- Strong analytical and problem-solving skills

- Knowledge of relevant financial laws and regulations

- Proficiency in financial software and tools

- Excellent communication and interpersonal skills.

When is the best time to come to the UAE for job hunting?

What makes the UAE hiring scenario different is its seasonal recruitment.

In the UAE, the summer months (June to August) including the month of Ramadan can be particularly hot and humid. This makes job hunting more challenging.

Some job seekers may prefer to come during the cooler months (October to April).

If you are lucky it would only take you 4 weeks to get a job. The worst-case scenario would be 1 to 3 months. It takes time with the visa process which is quite slow.

Overall, it is recommended to research the job market and industry trends before planning a trip to the UAE for job hunting.

Popular industries and sectors in the UAE

The United Arab Emirates or UAE’s economy is the fifth largest in the Middle East with a GDP of US$503 billion (AED 1.84 trillion) in 2022. And the following sectors and industries played a vital part.

Oil and Gas: Oil and Gas is one of the most established sectors in UAE with lots of opportunities for Finance Professionals. Approx. 3 million barrels of oil are produced every day. The massive reserve of funds from Oil and Gas production has made the nation capable of taking care of its residents for the next 40 years.

Banking and Financial Services: The banking sector has grown tremendously, as a result of inflows from various other sectors like Oil and Gas, real estate, and Tourism.

A few of the large banking groups in UAE are – First Abu Dhabi Bank (FAB) (Dubai), Emirates NBD (Dubai), Abu Dhabi Commercial Bank (Abu Dhabi), First Gulf Bank (Abu Dhabi), RAK Bank (Ras Al Khaimah). Most of the Job openings can be viewed in the Banks career portal alone.

Real estate: The real estate industry is a critical pillar of the UAE’s economic diversification. The UAE government is working on minimizing the country’s financial reliance on oil and gas revenue.

According to various reports, the real estate industry accounts for roughly 7% of the UAE’s overall GDP.

EMAAR, Nakheel, Dubai Properties, DAMAC Properties, and Kingdom Real Estate Development are a few well-known real estate corporations.

Hospitality: The well-established Hospitality Industry of the UAE has over 1,00,000 four-star and five-star hotels in Dubai. The UAE now hosts one of the richest hospitality markets in the world with an expected 25% growth in the industry by 2030 according to a report by KPMG.

Manufacturing: The manufacturing sector is growing to meet the demands of other ancillary industries in the economy.

With the advantages of High seas trading, there are many businesses with Commodity trading and other trading activities.

E-Commerce Companies: Dubai has become one of the most prominent contributors to the Middle Eastern E-commerce sector, surpassing Abu Dhabi, which has a significantly greater population than Dubai.

Owing to all the aspects mentioned above, lots of job vacancies are being created for Finance Professionals daily.

The Ministry of Economy declared that the SME sector accounts for more than 94% of all companies in the country. They employ more than 86% of the private sector’s workforce.

What are some sought-after Finance job roles in the UAE and their salaries?

Here are the types of roles that are available for Finance Professionals in the UAE.

Chief Financial Officer – AED57k – AED100k PM*

Financial Manager – AED21k – AED38k PM*

Financial Controller – AED19k – AED54k PM*

Chief Accountant – AED 13k – AED 21k PM*

Finance Director – AED 41.5k – AED64.5k PM*

CEO or Operational roles – AED 55k – AED 117k PM*

VAT Accountant / Tax Accountant – AED 48k – AED 190k PM*

Business Analyst – AED 15k – AED 26k PM*

Financial Analyst – AED 11k – AED 23k PM*

Investment Analyst – AED 13k – AED 44k PM*

Compliance Officer – AED 12k – AED 24k PM*

Management Consultant – AED 36k – AED 532k

*PLEASE NOTE – The above salary ranges will differ from industry to industry and also the size of business as a Finance Director responsible for a finance team of 5 is more likely to be earning less than a Finance Director responsible for a team of 20.

(The salary estimates have been acquired from GulfTalent and Payscale )

Are you looking to accelerate your career in finance? Fill up this form to talk to an industry expert