- When the India–EU Free Trade Agreement was announced in January 2026…Most headlines focused on textiles, wines, and electronics.

- But there’s a bigger story: this deal is a massive opportunity for CA firms, consultants, tax advisors, and finance leaders.

- We spoke with Robin Banerjee to unpack how this $24 trillion market is opening a once-in-a-generation trade corridor.

EU-India FTA “Mother of All Trades”?

This is not just a trade deal, it’s a 20-year effort to rewire global supply chains.

At its core, the FTA:

- Reduces tariffs

- Eases regulations

- Opens trade in goods, services, investment, and talent

- Brings to the two regions closer than ever before

But the scale here is what makes this particularly serious.

You’re talking about two massive economies coming together.

The entire European Union (27 countries) with $20 trillion in GDP and India’s economy is $4 trillion.

Put together? That is around $24 trillion!

To put this in perspective: global GDP is about $110 trillion. So this agreement touches nearly 22% of global GDP and directly impacts 2 billion people, roughly 25% of mankind.

Goods get a boost

India secured preferential access across 97% of EU tariff lines, covering 99.5% of trade value.

Key sectors benefiting include:

- Textiles and apparel

- Leather and footwear

- Marine products

- Chemicals

- Gems and jewellery

- Electronics

- Metals

On the other side, India is offering 92% tariff coverage to EU exports, accounting for 97% of trade value.

Take wines and liquor. Duties currently go as high as 150%. Under the agreement, those will gradually reduce, eventually to 20%.

Pharma, machinery, aerospace, chemicals, electronics, all part of the deal.

Agriculture is largely excluded from both sides to protect domestic interests.

All of these are significant.

But the leverage lies in services

Professional services like accounting, tax, legal, and consultancy have long struggled with:

- Difficult rules

- Visas

- Market-entry restrictions.

The FTA reduces these barriers, making market entry (to 27 EU countries!) more predictable while still respecting each country’s regulatory requirements.

Service areas covered under the FTA include:

- Information Technology (IT / ITeS)

- Professional services (accounting, consulting, legal, engineering)

- Business services (management consulting, corporate advisory, finance functions)

- Education services

- Digital & online services

- Other business processes and support services

It divides access into two buckets:

Bucket A: Business Entities (37 Subsectors)

Indian firms can now provide services in the EU under clear rules and visa support.

For instance, previously, if an Indian firm won a contract to implement an ERP system in Germany, getting the team there was a nightmare of “Economic Needs Tests” (proving no local could do the job).

The Change: The 37 subsectors create a “Green Channel.”

Bucket B: Independent Professionals (17 subsectors)

Individual consultants, specialists, and solo experts can now legally offer high-end advisory services in areas like IT, R&D, and higher education.

The FTA gives them a recognised legal identity, making direct European clients accessible.

Talent mobility made easy

Banerjee sums it up: “At the end of the day, Consulting is about moving and deploying talent across borders.”

The FTA sets clear rules for:

- Intra-Corporate Transferees (ICT): Executives and specialists relocating to EU affiliates

- Contractual Service Suppliers: Teams sent on short-term assignments like tech implementations, audits, or consulting projects

- Independent Professionals: Solo experts delivering services directly to European clients

It’s not free immigration; it’s a predictable, recognized framework that removes uncertainty and makes cross-border business smoother, faster, and more reliable.

Also read: U.S. Hit The World With Big Tariffs. Modern-day Great Depression?

Europe benefits too

European companies also gain significant access to Indian services markets (102 subsectors)…And easier market entry, which will likely translate into more European firms:

- Establishing subsidiaries in India

- Hiring Indian talent for operations

- Bringing in professional services expertise for local clients

Big names like BMW, Airbus, and Sanofi are already expanding in India to diversify from China—and they’re bringing their consultants along. That means huge opportunities for Indian CA, tax, and consulting firms!

Hot demand areas include:

- Tax structuring: navigating GST and corporate tax

- ESG & Carbon Auditing: ensuring Indian subsidiaries meet EU’s CBAM (Carbon Border Tax) standards

- Cross-border advisory: transfer pricing, OECD compliance, double taxation, VAT, and customs

