- The journey of BFSI GCCs in India has been remarkable, evolving from basic support roles to key players in the global financial ecosystem.

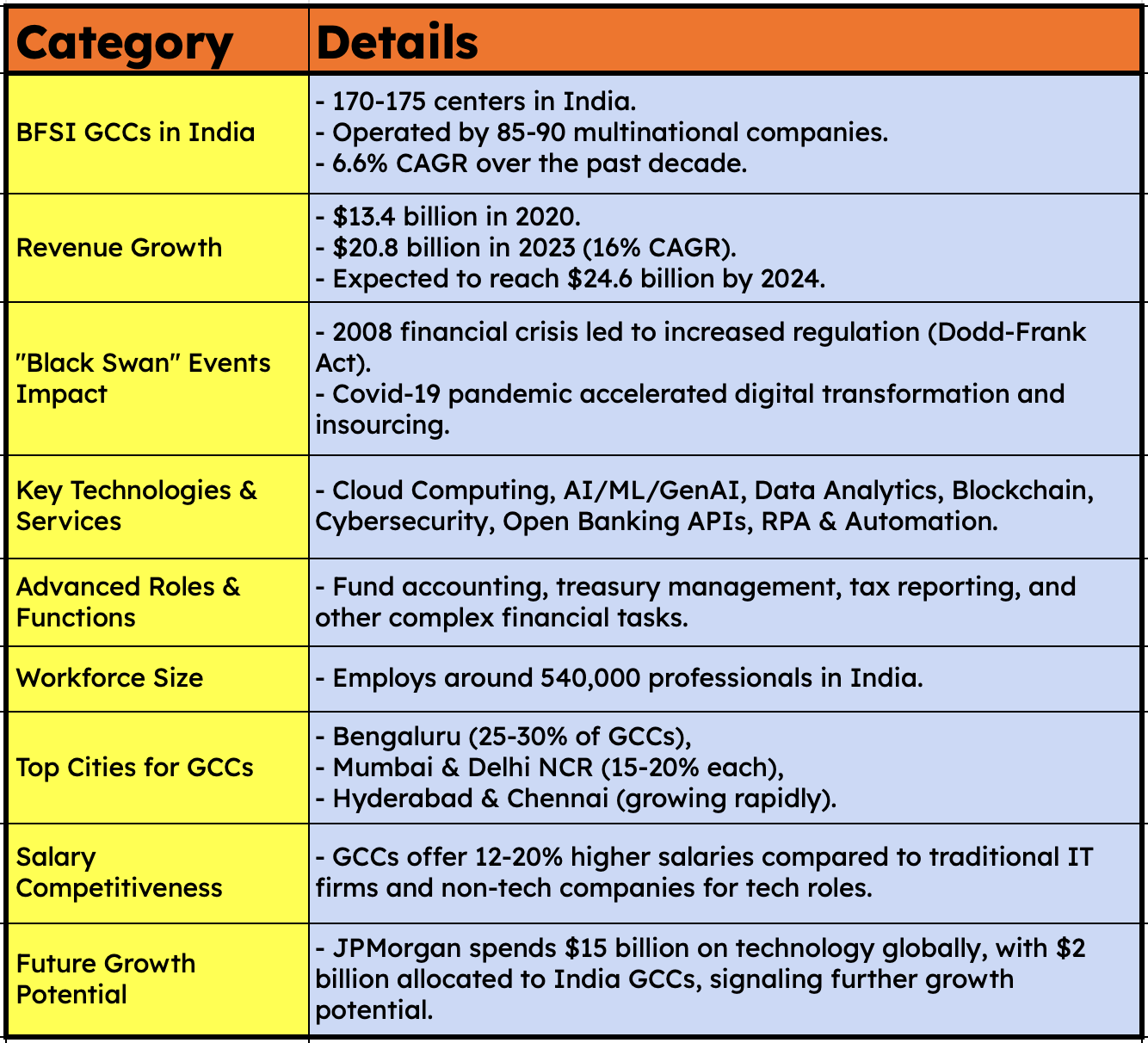

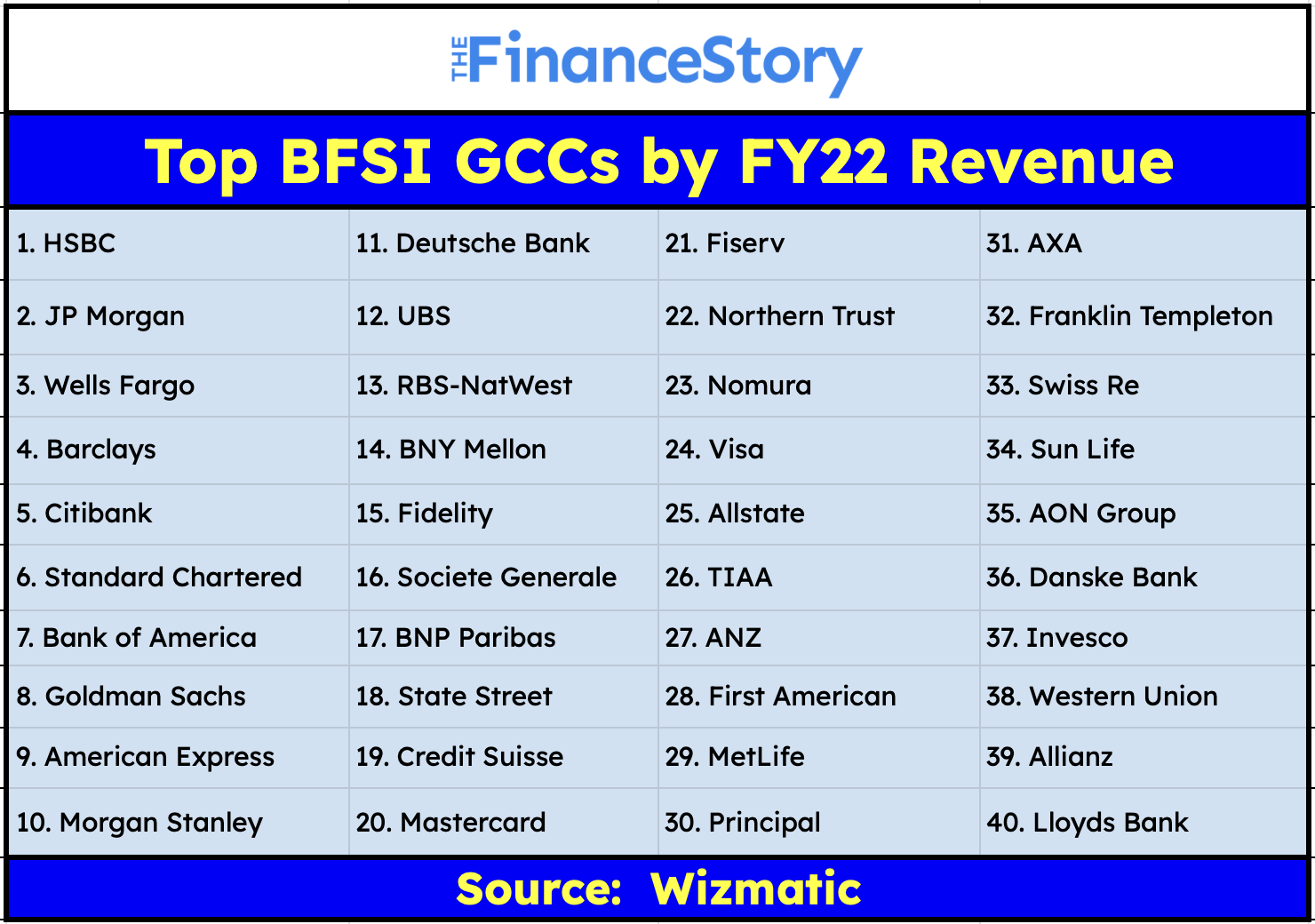

- A joint study by Wizmatic and EY revealed some fascinating data, as reported by the Times of India.

- Here’s a brief look at their evolution, current role, and future potential of BFSI GCCs.

Early beginnings: From back-office to strategic hubs

BFSI GCCs in India began as back-office centers handling basic tasks like customer service and IT support, aimed at cost reduction.

