- At the 5th GCC Summit 2025 in Bengaluru (organised by ICAI), industry leaders dropped some serious intel.

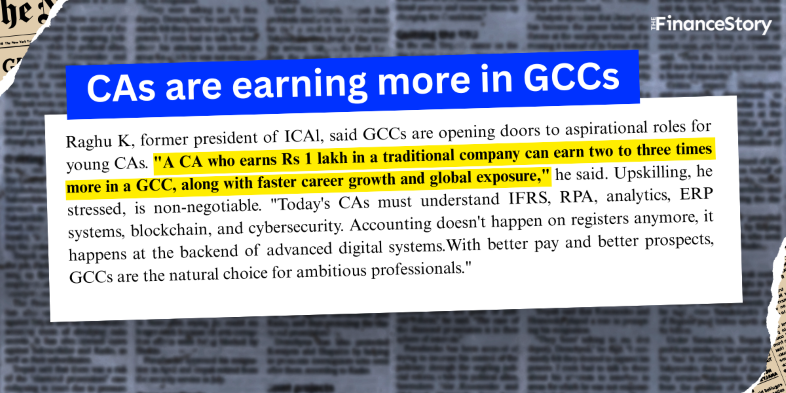

- “A CA earning ₹1 lakh monthly in a traditional company can earn 2–3x more in a GCC,” said Raghu K, Former ICAI President.

- But here’s the reality check: upskilling isn’t optional.

GCCs used to focus on only back-office work

There was a time when finance roles within Global Capability Centres (GGCs) were predictable and, frankly, menial.

Most professionals in GCCs were focused on:

- Journal entries and ledger maintenance

- Month-end close support

- Basic MIS and variance reporting

- Compliance documentation and audit support

Then they moved up the value chain

However, as the years passed, finance roles within GCCs became increasingly complex.

What used to be support work is now decision-making work.

What used to be execution is now analysis, judgment, and strategy.

Today’s GCC finance teams are handling:

- Global tax and statutory reporting

- Valuations and M&A support

- ESG and sustainability reporting

- Advisory, risk, and cross-border structuring

Sanjib Sanghi, convener of the GCC meetup, summed it up perfectly:

“GCCs have expanded from tech-heavy operations to strategic leadership centres.

With AI taking over routine tasks, the real value lies in cross-border tax planning, sustainability reporting, valuations, mergers, and fund initiation.

Over one lakh CAs already work in GCCs, many in senior leadership.”

And once the work changes, something else always follows…The money!

GCC compensations quietly skyrocketed

- Over five years, total compensation for many professionals has reached ₹70–80 lakh, including RSUs (Restricted Stock Units).

- Even semi-qualified CAs with multinational exposure are earning ₹30–35 lakh for Record-to-Report (R2R) roles.

- And get this: In many cases, that’s higher than what fully qualified CAs earn in traditional Indian companies.

A Tax Leader at a US-based GCC shared some on-ground intel,” If you join a listed multinational GCC, equity payouts alone (RSUs and ESOPs) can exceed an employee’s annual take-home salary.”

Also read: Trump’s $100K H-1B fee: A blow to Indian IT…or a boon for GCCs & offshoring?

It’s not just salary

Beyond compensation, GCCs offer:

- Comprehensive health and OPD coverage

- Wellness and sports reimbursements

- Progressive maternity and paternity leave

- Flexible and remote work policies

- Office meals, transport support, and home-office budgets

This is where GCCs quietly win over employees.