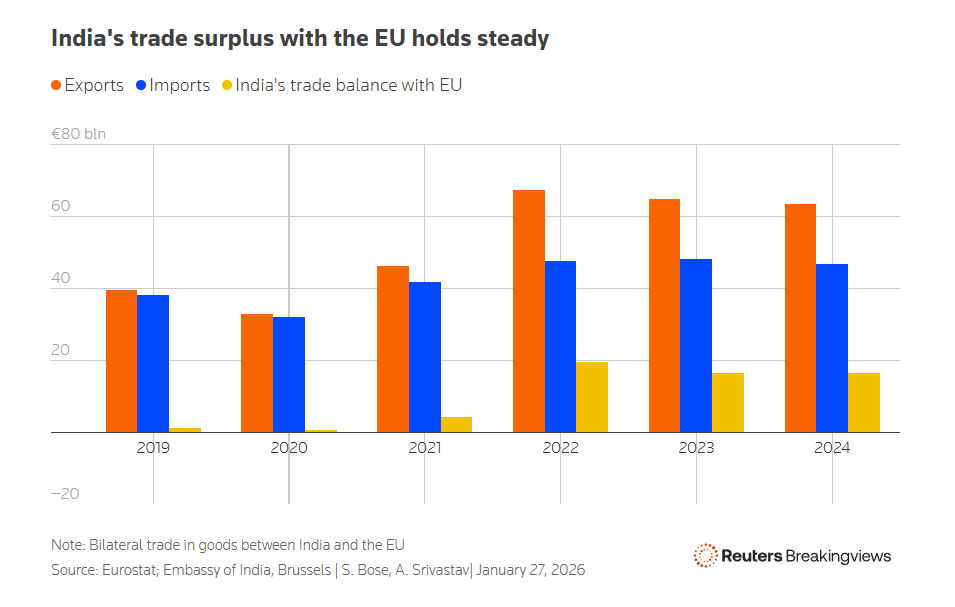

Trade between India and Europe is already over $190 billion and poised to grow even faster, so the opportunities are real, immediate, and massive!

Strategy to enter the EU market?

Banerjee’s advice is counterintuitive: Don’t rush to set up an office.

“If you have a tax problem in India, you call someone local who speaks your language…A European firm will do the same.

Instead of trying to be a ‘local’ firm in Berlin, partner with one,” he explains.

Zero in on the country you want to enter

In terms of large countries, the following countries would be my top preferences:

- Germany:

- France

- Italy

- Spain

- Portugal (if I had to add one more)

But be open to exploring other smaller countries. They could offer great opportunities.

How to start?

Attend exhibitions and professional seminars, such as the Chambers of Commerce convening.

Establish connections. Out of 100 business cards, you’ll find perhaps 20 that work very well.

I’ve seen it firsthand: Europeans receive Indian businessmen with open arms.

Tie up with European companies.

The tie-up could be:

- Start with an MoU (Memorandum of Understanding). Exchange partners; send one Indian partner to Germany and bring one German partner to India.

- Equity swaps

- Small investments in each other

- The cross-referral. If a German firm’s client has Indian assets, you handle the Indian audit. If your Indian client buys a factory in Italy, your Italian partner handles the local compliance.

There are various permutation combinations.

Also read: French President Macron aims to attract 30,000 Indian students by 2030

The “Non-Negotiables” of the EU market

The FTA removes the legal walls, but the cultural walls remain.

Banerjee highlights four areas where Indian professionals must adapt:

- Learning German, French, or Spanish is a “non-negotiable.”

- Europeans are obsessed with background checks. “If they find a negative article about your directors or a failed banking commitment, they won’t say ‘no’. They’ll just stall until the deal fades away,” warns Banerjee.

- In Germany and France, punctuality is a sign of respect. If a meeting is at 8:00 AM, being there at 8:01 AM is a red flag.

- “Even a CEO in Italy might work with about 4-5,000-word English vocabulary. Don’t speak fast, and don’t use ‘big’ words.”

The GCC wave

With India’s new data protection laws (DPDP Act) aligning with the EU’s GDPR, the floodgates for European Global Capability Centers (GCCs) have opened.

Banerjee notes a massive cost advantage: An employee costing €80,000 in Europe can often be supported by a high-calibre professional in India for a fraction of that cost.

Under the FTA, this isn’t just “outsourcing”, it’s integrated service delivery.

For this, we have to wait and watch.

Wrapping up…

This FTA is a once-in-a-generation opportunity.

- Big firms will move first

- Mid-sized and boutique firms that prepare smart partnerships early can capture niche opportunities

- Cross-border tax, transfer pricing, ESG advisory, and compliance are prime areas

The message is simple: prepare now, exchange ideas, explore opportunities, and scale globally.

While the deal was concluded in early 2026, legal vetting and ratification by 27 parliaments will take time.

The verdict: “Save the champagne for early 2027,” concludes Banerjee.