- Hi, we’re Shivadutt Bannanje (ex-Head of Legal & Company Secretary, Tally) and Sathya Pramod (ex-CFO, Tally).

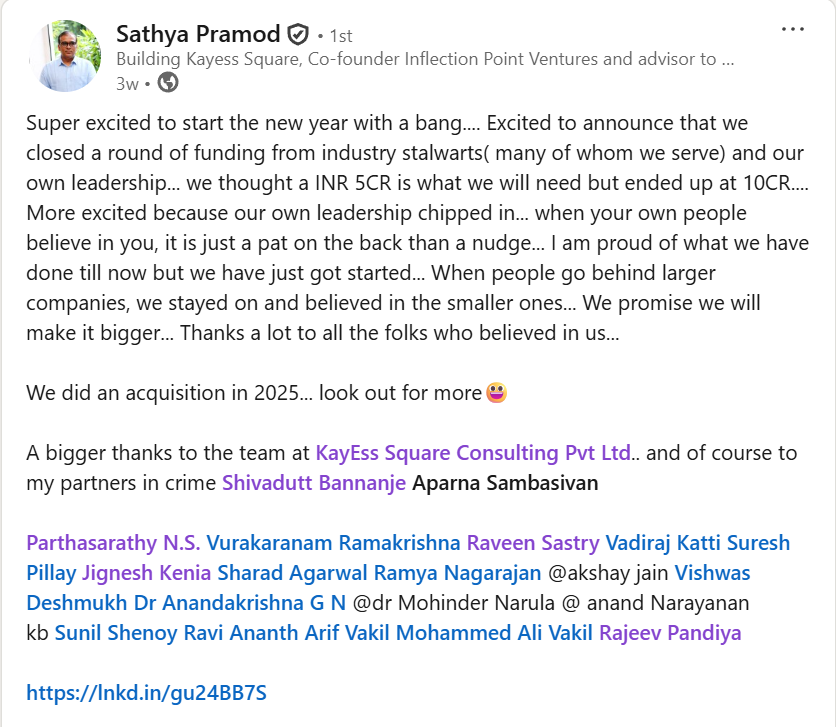

- In early January 2026, we raised $1.1 million (₹10 crore) for our firm, Kayess Square Consulting.

- To be clear, we’re not pivoting to a product or an AI-first approach…What won’t go away is the services business.

- So then, why did we raise capital and why did investors back us?

Backstory: Gap Big 4 firms never fixed

After decades across large corporations and Big 4 firms, we quit in 2017.

Not to build a unicorn…But to fix a problem we kept seeing across large professional services firms.

They had smart partners and capable teams.

But when it came to smaller companies or startup clients, they often ended up with:

- Junior-heavy execution

- Endless handoffs

- No real ownership

Kayess Square was built around this gap…To help early‑stage and growing businesses deal with messy decisions: structuring, compliance, cash flow, fundraising, and acquisitions.

Our operating model?

- Clarity over complexity: We don’t blow problems out of proportion to make them appear larger. Clients want clarity and solutions, quickly. And we are here to provide that.

- Faster turnaround: Let’s deliver the same rigour while solving problems faster and more practically.

- Hands-on approach: We handhold our clients to solve problems all the way through to the end. Yes, we get our hands dirty!

And 9 years later, that approach quietly compounded.

By 2026, we had grown to:

- Team of over 80 professionals

- Serving more than 100 clients across CFO advisory, tax, transactions, due diligence, legal, and compliance.

Also read: CFO-turned-investor shares why finance professionals should pivot towards startups

Fundraising was never part of the original plan

When we founded Kayess Square in 2017, we weren’t chasing aggressive growth targets.

Had we focused solely on chasing numbers, we might be much bigger today. But for us, building long-term relationships has always mattered more.

Our ambition was simple: focus on the fundamentals

- Build the right team

- Deliver consistently

- Build a reputation based on honesty and getting things done.

- Focus on long-term growth instead of short-term wins.

Yes, we have to charge our clients, but we don’t treat assignments as mere billable hours converting into fees. In the world of finance and advisory, trust is the most valuable currency.

So then why fundraise?

Need for inorganic growth

We were thriving across finance, legal, and accounting, but lacked a solid Tax advisory and compliance offering.

That’s when, in 2025, we acquired Consark’s tax practice.

That was the lightbulb moment when we realised:

“We started asking ourselves whether staying small was actually responsible.

Could we consolidate smaller firms?

Could we build something institutional?

Could we scale fast enough to matter?”

We realised inorganic growth through acquisitions could accelerate our progress…We began exploring our options more deliberately.

