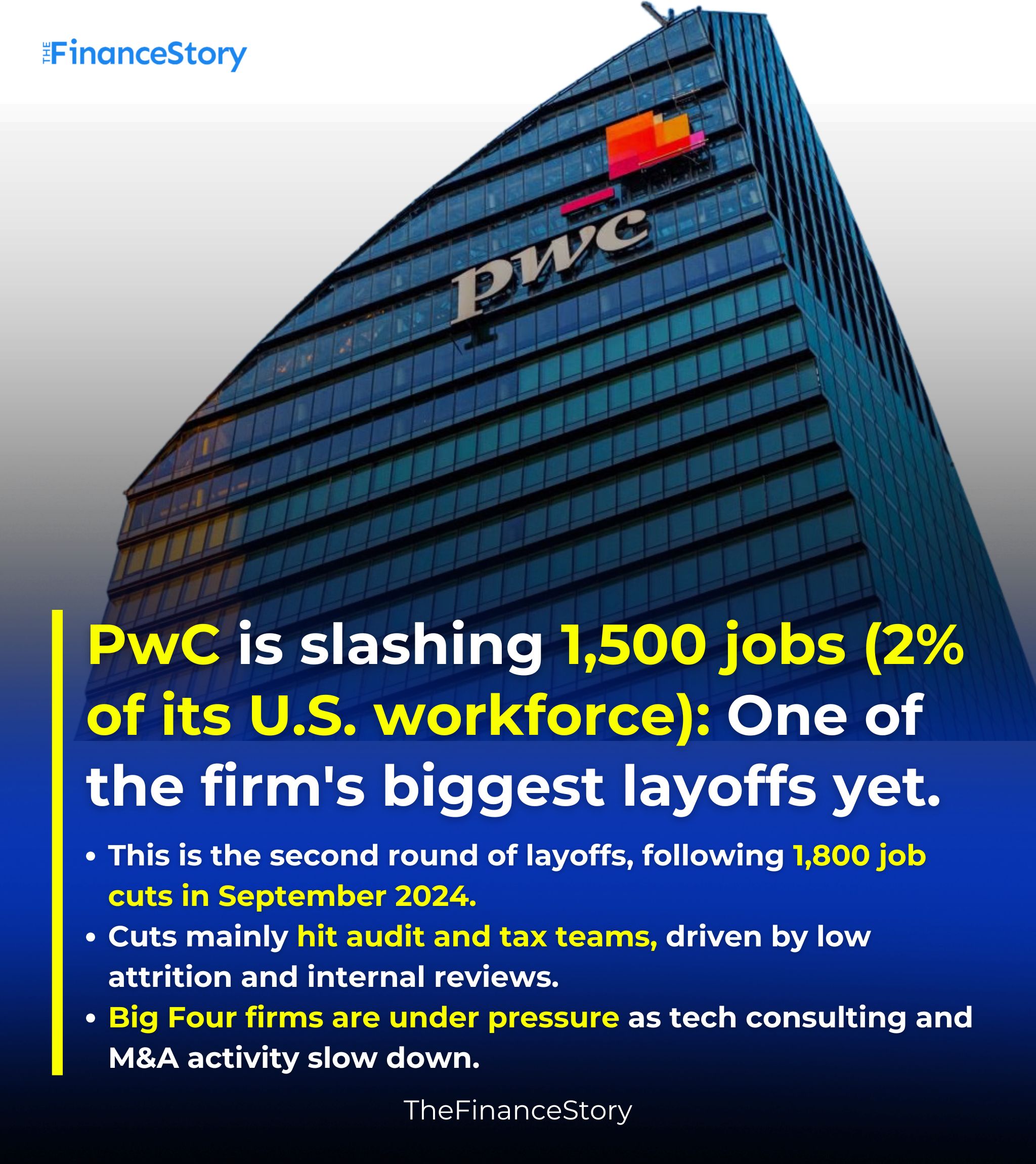

- PwC has let go of 1,500 employees in the US.

