- Cognizant, with $21 billion in annual revenue, built its empire on one simple hack: deliver global IT services from lower-cost locations, cut costs, and win big.

- Offshoring isn’t just part of its strategy. It is the strategy.

- But in its latest SEC filings, Cognizant acknowledged something uncomfortable: “Reputational Risks associated with offshoring.”

What’s happening?

For Cognizant and its peers Infosys, TCS, and Wipro, the math is straightforward.

They bill US and European clients at Western rates for tech services and digital transformation, then fulfil that work using massive offshore teams.

The margin between US billing and Indian operating costs is where the profit lives.

But in its 2025 annual report, Cognizant made a revelation: The model that made them rich is now a reputational liability.

Basically, Cognizant is saying: “We make money with offshore teams, but this model could trigger criticism or restrictions.”

Scale of exposure

As of December 31, Cognizant’s total workforce stood at 351,600 employees, up from 336,800 a year earlier. That is an increase of approximately 14,800 employees.

- India continued to account for the bulk of headcount, rising from 241500 to 256,900: an addition of 15,400 employees.

- In contrast, headcount in North America declined slightly to 41,600 from 42,800.

- Continental Europe fell to 14,600 from 15,700

- United Kingdom dipped to 7,800 from 8,200.

- Other regions saw an increase to 30,700 from 28,600.

Well, the workforce distribution reflects the company’s continued reliance on offshore delivery…Particularly India!

Also read: India’s IT layoffs driven by Global Capability Centres, not just AI?

The biggest threat right now?

Politics

The US government, especially Donald Trump, has opposed offshoring and outsourcing to boost local employment.

Take the HIRE Act (Halting International Relocation of Employment), for instance.

Although it’s just a legislative proposal, the HIRE ACT could be a serious threat to outsourcing and offshoring.

It would impose a 25% excise tax on payments that U.S. companies make to foreign firms/workers for services that benefit U.S. consumers.

For instance, if a U.S. company pays Cognizant $1 million for a project done in India, the government might slap a $250,000 tax on top of it. They also want to stop companies from deducting these costs from their taxes.

The goal is simple: make offshoring so expensive that companies have no choice but to hire locally.

Visa dependence

Cognizant also highlighted its reliance on skilled workers holding H-1B and L-1 visas within the US.

Changes to immigration laws, visa caps, processing timelines, or executive policies could increase costs or delay staffing deployments, the company warned.

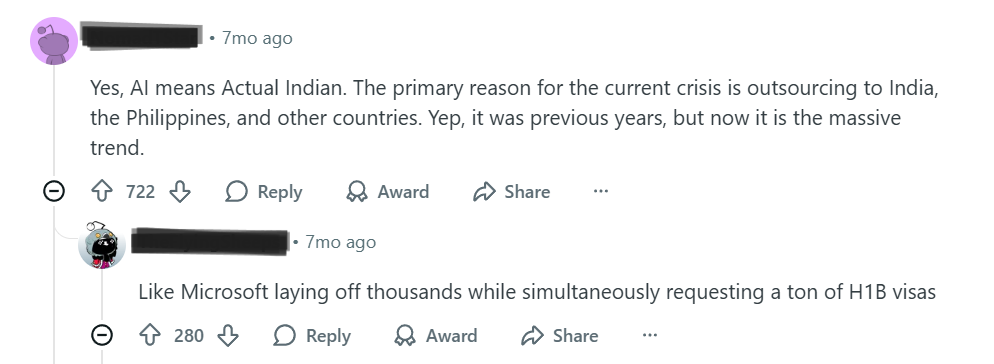

Public perception of offshoring: Uglier

Beyond the laws, there’s a massive PR problem.

You’ve heard the complaints:

“They’re firing locals to hire cheaper labour abroad.”

or

“Greedy MNCs are sending jobs to Indians, claiming there’s a talent crunch. But in reality, they just want to cut costs and maximise shareholder value.”

This isn’t just noise anymore; it’s a reputational risk that can make big clients think twice before signing a new contract.

Yellow flag on emerging tech

Cognizant admits AI tools may not always perform as promised.

If AI underdelivers, it could mean cost overruns, missed deadlines, unhappy clients, and reputational damage.

A meaningful portion of Cognizant’s contracts is tied to performance metrics, cost savings, efficiency gains, and revenue impact. That sounds attractive when things go right. But it also means revenue and margins can swing if targets aren’t met.

Then there’s the tech itself. If AI eats the work, the “offshore advantage” disappears overnight.

Data security concerns

These firms typically maintain certifications such as ISO 27001, SOC 2 Type II compliance, and adhere to frameworks like GDPR and US state privacy laws to demonstrate their security posture.

But here’s the thing: even though there haven’t been any major data breach incidents in India’s offshore delivery centres, there is a negative connotation to it.

The GCC risk

Once a client builds a GCC, they have less reason to hire Cognizant. Their own clients are becoming their competitors.

Also read: Trump’s $100K H-1B fee: A blow to Indian IT…or a boon for GCCs & offshoring?

Wrapping up…

Cognizant CEO Ravi Kumar S and CFO Jatin Dalal are steering a company that still generates billions in free cash flow.

But when a company as big as Cognizant puts these warnings in writing, it means the management sees “offshoring” as a real potential threat to their bottom line.

Investors are watching because margins could shrink if offshoring is limited.

And it’s not just IT services; could this also threaten finance and accounting offshoring services?

FAQs

Could the US HIRE Act threaten offshoring or outsourcing to India?

Yes. The proposed HIRE Act seeks to impose penalties and remove tax benefits for US companies outsourcing jobs overseas, which could make offshoring to India more expensive and less attractive.

However, it is currently only a proposed bill in the US Congress and has not yet been passed.