- According to the Financial Times, KPMG pushed its long-time auditor, Grant Thornton UK, for a significant fee reduction.

- The argument was brutally simple: If AI is cutting effort and time, audit fees should reflect it.

- Grant Thornton agreed…resulting in a roughly 14% cut.

- Needless to say, the move has sparked a storm of mixed opinions across social media.

Some backstory

Over the past two years, major accounting firms have heavily promoted their investments in AI.

Firms say their tools can now scan entire transaction populations instead of samples, automate routine testing, identify anomalies in real time, and even assist in drafting documentation.

Audit leaders have framed AI as a breakthrough that enhances both speed and quality.

In December 2025, Grant Thornton’s UK audit leader, Gary Jones, shared in a blog post that the firm’s work was becoming faster and smarter thanks to automation.

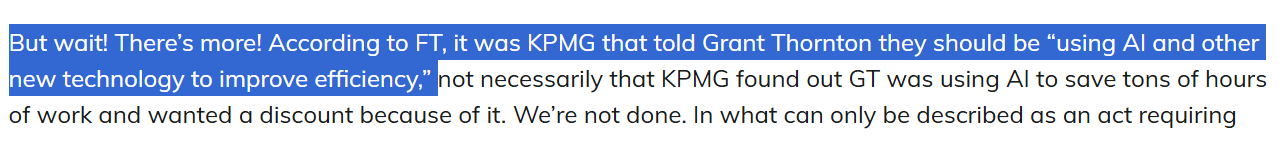

….But public messaging about AI efficiency carries risks?

If firms tell clients that audits require fewer hours and less manual work, clients may reasonably ask why fees remain unchanged.

In 2025, PwC said, “Clients know that AI is making us more efficient, saving manhours. And now they’re asking for discounts.”

KPMG asked its auditor for an AI discount

Insiders told Financial Times that KPMG didn’t just ask for a discount. They threatened to replace Grant Thornton as its auditor if it did not agree to a “significant” fee reduction.

The message was straightforward: if technology reduces effort, pricing should reflect it.

KPMG also believed that their books were not especially complicated, hence they deserved a discount on their fees.

Headquartered in London, UK, KPMG International Limited serves as the global umbrella under which independent national member firms operate.

And it worked

Grant Thornton’s fee for auditing KPMG International:

2025: $357,000

2024: $416,000

That’s a reduction of about 14 per cent!

Paradox facing the Profession

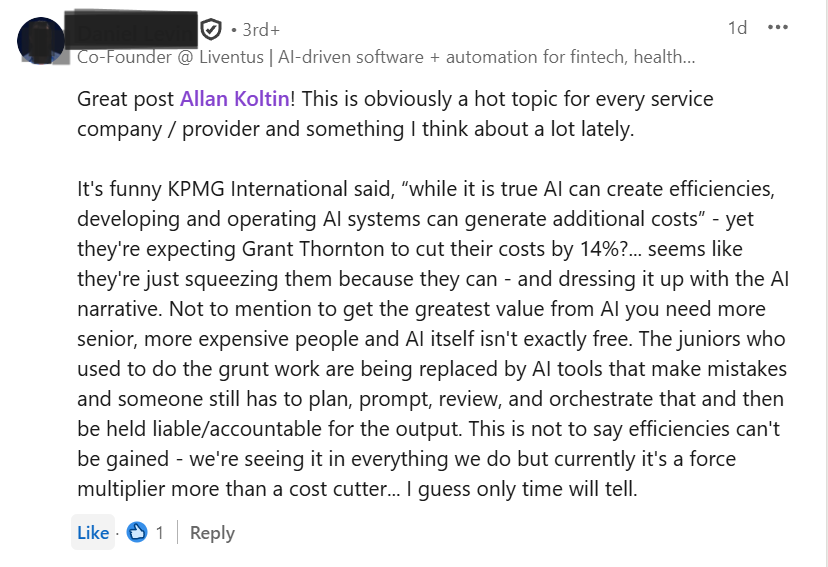

Yes, AI is increasing efficiency, but it also costs millions, if not billions of dollars, to build and deploy AI.

