- It’s raining Partners!

- 3,300 – Yes, that’s how many Partners the top professional services firms such as EY, PwC, and Grant Thornton Bharat in India have roped in so far.

- The sector is experiencing significant growth in advisory businesses.

Top Indian professional services firms: Partner count?

The professional services landscape in India is witnessing an extraordinary transformation.

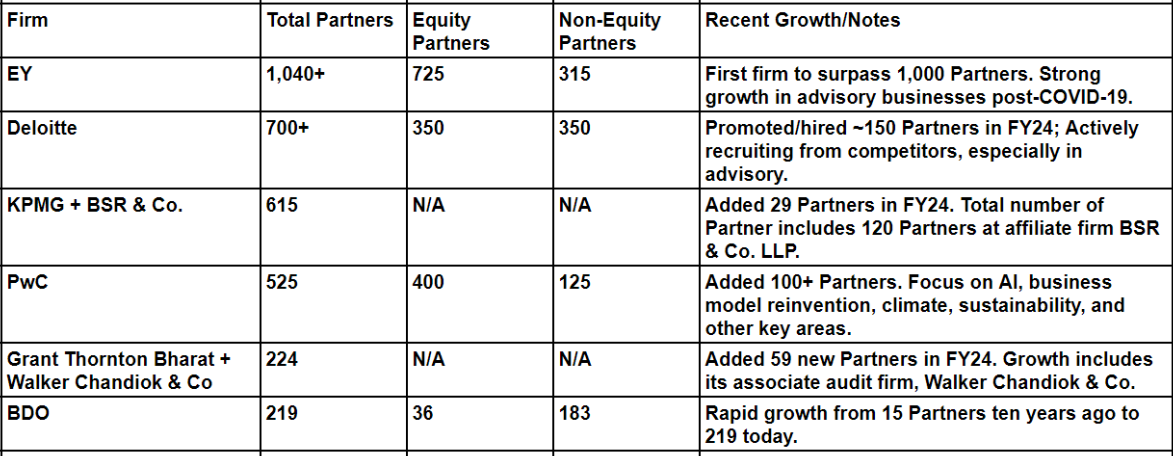

The top six firms namely have collectively amassed over 3,300 Partners, combining both equity and non-equity roles, as reported by The Economic Times:

- EY

- Deloitte

- KPMG

- PwC

- Grant Thornton Bharat

- BDO

What roles are they hiring for?

The top professional services firms have expanded their middle and top-level leadership.

This has resulted in record Partner additions, particularly in: Consulting and Tech consulting roles.

In the last three years, advisory businesses – encompassing consulting, deals, and risk management – have experienced explosive growth, outpacing traditional areas like audit and tax.

While advisory services have grown by an impressive 25% or more, audit and tax services have maintained a growth rate between 15% and 22%.

Firm-specific growth trajectories

EY India

In a groundbreaking achievement, EY has become the first firm to surpass the 1,000 Partner benchmark.

This milestone has been driven by the continued strong growth in advisory businesses following the COVID-19 disruption.

Equity Partners: 725

Non-equity Partner: 315

Deloitte

In FY 23-24, Deloitte promoted and laterally hired around approx 150 Partners.

To put this growth into perspective, the firm had only 173 Partners in total back in 2014 and in 2024 almost 700 Partners.

Notably, Deloitte was actively seeking to recruit over 25 Partners from EY in Advisory Businesses, particularly in areas like cyber, risk, financial services, and technology. 13 of these Partners have already made the switch.

Romal Shetty, CEO of Deloitte South Asia, told ET,

“Deloitte is currently the fastest-growing large firm in India, and we are significantly expanding our partnership due to robust demand for our services.

We are building innovation not just for India, but for the world.”

Equity Partners: 350

Non-equity Partners: 350

KPMG

KPMG added 29 Partners to its ranks in FY24, which brings their total to 615, including 120 Partners at their affiliate firm BSR & Co. LLP.

PwC

PwC internally promoted or laterally hired more than 100 Partners bringing their total to 525.

Sanjeev Krishan, Chairman of PwC India, told ET, “To stay ahead in business-critical fields like AI, business model reinvention, climate and sustainability, cyber, tax, and trust, we have strategically invested in the acquisition and development of top-tier leadership talent.”

Equity Partners: 400

Non-equity Partners: 125

Grant Thornton Bharat

The growth story isn’t limited to the Big 4.

Grant Thornton Bharat and its associate audit firm, Walker Chandiok & Co, have added 59 new Partners in the new financial year, totaling 224 Partners.

BDO

Mumbai-based BDO has seen exponential growth, scaling up from just 15 Partners ten years ago to 219 Partners today.

Equity Partners: 36

Non-equity Partners: 183

Also read: Big 4 India Partners jumping from one firm to another: High alert as Partner poaching surges

Driving factors behind the Partner hiring boom

- Increased economic activity

- Growing regulatory complexity

- Rapid tech-led disruption

- Increasing digitization

Big 4’s financial milestone

The combined revenue of the Big 4 firms, including their affiliates, has crossed a staggering ₹39,000 crore in the last financial year.

Senior Partners estimate that the total Partner profit pool for the Big 4 firms, including audit affiliates, could range between ₹6,600 crore and ₹7,000 crore in FY24, as reported by ET.

Also read: Big 4 India Inside Scoop: Appraisal, Benching, Hiring

Rapid career growth at the Big 4

The stairway to the Partner position is more accessible than ever before.

Why do we say that?

Firms are adding non-equity Partners at a faster rate and hiring more extensively from the industry.

Additionally, the Big 4 are actively advancing younger Partners into leadership roles, with the average age ranging from 33 to 35. In the past, the typical age range for non-equity Partners was around 38 to 40 years old.

Source: The Economic Times

With AI the journey to becoming a Partner will be shorter. Now the avg age is 38-42 it will soon become 32. What is your take?

All this AI, Cyber security are unproven products in the market. Reckless use, combination of these tools, technologies will lead.to more and more cybercrimes,cyber thefts which police department is neither able.to detect nor able to solve..India becoming a test ground for these untested technologies and implementing untested technologies can move significantly backwards performing worse than those countries which do not do these technologies. India has implemented PAN technology foolishly leading to many undetectable cyber thefts.people without having PAN Card are proving to be more rich and wiser than those in whose pockets these cards are put…