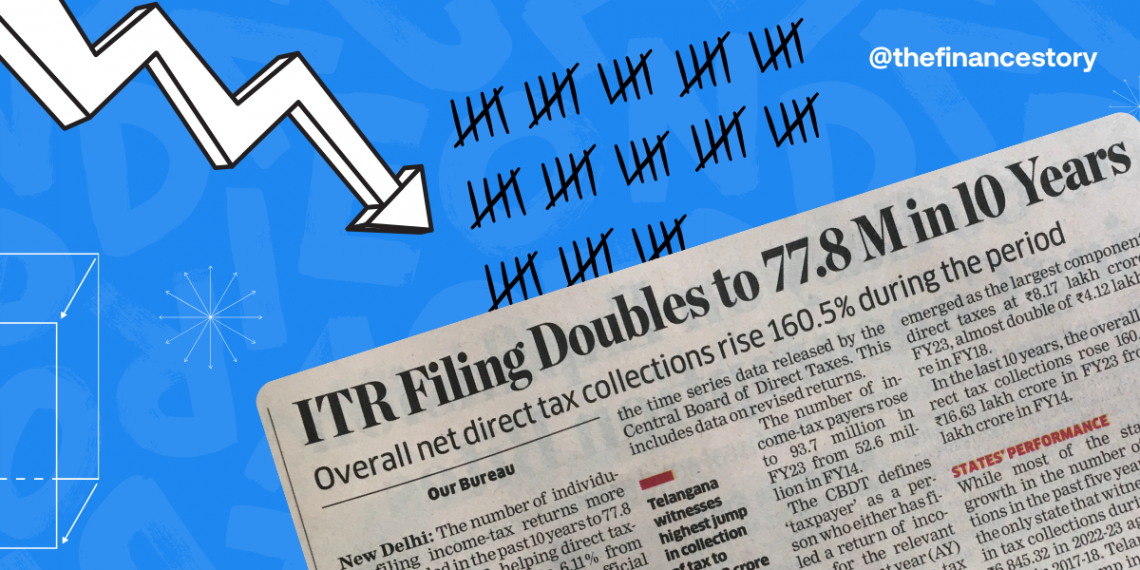

- Over the last decade, India has witnessed a surge in Income Tax Return (ITR) filings.

- The number of people filing for Income Tax Returns has doubled from 38 million to 77.8 million.

- Let’s look at the driving forces behind the surge and how it has positively impacted the economy.

Formalization initiatives

The push for formalization of the economy has played a major role in driving this increase.

Encouraging formal employment and tax compliance has caused a change from informal to formal income sources.

Enhanced tax awareness

The government’s actions to simplify tax filing and educate taxpayers have played a crucial role.

This has enabled individuals to fulfill their tax duties more efficiently.

Technological advancements

The adoption of digital platforms and technological innovations has revolutionized the tax filing landscape.

Online portals, mobile applications, and pre-filled ITR forms have streamlined the process.

These efforts have made tax filing more accessible and convenient for taxpayers.

Revenue boost

The doubling of ITR filings has translated into a significant increase in tax revenue for the government.

This influx of funds provides vital resources for public infrastructure projects, social welfare programs, and other developmental initiatives.

Data Insights

The data derived from ITR filings offers policymakers invaluable insights into income distribution, employment patterns, and sectoral trends.

This data-driven approach enables more informed decision-making and targeted policy interventions.

Conclusion

While the doubling of ITR filings is a significant achievement, challenges remain in bringing the entirety of the economy under the tax net.

Ensuring that workers in the informal sector and small businesses comply with tax regulations is crucial for a more inclusive tax system.

To make the tax filing process smoother and drive long-term fiscal progress, the government must provide digital literacy programs, adopt emerging technologies like AI and blockchain, simplify tax laws, and rationalize tax rates.