- When CA Ankush Bhutra took the leap from a Big 4 to Blume Ventures as a Finance Controller, it was full of learnings;

- From adapting to the fast-paced environment to learning the importance of cash flow management in a VC.

- Are you curious to know what goes on in the Finance team of a Venture Capital firm? How can one find such opportunities? Here are insights from Ankush to help you.

TFS: After 11 years in tax-focused roles at big companies like EY, and Deloitte, why did you decide to move to a VC firm as a Finance Controller?

After qualifying as a Chartered Accountant in 2011, I garnered attention from multiple companies during campus placements and secured interviews with them.

During that period, India was witnessing a significant surge in Transfer Pricing litigation, and the realm of International Tax remained a relatively uncharted territory. Motivated by these circumstances, I decided to start with Transfer Pricing and joined Ernst & Young.

After my tenure at Ernst & Young, I transitioned to BMR, a distinguished boutique professional services firm in India founded by former Andersen Partners. This move allowed me to further specialize in the field of Corporate Tax.

Subsequently, I gained valuable experience during my four-and-a-half-year tenure at Deloitte.

After spending a decade immersed in tax-focused roles, I embarked on a profound introspection of my career path.

50-60% of my experience at BMR and Deloitte was in dealing with private equity funds, setting up funds, solving transaction queries, and solving investor queries. I was also handling a lot of work related to International Tax.

Growing up in a family that trades in the markets, makes investments, and evaluates investments, I was naturally drawn to investments.

These two factors motivated me to enter the sunrise industry.

What next?

I reached out to my connections to explore potential opportunities and that’s when I discovered Blume Ventures. Blume Ventures is an India-based early-stage VC firm that had recently raised USD 250 million for Fund 4. Coincidentally, they were in the process of establishing their Finance team during that time.

After a lot of discussion with the founders, we decided to move forward together.

I joined them as a Finance Controller in March 2022 – Transitioning from the highly regimented and fast-paced environment of a Big 4 firm to the moderately-paced and unpredictable nature of a venture capital firm is a significant shift.

TFS: What is your role as a Finance Controller at Blume Ventures? Do you interact with a lot of investors, and startup founders?

Different VCs are structured differently.

But typically, as a Finance Controller, my role includes,

Cash flow management

- Cash flow management is a very important aspect of a Finance Controller’s role.

- It helps VCs track how much runway a particular fund has to invest or reinvest.

- Without accurate cash flow information investment leads would not be able to evaluate the right set of target companies and determine the size of investments.

Regulatory compliance

- When setting up a fund, Finance Controllers must also consider the commercial, regulatory, and tax implications.

- We have to work with all stakeholders to create a structure that is optimal for everyone involved.

- We must also ensure that all transactions are structured in a way that complies with tax and regulatory requirements. This is important for both the VC and the Limited Partners (LPs).

Additionally, Finance Controllers are responsible for,

- Accounting

- Auditing

- Financial statements

- Registrations

Interacting with investors to report on their income and taxes, is also part of my responsibilities.

Some investors have very specific reporting requirements, as they may be large institutions or sovereign funds with multiple reporting obligations.

Therefore, it is important for us Finance Controllers to work with investors to ensure that their reporting is accurate and meets their needs.

The role of a Finance Controller is complex and ever-evolving with new fund jurisdictions emerging in India.

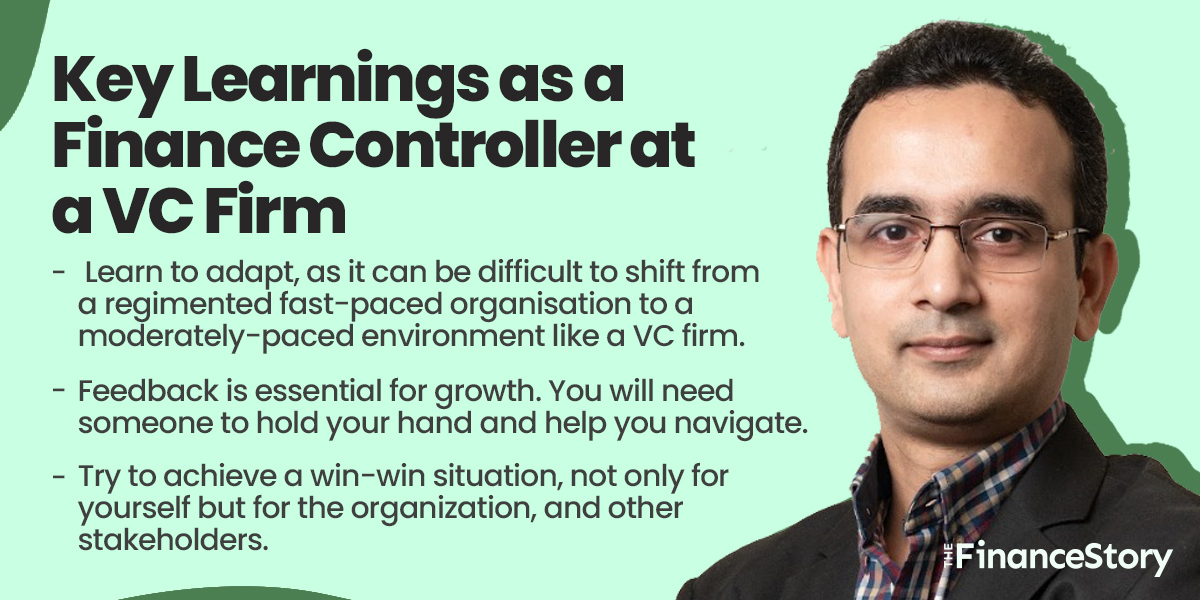

TFS: What are some of the key learnings you’ve gained in your current role as a Finance Controller?