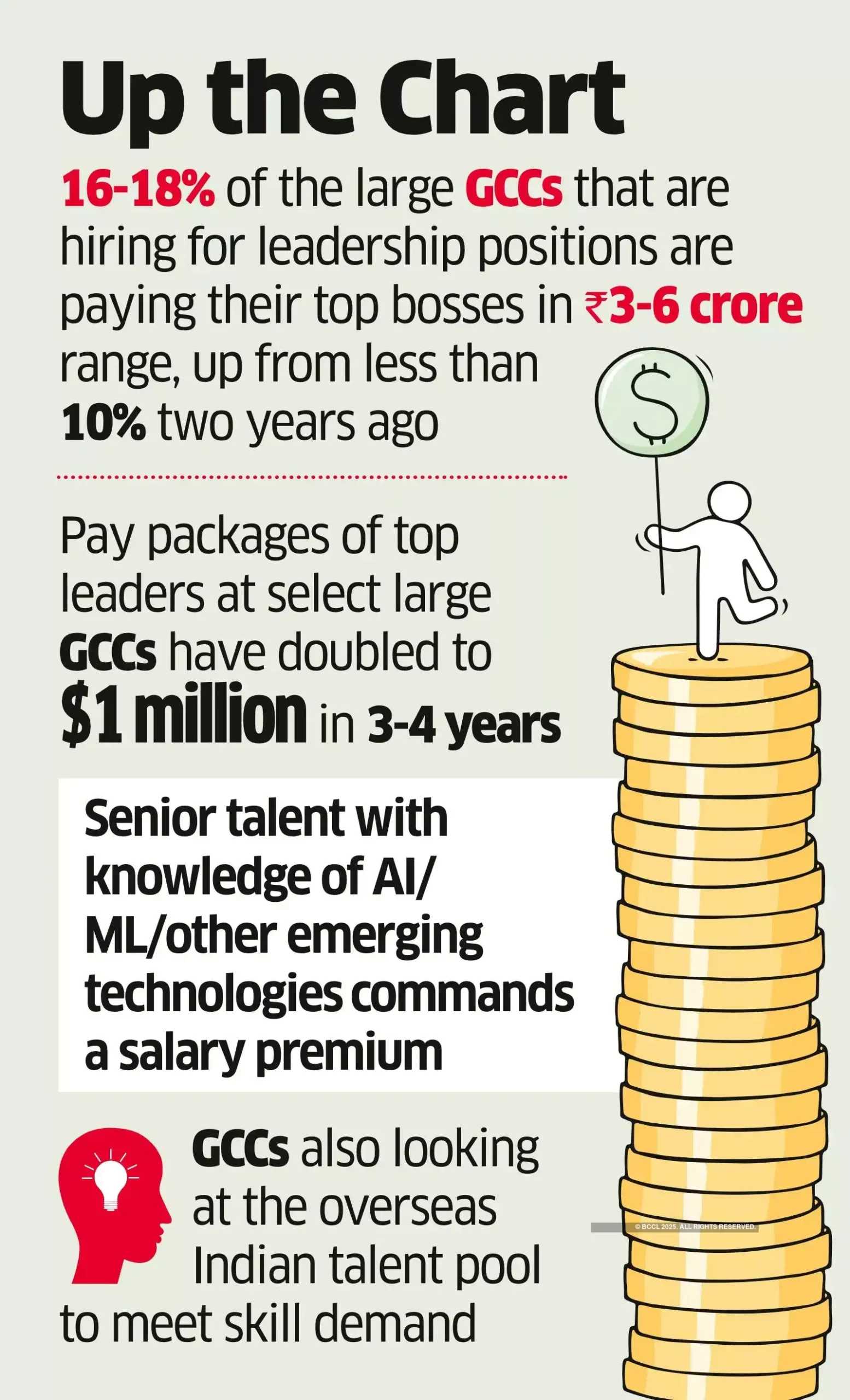

Now let’s move to the top of the pyramid

According to an Economic Times article, professionals with 18–25 years of experience are seeing a sharp jump in pay:

- CTOs: ₹1.6–2.0 crore per year, about 14% higher than comparable roles

- CFOs: ₹1.5–2.0 crore, depending on company scale and global exposure, roughly 12% higher

- CHROs: ₹1.5–1.8 crore annually, with pay up to 25% higher as the role becomes more strategic

- Managing Directors & Country Heads (mature GCCs): $1+ million a year ( ₹8.3 crore)

These pay levels are almost double what similar roles earned just a few years ago.