- That’s roughly 2% of its 75,000-person workforce.

- Here’s what’s behind the headlines — and what it means for the rest of the industry.

Who’s impacted?

PwC US has slashed a significant number of professionals from its Audit and Tax divisions.

These areas are considered the traditional bread-and-butter service lines within its 75,000-strong workforce.

To top it off, it’s their second biggest layoff in less than a year (1,800 US employees were fired in September 2024).

Why did it happen?

Three words: Low staff turnover.

In the past, juniors would quit because of burnout or chase better pay. That helped balance the books.

But now, employees just aren’t leaving like they used to — especially with economic uncertainty.

As a result, even though their business didn’t scale adequately, headcount ballooned.

How did PwC deliver the news?

Microsoft Teams invite (Yes, that dreaded calendar ping).

Followed by emails with severance details.

Many didn’t see it coming — especially since PwC was still hiring recently.

PwC reassigned hundreds of staff to “growth areas” like consulting and advisory earlier this year. But those internal moves couldn’t absorb everyone.

What’s the tone inside the firm?

Employees feel blindsided by this decision.

Some say communication was lacking, and hiring was misaligned with business reality.

Others say it’s a cost play in disguise, wrapped in the language of “business needs”.

Big 4 reality check

PwC isn’t alone — the whole Big Four is under pressure:

KPMG slashed 5% of its US workforce in 2024.

Deloitte and EY also made layoffs earlier this year.

Deloitte recently told employees no more layoffs (for now) but admitted they’re “reviewing staffing levels continuously”.

However, EY’s CEO Janet Truncale spoke at the Milken conference, in Los Angeles and said – AI won’t decrease its 400,000-person workforce — but it might help it double in size!

Also read: PwC fires 1,800 employees. What’s driving Big 4’s major U.S. layoffs?

The bigger picture

Here’s what’s happening behind the scenes:

Firms overhired in 2021–2022

Coming out of COVID, there was a massive hiring boom. Companies scrambled for talent.

And now? Demand has slowed, and payrolls are bloated.

Hybrid work changed the game

It’s harder to track productivity, harder to manage teams, and firms are learning they might not need as many boots on the ground.

AI is creeping in

Automation, data analytics, and AI are quietly replacing low-level audit and tax work.

Expect AI-first hiring in 2025 and beyond.

What next?

This won’t be the last round of cuts….

- Firms are rebalancing — some roles will vanish, new ones will pop up.

- The Big Four of 2026 will look very different from what we’ve known.

- More focus on profitability, leaner teams, AI + tech-driven workflows.

PwC US layoffs: A wake-up call for anyone in professional services

If you’re working in or aiming for the Big 4:

- Upskill beyond audit/tax basics — think analytics, AI tools, ESG reporting, cloud tech.

- Get exposure to consulting, advisory, or deal services — these are still growth areas.

- Stay connected internally — visibility matters more than ever.

- Don’t rely on traditional “career paths” — the game is changing fast.

You can’t rely on stability — adaptability is the new job security.

The Big Four brand still holds weight, but even it isn’t bulletproof anymore.

Firms are shifting toward a consulting + AI-powered model, leaving old-school roles behind.

Also read: PwC exit low-performing markets & cut ties with risky clients

FAQ

Are there any recent layoffs in the Big 4?

PwC isn’t alone — the whole Big Four is under pressure:

EY:

In December 2024, EY confirmed plans to cut 150 roles in its UK consulting division following a 4% revenue decline in that segment. By March 2025, the firm announced it would also lay off dozens of senior partners.

KPMG:

In November 2024, KPMG announced the layoff of around 330 employees, representing less than 4% of its U.S. audit workforce.

Deloitte:

In early 2025, Deloitte US announced unspecified reductions in its consulting workforce. Reasons? A slowdown in federal consulting contracts.

What’s causing layoffs in Big 4?

- Post-pandemic economic drag

- Tech replacing low-level tasks

- Fewer resignations → More overcapacity

- Consulting slowing down, clients cutting costs