One key learning for me, after joining as a Finance Controller at Blume was the importance of cash flows. In addition,

Adaptability:

- The second biggest learning was adaptability.

- When you come from a very regimented fast-paced environment, it can be difficult to adjust to a moderately-paced environment like a venture capital firm.

- I had to adapt to different working styles, personalities, ways of thinking, and communication. Luckily it worked out for me here and I adapted to the new environment.

Open to feedback:

- Feedback is essential for growth and development.

- When you move to a different working environment, you will need someone to hold your hand and help you navigate.

Achieving a win-win situation:

- It’s important to always try to achieve a win-win situation, not only for yourself, but for the organization, your team, and other stakeholders.

TFS: What are the challenges you face in your current role at the VC firm?

Keeping pace and being relevant is a clear challenge for me.

For example, one morning you might wake up to read about a new technology like Chat GPT.

“What is it and how can it impact my business? How do I use it to benefit myself and the finance team?” You have to figure that out as well.

In order to be successful, one needs to be innovative and on their toes. Here’s how I keep myself updated to achieve that,

Reading:

- You need to have a focused approach and choose your reading material smartly.

- Read what is happening in your domain, both domestically and worldwide.

- I am very grateful to my father for introducing me to the habit of reading newspapers when I was in the eighth grade.

Listen to podcasts:

- We are now in the age of podcasts.

- If you don’t prefer reading, opt for listening to podcasts.

- I do this while commuting to and from work. The Blume podcast “X Unicorns” on Spotify is a great series.

Subscribe to newsletters:

- Big VCs like Andreessen Horowitz, Y Combinator, General Catalyst, and other big organizations send out regular newsletters, so leverage them.

TFS: What exactly goes on in the Finance Team of a VC firm? Could you give us an overview?

If you want to be a part of the finance team of a VC firm, here is a bird’s eye view of what you can expect,

- Fund structuring: This is the initial stage, where you will need to work with the investment team to define the fund’s corpus, life, structure, and commercial terms.

- Fund registration: Once the fund structure is finalized, you will need to register the fund with the relevant regulator.

- Investor onboarding: This is the process of collecting information from investors and setting up their accounts. You will need to deal with a variety of queries, such as KYC, certifications, class of unit, and currency.

- Fund management: Once the fund is live, you will need to manage the cash flows, deploy the funds in the right investments, and settle down the fund with the right accounting and reporting practices.

- Valuation: As part of the finance team, you will also need to lead the valuation process. This part can be subjective and is becoming increasingly critical as regulators pay more attention to this area.

- Exits and fund wind down: As the fund approaches its end of life cycle, you will need to manage the exits and the entire fund wind down and the distributions to investors.

In addition to these core responsibilities, communication skills are essential for success in the finance team of a VC firm.

You will need to be able to communicate effectively with a variety of stakeholders, including investors, advisors, and regulators.

I believe ESG (environmental, social, and governance) investing is another important aspect that we have to look at, given all the climate commitments that many nations have made.

TFS: What are the key skills needed to join a VC firm’s investment team?

While making investments and achieving successful exits may be the glamorous side of venture capital, there are several other crucial components that drive these outcomes. Among these components, the finance platform plays a significant role in facilitating and optimizing investments.

However, if your goal is to join the investment team of a venture capital firm, there are several steps you can take to prepare yourself effectively.

Develop a strong understanding of the venture capital industry:

- Familiarize yourself with the key concepts, trends, and investment strategies within the venture capital landscape. Stay updated on industry news, attend relevant events, and engage with thought leaders in the field.

Build a robust knowledge of startup ecosystems:

- This will help you identify potential investment opportunities and evaluate their growth potential.

Identifying your strengths and weaknesses:

- To join a VC firm, it’s crucial to identify the skill sets you can bring to the table.

- Avoid venturing into completely uncharted territory.

- Sometimes, you may enjoy the work in a VC firm, but may not fit well with its culture, or vice versa.

Leverage your network:

- It would be best if you connected with individuals who can introduce you to relevant opportunities and provide guidance, rather than approaching the industry as a complete stranger.

Domain expertise and business acumen:

- The industry is now seeking individuals with domain or sector expertise and financial qualifications like Chartered Accountants (CAs).

- Possessing valuable business knowledge, including distribution networks, can make you a suitable candidate for a venture capital or private equity fund focused on investing in consumer businesses.

Venture capital demands unwavering commitment and relentless hard work.

In this dynamic industry, the future remains unpredictable, making it challenging to anticipate what the world will look like ten years from now.

It is a high-risk and high-reward business. Therefore, my advice is to pursue what truly aligns with your passion and capabilities, allowing you to chase your true calling whether it is in the VC space or otherwise.

FAQ

Q. Does an MBA help in joining a VC firm?

In my opinion, MBAs may be better than CAs at assessing businesses, and can easily move from VC finance to investment team.

Q. How much does the CFA qualification help in securing a position at VC firms?

The CFA qualification equips individuals with the skills to effectively analyze investment returns and interpret financial data of portfolio companies. This could be a valuable selling point when joining a VC.

Q. What opportunities are available for retired CAs in startups or VC firms?

Retired CAs have deep expertise in financial management, be it bank entries or financial statements. This makes them well-suited for opportunities in VC Finance.