Investment banking-led GCCs sit at the top

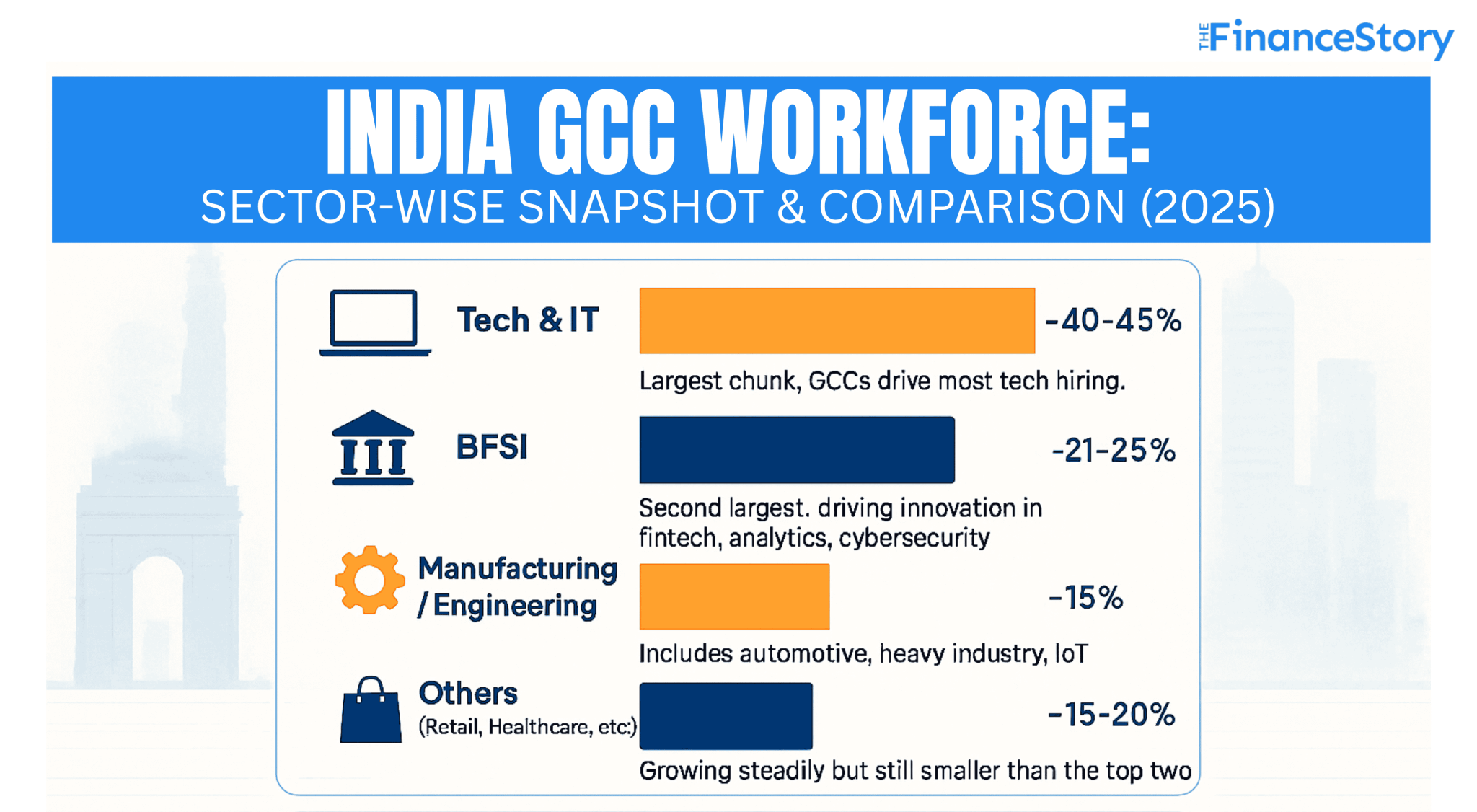

20–25% of all GCC employees in India work in the BFSI sector, employing over 380,000 professionals.

But even within BFSI GCCs, one segment consistently leads the compensation curve: Investment banking–led GCCs

- Data Scientists: ₹22.1–46.9 LPA, driven by advanced analytics and AI demand

- Full-stack Developers: ₹20.7–47.5 LPA, as banks push for full digital ownership

- Risk & Compliance Leaders: Risk Analysts, Compliance Associates, Senior Risk Managers, FRM Leads, Heads of Compliance, and Global Finance Directors earn anywhere between ₹6–90 LPA

If you’re tracking where the real money is inside GCCs, investment banking–led centres are setting the benchmark.

Which city pays the most?

Compensation levels vary sharply by city.

Bengaluru obviously leads the pack, with over 25,000 Chartered Accountants and the highest concentration of GCCs in the country. Bengaluru’s compensation levels sit about 24% above the rest of the market.

Hyderabad offers pay levels about 19% higher, powered by its fast-growing tech and BFSI GCC base

Mumbai mirrors this at 19% above market, particularly strong in IT services and financial services roles

Delhi/NCR stands out at around 21% above market, driven by leadership, regulatory, and enterprise-facing roles

While GCCs continue to pay the highest salaries in metro locations, they are increasingly expanding into Tier-2 and Tier-3 cities for talent and scale.

Now, here comes the reality check

Yes, GCCs are paying more than traditional companies. But it’s not that straightforward.

Raghu K, former President of ICAI, put it bluntly: upskilling is no longer optional.

As AI takes over repetitive tasks, CAs must master:

- IFRS and global accounting frameworks

- RPA, analytics, and ERP systems

- Blockchain and cybersecurity

- AI-driven finance workflows

Adapt, and you’re likely to move faster than ever.

And those who don’t keep up will be left behind.

Also read: India’s GCC revenue $64.6 Billion Up By 40% – Rising opportunities Tax Firms

Wrapping up…

India now hosts more than 1,800 GCCs, accounting for over 55% of the global total.

According to ET and NLB Services’ report India’s Talent Takeoff,

- GCCs are expected to deliver 9.8% salary growth over the next 12 months alone.

- FY25 revenue is projected at $178 billion, supporting 1.9 million professionals and 10.4 million jobs overall.

- By FY30, India could see 2.8–4 million new GCC jobs, with the market projected to reach $110 billion.

By 2030, the GCC market in India is projected to grow to $99-105 billion (GCCs revenue in FY 24 was $64.6 billion, up from $46 billion, a 40% rise.

With top-tier compensation, high-value work, and global exposure on the table, the question isn’t whether GCCs are attractive anymore.

The question is, “Can traditional companies keep up?”

FAQs

Q: How will AI impact GCC finance roles?

AI will significantly impact GCC finance roles, but in a transformative way.

GCCs are prioritising AI adoption and upskilling; an EY survey show about 70% are investing in generative AI and related capabilities, with finance, operations, and analytics being key focus areas.

AI is reshaping job responsibilities: routine, repetitive tasks (such as manual reconciliations) are increasingly automated, while GCCs are hiring for higher-value analytical, strategic, and tech-enabled finance roles.

Q: How big is the GCC market in India?

The GCC market in India is booming. Revenue jumped from $46B to $64.6B in FY24. That was a 40% surge.

And the revenue is projected to hit $99–105B by 2030.