- For the first time since 2009, PwC has announced a significant reduction in its U.S. workforce.

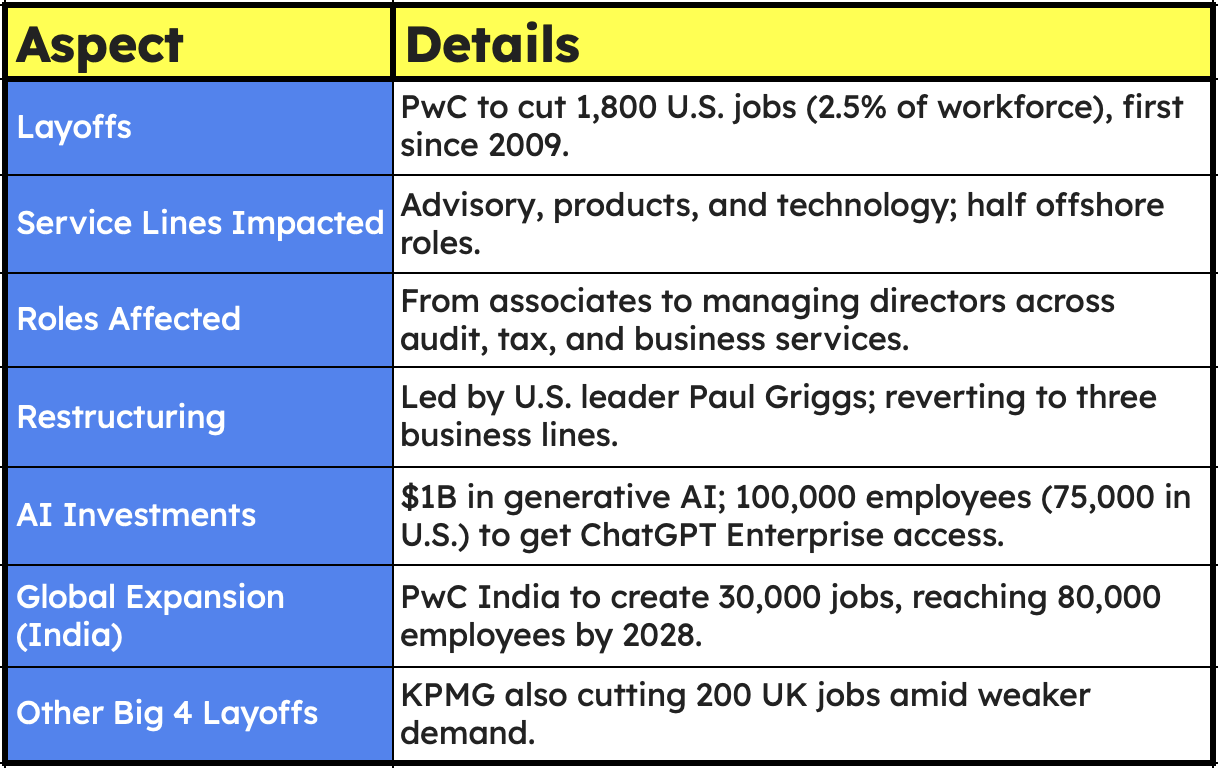

- About 1,800 employees—roughly 2.5% of the U.S. workforce—will be affected as PwC adjusts to changing market demands.

- So, what’s driving PwC’s first major U.S. layoffs in over a decade?

The numbers: Who’s affected?

In this sweeping layoff announcement, PwC is not holding back.

The cuts will hit employees across various levels, from associates to managing directors.

Key verticals such as business services, audit, and tax will bear the brunt of the restructuring.

Nearly half of the layoffs are expected to impact offshore roles, reflecting the firm’s intention to streamline its global operations.

Employees are anxiously waiting for notifications, set to arrive in October 2024—a tense and uncertain time for many.

Also read: Big 4 India Inside Scoop: Appraisal, Benching, Hiring

Why now? The story behind the cuts

The layoffs come as PwC faces a slowdown in demand for some of its advisory services, according to The Wall Street Journal.

This drop in business has led the company to make tough decisions to stay competitive in a changing market.

The layoffs are part of a bigger plan that started in July 2024 when Paul Griggs took over as PwC’s U.S. leader.

In a memo, Paul Griggs, shared the firm’s strategy, noting that these cuts are part of a broader effort to “position our firm for the future, create capacity to invest, and anticipate and react to the market opportunities of today and tomorrow.”

But there’s more to this story.

PwC’s COO, Tim Grady, echoed these sentiments, stating, “To remain competitive and position our business for the future, we are continuing to transform areas of our firm and are aligning our workforce to better support our strategy.”

Also read: This Big 4 Service Delivery Centre quietly fired 300+ staff

Doubling down on AI

While PwC is cutting jobs, it’s also doubling down on AI—in a big way.

The firm has committed $1 billion to invest in generative AI for its U.S. operations over the next three years.

This bold move includes integrating OpenAI’s ChatGPT Enterprise across the firm, with a rollout to 100,000 employees planned—75,000 of those in the U.S. alone.

Global troubles: PwC’s China crisis

The real trouble lies in the fallout from the Evergrande scandal.

PwC is under scrutiny after China’s securities regulator accused Evergrande of inflating its revenues by nearly $80 billion—even as PwC’s China unit signed off on its accounts.

This has led to talk of a six-month suspension for Zhong Tian LLP, PwC’s auditing arm in mainland China.

While PwC looks to the future in the U.S., it faces mounting challenges in China.

The firm recently lost a major client when Country Garden Holdings dropped PwC as its auditor. A major blow to its business in the region!

And that’s not all—PwC has been dropped by major Chinese companies, including Bank of China, China Life Insurance, PICC, China Taiping Insurance, and China Cinda Asset Management.

These exits follow government guidance and signal the firm’s increasingly precarious position in China.

The Big 4 and industry-wide challenges

PwC’s decision to axe jobs in the U.S. mirrors broader challenges faced by the Big Four accounting firms.

KPMG, EY, and Deloitte have also been grappling with economic pressures and higher interest rates, resulting in significant layoffs across the industry.

In June 2024, KPMG cut 200 jobs in the U.K. as part of its own cost-cutting measures, highlighting the difficult choices firms must make to stay afloat in these uncertain times.

What’s happening in other regions?

In July – August 2024 one particular Big 4 Service Delivery Centre in India caught everyone’s attention – Approximately 250+ people were forced to resign or faced with stalled promotions, leading them to resign voluntarily.

On the contrary, in 2023, PwC India unveiled plans to create 30,000 new jobs over the next five years, strengthening its presence in the country.

This expansion could bring the firm’s total employee count in India to over 80,000 by 2028.