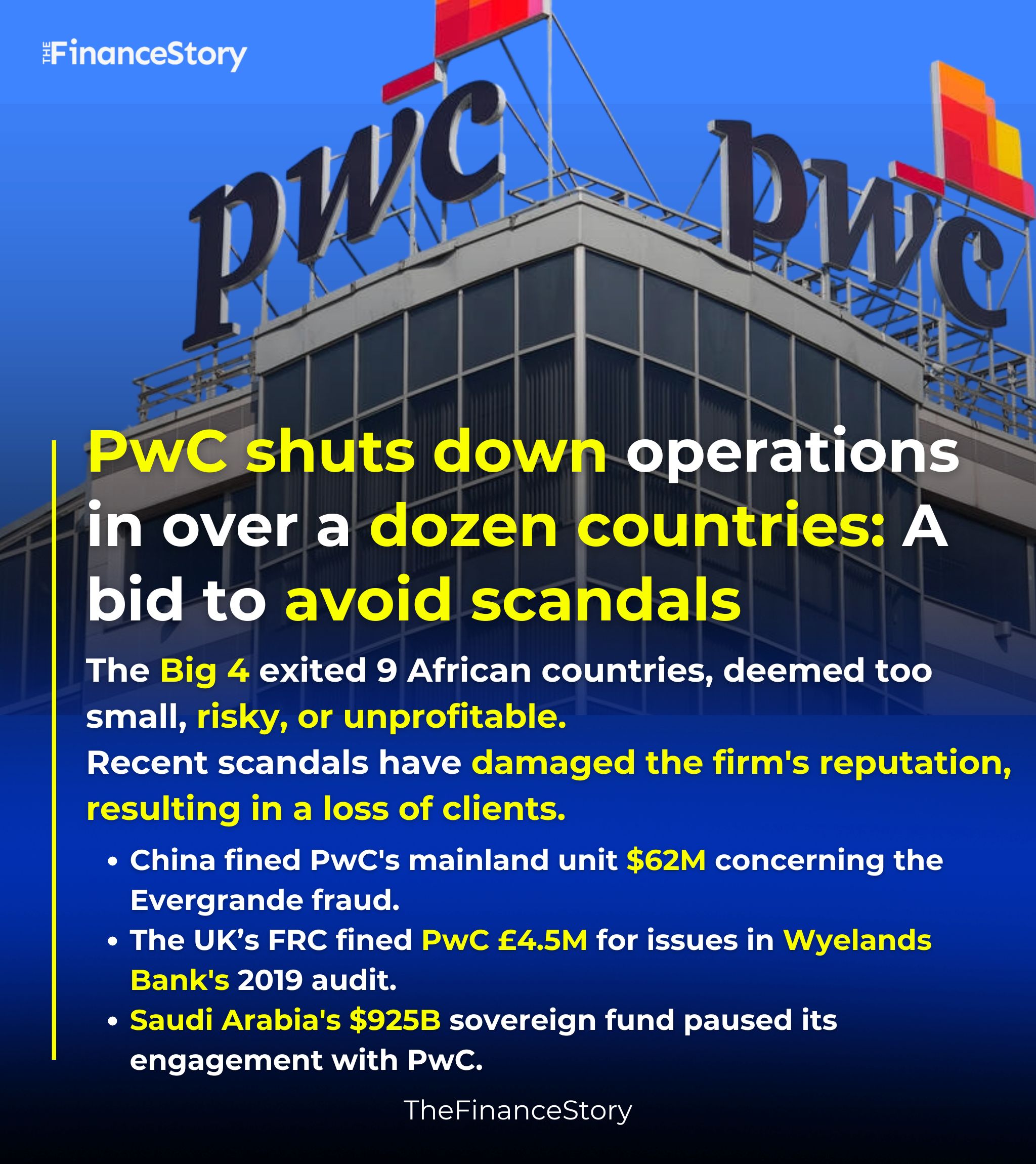

- PwC is pulling out of over a dozen countries. Why? To exit low-performing markets and cut ties with risky clients.

- Scandals like the Evergrande audit failure in China have damaged the firm’s reputation. The Big 4 can’t let it happen once again.

- Yet, despite it all, PwC hit $55.4B in revenue in 2024.

PwC Under Pressure: Scandals, Crackdowns & Internal Turmoil

Over the past few years, PwC is grappling with:

- Regulatory crackdowns

- Public scandals (And a bunch of them)

- Internal conflicts

- Increasing scrutiny from governments and global investors

PwC scandals that sparked the storm

PwC Australia

- PwC Australia was banned from receiving new tax-related government contracts for three months.

- Why? A former tax partner leaked confidential government tax plans designed to prevent corporate tax avoidance.

PwC China

- In 2024, China hit PwC with a $62 million fine and suspended it from auditing in the country for six months.

- The reason? PwC’s audits missed massive red flags in the $78 billion fraud scandal at property giant Evergrande.

PwC European Union

- Back in 2023, PwC was accused of helping Russian nationals bypass EU sanctions and asset-freezing measures.

Saudi Arabia

- And recently, (in February 2025), Saudi Arabia’s Public Investment Fund (PIF), a $925 billion sovereign wealth fund, and 100 other subsidiaries cut ties with PwC regarding any kind of advisory work!

So, what next?

PwC cuts ties with high-risk clients!

PwC’s global leadership is taking steps to protect the firm’s reputation by ending relationships with clients considered “high-risk.”

The Big 4 has ceased operations in more than a dozen countries due to the market being,

- Too small to scale.

- Client risk being too high.

- Unprofitable; especially where compliance costs keep climbing.

- And local operations? They no longer align with PwC’s new global risk standards.

PwC has exited Sub-Saharan Francophone African countries, including,

- Côte d’Ivoire

- Gabon

- Cameroon

- Democratic Republic of Congo (DRC)

- Republic of the Congo

- Madagascar

- Republic of Guinea

- Senegal

- Equatorial Guinea

Similarly, just months ago PwC ended its association with member firms in,

- Zimbabwe

- Malawi

- Fiji

And more closures are expected in Asia, Eastern Europe, and Latin America, according to Financial Times.

Comes at a cost…

This decision has had a major impact on local offices in several African countries.

Partners say they’ve lost more than a third of their business in recent years because they were asked to drop these clients—who, in many cases, were their largest sources of revenue.

Despite these changes, PwC has reassured that it will continue to support clients through its other offices throughout the region.

Also read: Saudi Arabia’s PIF, $925Bn sovereign wealth fund bans PwC

Is PwC still profitable despite all this?

Yes. PwC posted $55.4 billion in revenue in 2024, a 4.5% year-over-year growth.

Growth drivers included:

-

Consulting and tech services

-

Private equity support

-

Strong demand in mature markets like the U.S., U.K., and India

What about other Big 4 firms?

KPMG is consolidating its presence across Africa, merging 13 country offices into one central team.

- KPMG is combining its offices in 13 African countries into one big team, the Financial Times reported last month.

- In 2023, KPMG had over 120 units, but it has since reduced this number to around 75.

- KPMG aims to further cut this by another 50% to between 30 and 40 by the end of next year.

- Smaller units (<$300M revenue) will be combined into larger clusters!

Why? To improve audit quality, boost governance, and increase investment in technology and services.

Also read: PwC fires 1,800 employees. What’s driving Big 4’s major U.S. layoffs?

Wrapping up…

Firms like PwC are becoming more selective about markets and clients, prioritizing compliance, brand protection, and scalable growth.

While scandals have sparked this shift, the strategy reflects a broader move by the Big 4 to future-proof their business models.