Growth requires talent

Expanding requires top-quality talent, and attracting that talent depends on growth.

Could we bring in more senior leaders?

Add new lines of business?

Expand into new geographies?

Market dynamics are shifting

Traditionally, consulting firms don’t need external capital to scale.

The margins are healthy, and the model sustains itself.

But globally, if you look at the consulting sector/professional services firms now, you see a lot of ‘consolidation’.

And with MNCs entering India and consolidation picking up, investors see an opportunity to build platforms, not just firms.

Strong inbound interest, too!

We had planned to raise around ₹8 crore, but the investor response exceeded our expectations. The round closed at ₹10 crore.

But why did investors back us?

Services offer predictable economics

AI and product startups get attention, but experienced investors know the math: out of ten bets, only a few succeed.

In professional services firms, that cannot be the case. Why? Services firms offer steady cash flows and balanced risk.

Growth may not be 100% year-on-year, but 25–30% is predictable.

Rise in consolidation

If you’ve seen the latest trend, especially with a lot of MNCs entering India, consulting/professional services firms are looking at consolidation.

A services business like ours works like a mutual fund.

- Investors can expect 20–30% year-on-year growth, which is steady and reliable.

- And with consolidation and acquisitions, this can increase to 50–60%, without taking the risks of a product business.

Advisory services will always be needed

Entrepreneurs need guidance, help with decisions, scaling responsibly, finding opportunities, and managing complexity.

AI may assist, but human judgment, context, and experience remain essential. Investors see this as a long-term advantage.

India’s growth has always been driven by services

Look at Infosys, TCS, or even the Big 4.

Also read: Ex-Tally CFO consulting firm KayEss Square acquires Consark’s tax division

Valuation metrics

For us, the valuation was done by a registered valuer.

But revenue alone rarely tells the story; profitability matters more.

We looked at a balanced approach:

- EBITDA multiples

- Growth consistency

- Business quality

- Interest-rate environment

The reality: Professional service firms do not command the valuation that a product startup.

Big question: What’s next with the capital raised?

The capital which we have raised is planned to invest in the growth of the business.

Better services: Many firms raise capital and immediately pivot to software products. That was never our plan.

So, we won’t chase the FOMO of building products.

Yes, there are millions of products that can be built in and around this.

Technology will be used to serve clients better, faster, more accurately, and more integrated. What won’t go away is the services business.

Geographical expansion: We are a Bangalore-based firm, with operations in Chennai and some presence in Delhi.

- Mumbai will be an essential part of our long-term journey, especially in financial services, advisory, and fundraising.

- Other metros are also on our radar. Kolkata has strong talent.

International expansion and global services: We are exploring multiple ways to make this happen and will act when we’re confident we can do it well.

There’s already inbound interest, and we’re open to conversations.

Consolidation/ Acquisition: Acquire similar consulting practices or acqui-hires to grow faster, reach size, and eventually explore exit or public markets

Our internal targets?

- 3× revenue growth

- 2× team size in the coming years

- Maintain healthy margins

Wrapping up…

Companies are doubling down on what they do best and outsourcing the rest.

And Consulting firms that deliver reliably in these “non-core” areas are the real winners.

For years, India’s professional services firms grew quietly, bootstrapped, partner-funded, and ignored by VCs. That’s changing fast.

India’s advisory market is still highly fragmented, which is exactly why investors are circling accounting firms, tax practices, CFO advisory platforms, transaction boutiques, and compliance-led consultancies.

The opportunity? Massive.

FAQs

1. Should consulting firms in India raise external funding?

It depends.

Funding makes sense when a firm wants to:

- Build a deeper senior talent pool

- Expand into new geographies or service lines

- Pursue consolidation or acqui-hires

- Create an institutional, scalable platform

Firms that want to remain small or lifestyle-led may not need capital. But firms aiming for national or global scale should strongly consider it, according to industry leaders.

2. What revenue metrics do investors look at in consulting firms?

Investors focus on the quality and predictability of revenue, not just topline numbers.

Key metrics include:

- Revenue growth rate (steady and consistent)

- Recurring vs project-based revenue mix

- Client concentration

- Average revenue per client

- Revenue visibility and pipeline

- Link between revenue and EBITDA margins

3. Which finance consulting services are most profitable in India?

Specialised, high-value advisory services, especially those with recurring or repeat demand, are highly lucrative.

Most attractive areas include:

- Tax and transfer pricing

- CFO advisory and controllership services

- Transaction advisory and due diligence

- Valuations and deal support

- Regulatory, governance, and compliance-led advisory