Over time, BFSI GCCs have shifted from operational centres to innovation hubs. They now design and implement advanced tech solutions…Making India essential to the global operations of many MNCs.

Today GCCs now focus on providing high-end services that go beyond back-office tasks.

Key areas include:

- Cloud Computing

- AI/ML and Generative AI

- Data Analytics

- Blockchain

- Cybersecurity

- Open Banking APIs

- Robotic Process Automation (RPA)

The talent pool in India has matured considerably, and these centers now handle complex tasks.

- Fund accounting

- Treasury management

- Tax reporting

- Regulatory compliance

Moreover, the Indian workforce has proven itself to be adept at delivering these services at a fraction of the cost compared to developed markets.

Current landscape of BFSI GCCs in India

Today, India hosts 170-175 BFSI GCCs, operated by around 85-90 multinational corporations.

These centers have witnessed a compound annual growth rate (CAGR) of 6.6% over the last decade.

A joint study by Wizmatic and EY revealed the following data:

Key cities:

- Bengaluru dominates the GCC scene, accounting for 25-30% of all BFSI centers.

- Mumbai and Delhi NCR each contribute around 15-20%.

- Hyderabad and Chennai are also significant hubs, with a growing number of GCCs.

Skyrocketing revenue:

- In 2020, BFSI GCCs generated $13.4 billion in revenue.

- By 2023, this figure had jumped to $20.8 billion, marking a staggering 16% CAGR.

- The upward trajectory is expected to continue, with revenue projected to reach $24.6 billion by 2024.

Talent pool

- BFSI GCCs in India employ an estimated 540,000 people

- This makes them a significant employer in the country’s tech and finance sectors.

Competitive salaries: Attracting top talent

- GCCs in India are offering competitive salaries, especially for technology roles, which are about 12-20% higher than those offered by traditional IT service companies and non-tech firms.

- This higher pay has allowed BFSI GCCs to attract top talent, particularly in tech-centric roles.

But, why the rise of BFSI GCCs in India?

Two major global crises significantly contributed to the rise of BFSI GCCs in India:

2008 financial crisis

- The crisis led to stricter regulations for global banks like the Dodd-Frank Act. This required banks to overhaul compliance and risk management.

- Banks turned to their GCCs in India to manage these tasks efficiently and cost-effectively.

Covid-19 pandemic

- The pandemic accelerated the move towards digital banking due to disrupted physical operations

- BFSI GCCs played a key role in ensuring business continuity and enabling remote work transitions

Impact on the Indian IT and tech ecosystem

The growth of BFSI GCCs has not only created jobs but has also had a transformative effect on India’s broader IT and tech ecosystem.

Some traditional IT services companies have lost out on contracts as global financial institutions increasingly prefer insourcing critical operations to their GCCs in India rather than outsourcing to third-party service providers.

Future outlook

Looks incredibly promising, driven by:

- Insourcing by Global Banks: Critical tasks are increasingly being handled by India’s GCCs.

- Advanced Tech Expertise: India’s strength in AI, machine learning, blockchain, and cybersecurity is growing.

- Post-Pandemic Demand: There’s rising demand for regulatory compliance and risk management.

Example: JPMorgan spends $15 billion on tech globally, with just $2 billion in its India GCC, highlighting the potential for growth as more banks expand their GCCs.

BFSI GCCs in India also face some challenges:

- Talent Retention: As salaries increase, so do expectations, and retaining top talent in a highly competitive market can be difficult.

- Innovation and Skill Development: As GCCs transition to more high-end tasks, constant upskilling, and innovation will be key to staying relevant and competitive.

- Regulatory Changes: Any changes in global regulations could disrupt the current setup and require quick adaptation.

Also read: Global Capability Centers in India are offering 12-20% higher salaries

And this presents…Opportunities for Chartered Accountants

- Transfer Pricing: Expertise in cross-border transactions and tax compliance is needed to develop transfer pricing strategies and ensure global compliance.

- Taxation: Crucial for managing complex tax planning, compliance with local/global tax laws, and resolving tax disputes for multinational companies.

- Advisory Roles: Strategic insights on mergers, acquisitions, international expansion, and financial restructuring, helping shape the company’s global growth.

- Fund accountants, and several other roles