- Picture this: Seasoned Big 4 Partners leaping from one firm to another, creating excitement in the industry pond.

- It’s not just a simple change of desks; it’s a power play, a testament to the allure of new opportunities and challenges.

- Breaking Records: Last month, the Big 4 firms shattered records as the total partner count surged past the 3,000 mark.

Deloitte India: Big Dreams Meet Bold Actions

Led by CEO Romal Shetty, Deloitte South Asia is on a mission to double its business in 3-4 years, and they’re doing it by bringing in the best talent. (But obvious!)

In 2023, Deloitte went on a hiring spree snagging top talent in areas like:

- Tax,

- Risk,

- New Technology building a powerhouse team for the future.

Over the past 12 months, Deloitte has hired around 53 lateral Partners, with nearly half coming from competing firms (EY, KPMG, PwC), often as part of large team transitions.

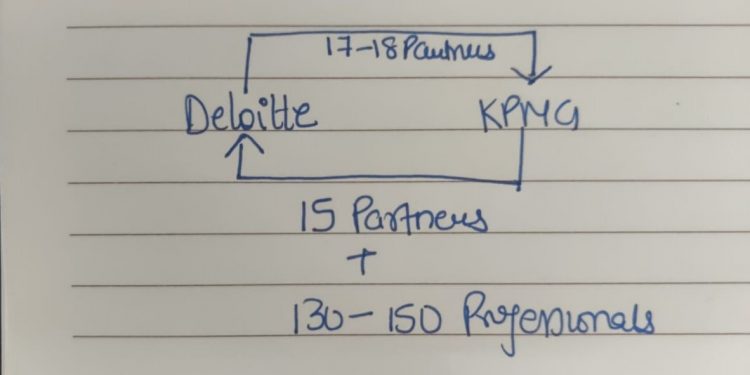

First of all, Deloitte gave a bear hug to KPMG Partners and about 15-20 Partners from Tax practice left KPMG and joined Deloitte… with 130-150 members. This was one of the largest team movements among the Big 4s in recent times.

A big impact on the clientele, the employees, and all of them…. KPMG’s whole tax practice was ruined.

- Rohit Berry, KPMG’s National Head of Deal Advisory, was to move to Deloitte along with Vivek Gupta, who heads M&A/private equity tax and family office practices for the firm.

- Vivek Gupta seemed to have already joined Deloitte.

In December 2023, Chirag Agrawal, a Partner in Investment Banking at EY India, decided to leave the firm. He is set to become the new Head of Corporate Finance at Deloitte India, according to Money Control.

As recently reported, Deloitte is aggressively hiring over 25 Partners from EY in Advisory Businesses, largely in cyber, risk, financial services, and tech—out of which 13 have joined with the remainder in various stages of negotiations and expected to join in the next few months.

In all, about 50 partners will be joining Deloitte in the next few months.

PwC India’s Talent Tango

PwC India isn’t holding back—they’re in the midst of an aggressive growth phase, locking horns with competitors like Deloitte.

PwC India, led by Sanjeev Krishan, is rapidly expanding its:

- Consulting

- Risk

- Digital operations

“The strong business environment has raised the need for senior expertise, prompting our ongoing investment in key areas,” said Sanjeev Krishan, chairman, of PwC India in a conversation with Economic Times.

PwC raided KPMG’s Advisory Practice including the ESG and the technology risk consulting talent pool and yet again 15- 20 partners from KPMG joined PwC and with their whole teams and the clients.

PwC India’s recruitment efforts have borne fruit, with 25 partners joining the ranks in recent months.

It’s a numbers game, and PwC is playing to win.

KPMG India

KPMG has been a victim of this poaching… literally!

They have been facing Partner turnover, losing over 50 Partners in three years. Most of these Partners moved with their teams!

So KPMG Tax and Advisory divisions have been ruined by Deloitte and PwC respectively.

Yezdi Nagporewalla, CEO of KPMG India said he had observed a recent trend where partners are approaching his firm in teams of 2-3 or larger groups.

However, as reported by the Economic Times KPMG is not giving up. The firm is in active talks with partners at rival firms—EY, PwC, and KPMG—and IT MNCs to recruit tech and advisory talent, preferring smaller teams for easier integration.

- KPMG made a concerted effort to woo 17–18 Deloitte Partners who had previously worked with the company, as well as their teams from the rival’s corporate investigation and risk departments

- KPMG secured Ankur Nishar, previously of PwC, as a Partner in deals and tax advisory

KPMG’s proposed 50% salary cut during the six-month gardening leave for Partners joining a rival.

EY India, the market leader follows selective recruitment

EY India is the market leader that enjoys loyalty from its Partners… Are now seeing attrition! As mentioned Deloitte has poached almost 25 Partners from EY.

But who is EY poaching? In the words of the Economic Times – EY, has opted for a more selective approach to hiring.

Why the poaching?

This hiring spree and investment are fueled by the promising business environment in India.

They are seeking senior expertise in areas such as:

- Business transformation

- Digital transformation

- Cybersecurity

- Emerging technologies

- Financial services, and more.

IT giant Accenture has also been a favourite hunting ground for all the Big 4s firms for tech talent required to manage and deliver larger tech transformation projects.

Over 15% of the net addition by the Big Four accounting firms (Deloitte, EY, PwC, and KPMG) in FY22 was from the top five IT companies.

Accounting firms like Deloitte and EY have hired more employees on a net basis, becoming top recruiters of IT talent laterally.

Insider news!

These poaching strategies come with lucrative bonuses and stringent exit clauses, reflecting the cutthroat competition.

However despite the fat salaries and bonuses some folks who have joined Deloitte and PwC from KPMG… seem to be regretting it!

In the past 6 months, few of them are facing the pressure to get more business…. And many are unable to adapt to the culture.

So it has gotten a little ugly!

On the other hand, according to sources, the recent appraisals at KPMG were really good. Who all were there on their active payroll have been promoted or given a hike of, like, 20-25% minimum… In some cases even if they did not deserve the hike!

Currently they’re trying to retain the talent, and attract mid-level talent!

PwC appraisals and the promotions might not be very good says our sources! Why? They have over hired, given huge joining bonuses, and hikes in the last year. So it is expected that there will be a high attrition in the coming year at PwC!

EY is a stable company right now. EY has given median appraisals and promotions in the past 3 years. When other firms are facing attrition at a high level, EY has shown some sort of stability.

Wrapping up…

The combined revenue of the Big 4s India approached $4 billion in FY2022-23.

As the battle for talent intensifies, the Big Four firms remain at the forefront of the professional services industry, driving innovation, growth, and transformation in India and beyond.

(Source is Economic Times)