- The once-mighty ed-tech giant, Byju’s is facing a daunting financial challenge as it seeks “Rights Issues” at a $500 Mn valuation.

- Byju’s was earlier valued at $22 Billion!

- Here is what is happening.

Financial struggles

Byju’s parent company, Think & Learn, reported a significant loss of Rs. 8,245 crores in FY22, up by 80.6% from the previous year.

The loss exceeded the revenue growth, which was Rs. 5,014 crore.

Stressed assets

About half of the losses (Rs. 3,800 crore) were due to “stressed assets” acquired during the pandemic, like Whitehat Jr and Osmo.

Byju’s valuation drop

Byju’s, once valued at $22 billion, (in 2022) has seen a massive drop of 97.8% in its valuation.

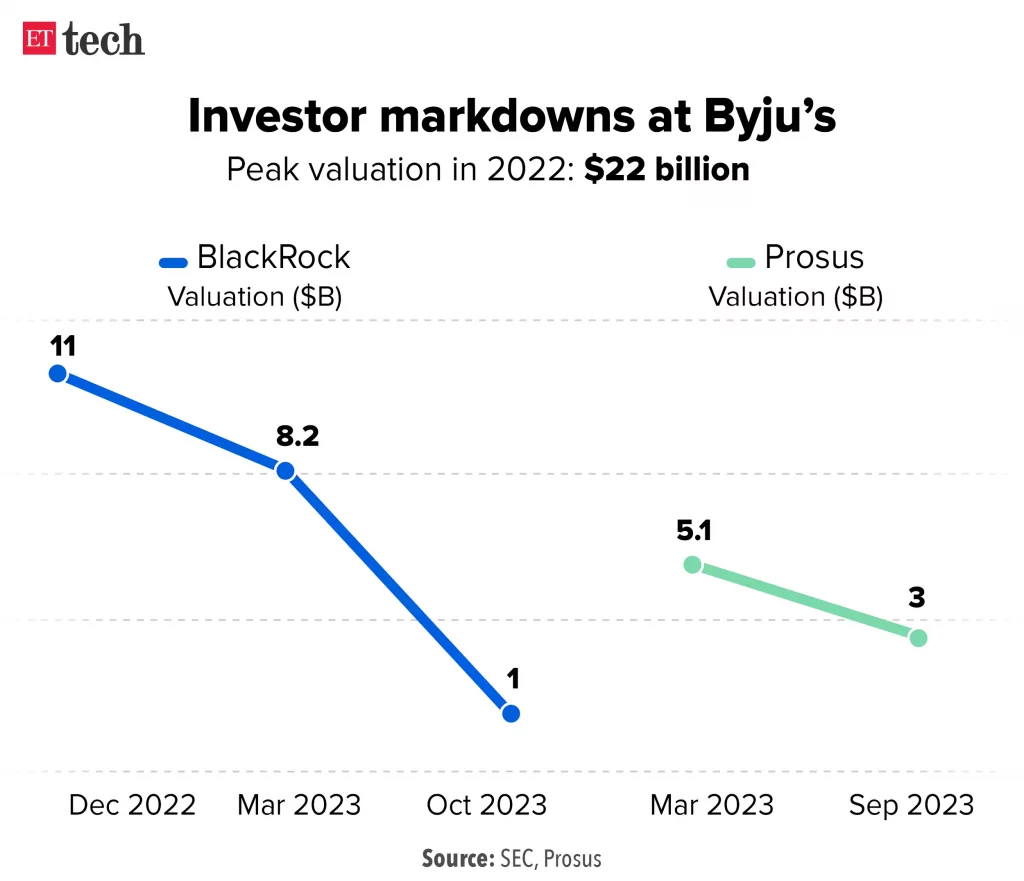

In April 2023, The leading global asset manager BlackRock reduced Byju’s valuation by almost 50% to $11.5 billion.

In November 2023, Ervin Tu, the interim CEO of Prosus, announced that the company has reduced Byju’s valuation to less than $3 billion.

BlackRock further devalued its shares in Think & Learn, marking down Byju’s valuation to approximately $1 billion.

Rights issue

Byju is exploring a “rights issue” to raise $100 million at a valuation of $500 million.

This allows existing investors to acquire new shares at a reduced valuation, helping Byju’s with much-needed funds.

You can learn all about rights Issues here.

Legal battles and debt

Byju’s is in a payment dispute of Rs. 158 Crores with the Board of Control for Cricket in India (BCCI).

The company owes USD 1.2 billion term loan B (TLB) to foreign lenders.

How many investors does Byju’s have?

As per Traxn Byju’s has 94 institutional investors including General Atlantic, IFC, and Qatar Investment Authority.

MIH Ventures is the largest institutional investor at Byju’s, while Mohandas Pai and 26 others are Angel Investors at the same.

How much funding has Byju’s raised to date?

As per Traxn, Byju’s has raised a total funding of $5.08 billion over 28 rounds. Its first funding round was on 30th March 2013.

Its latest funding round was a Conventional Debt round on 12th May 2023, for $250 million.

One investor participated in its latest round, which included Davidson Kempner Capital Management.

Challenges ahead

Byju’s needs to focus on cost-cutting, strategic refocusing, and potentially restructuring acquired assets to regain investor confidence.

Asset sales and funding arrangements are being considered by the top management.