- In September 2022, the UAE government introduced Emiratisation quotas for the private sector.

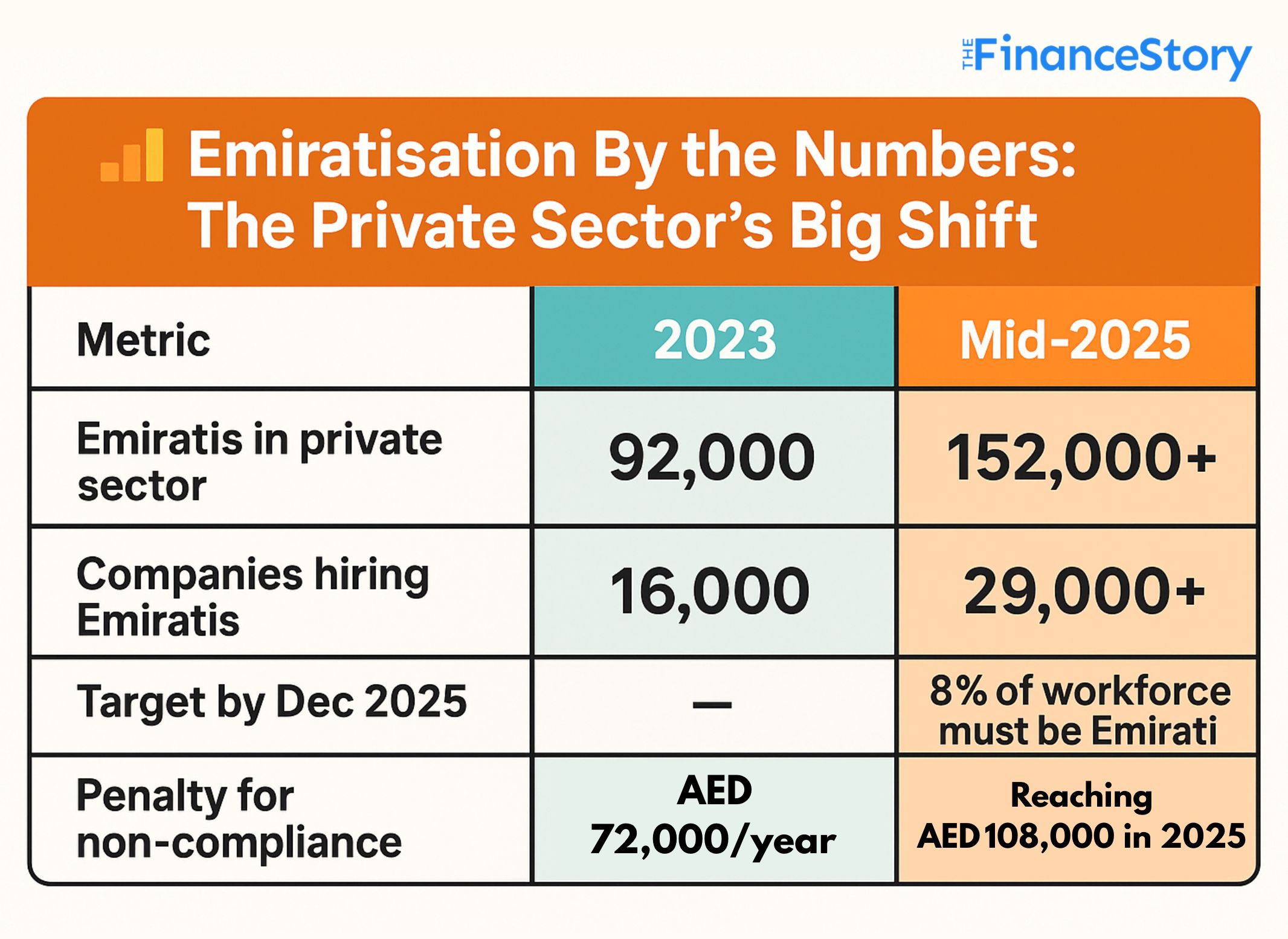

- Fast forward to 2025? Over 152,000 Emiratis are working in the private sector (compared to just 92,000 in 2023).

- That is a 22% year-on-year increase, according to the Ministry of Human Resources and Emiratisation (MoHRE).

What is Emiratization in the UAE?

Emiratisation is a UAE government initiative, formally reinforced in September 2022.

The government announced it to encourage the employment of Emirati citizens in the private sector.

It encourages companies to hire and retain UAE nationals by setting hiring quotas, offering incentives, and applying penalties for non-compliance.

The goal? To build a sustainable national workforce and reduce overreliance on expatriate labor.

And as of June 30, 2025, the UAE just crossed a major employment milestone.

What’s fueling the surge?

According to the Emiratization rules, private companies (especially those with 50+ employees), are obligated to hire a certain percentage of UAE nationals.

These firms had a deadline to,

- Increase Emirati headcount by 1% every 6 months, since 2023.

- Hit 8% Emiratisation in skilled roles by December 2025.

- Even smaller firms (20–49 employees) in high-opportunity sectors must hire at least one Emirati, before the end of 2025.

Also read: UAE expands Emiratisation to private sector firms with less than 50 employees.

What happens if you don’t comply?

Non-compliance comes at a steep price: Fines of over AED 100,000.

In some cases, even business license suspension!

Those who comply? Gets rewarded

Through the NAFIS platform, compliant companies can access:

- Salary support (up to AED 8,000/month)

- Pension subsidies

- Free recruitment services

- Government procurement advantages

Where are Emiratis working?

- 35% in Finance and Insurance

- 21% in Professional Services & ICT

- 18% in Manufacturing and Logistics

- 14% in Healthcare and Education

- 12% in Retail, Hospitality, and Real Estate

(Giorgio Torre – Project Senior Manager, KPMG Qatar)

Also read: UAE’s new medical & pharmaceutical laws: Non-compliance fines upto $272,000

Building a business in the UAE?

Emiratization isn’t optional.

- Know the headcount rules (based on company size and sector).

- Plan for real hiring, not paper compliance.

- Tap into NAFIS for recruitment, training, and salary support.

- Get audit-ready. MoHRE may inspect anytime.

- Embrace inclusion, not just quotas. Retention and growth matter.

- Align with Vision 2030, as this is part of the UAE’s broader economic transformation.

Wrapping up…

Experts predict Emiratization will bring an extra AED 53 billion boost to the UAE’s GDP by 2030.

Additionally, every 1% increase in Emiratization drives a 2.4% rise in national productivity.

It is the foundation for growth that benefits everyone, creating a sustainable UAE economy.

It’s not about bias, but about empowering the native citizens of the UAE.