So if costs increase, how are firms going to offset it if clients demand discounts?

Alan Koltin, CEO of Koltin Consulting, wrote:

“AI technology produces a higher quality product, and the fee (and related margin) should increase (not decrease). Ironic that this fee reduction was caused by a client that was actually a CPA firm!”

An ex-KPMG Partner stated that GT should’ve pushed back and asked a simple question:

“We’ve invested millions in AI over the last five years. Are you factoring that into the fee, or just expecting the benefits for free?”

Some pointed out that KPMG would likely deny similar discounts to its own clients.

But little does KPMG know that its clients are also listening.

Is the Audit Pricing model under pressure?

Traditionally, audit revenue was driven by:

- Large teams of articled staff and associates

- Manual testing and documentation

- Billable hours model

Today, AI systems can:

- Scan 100% of transactions instead of samples

- Identify risks in real time

- Auto-generate working papers

- Flag compliance issues instantly

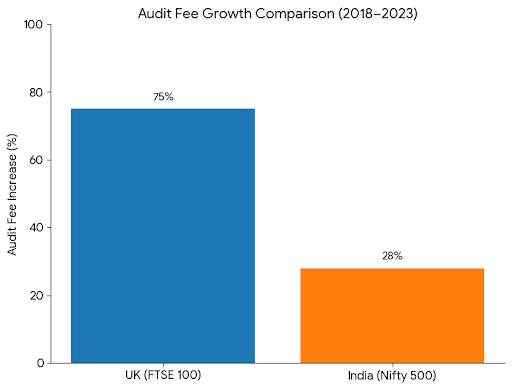

If firms in the UK are already seeing 14% pay cuts, what happens to India, where audit fees have been stuck in the mud for a while?

- UK (FTSE 100): Audit fees increased 75% (2018–2023).

- India (Nifty 500): Audit fees went up just 28%.

Let’s not forget that the Audit costs/risks have significantly increased thanks to

- Tighter standards

- Exploding documentation,

- Higher liability exposure,

- Rising talent costs, and

- Substantial technology investments

If AI becomes the final tool for fee compression, we may see a mass exit of CA firms from the audit space entirely. Or will it be the reverse?

Also read: Big 4 firms introduce a new kind of audit – AI Audit services

Should Auditors panic?

History is full of human failure, from Wirecard to Enron, auditors missed “needles in the haystack” because they were stuck with manual sampling.

So, Audit is ripe for an AI disruption.

But it’s unlikely humans will be cut out entirely, largely because AI can still “hallucinate.”

In 2025, Deloitte Australia had to refund A$440,000 to the government after their AI made up fake court cases and companies in a report.

Also read: Big 4 firms scramble to win the consulting race. Investing over $4B in AI.

Wrapping up…

On the surface, this looks like just another aggressive commercial negotiation.

But beneath the $59,000 price cut, the KPMG/Grant Thornton episode has ignited a debate:

Will AI ultimately compress audit margins?

Is it a warning shot for law, consulting, and every other “billable hour” profession? Will the “Billable Hour” finally die?

Will The 14% “AI Tax” be the new industry benchmark?

FAQs

Can AI replace human auditors?

No! While AI can automate routine and data-intensive audit tasks, it cannot replace human auditors.

Human oversight is vital in audits, as they provide professional judgment, ethical oversight, and accountability in making final decisions and evaluating complex business contexts.

How to use AI for audits?

AI can be a great tool for Auditors, making them more efficient.

AI streamlines audits by

- Automating the analysis of full data sets

- Flag exceptions,

- Risk assessment,

- Evidence gathering

- Data processing,

- Pattern recognition,

- Risk detection,

- Document review

This frees up auditors’ time to concentrate on interpretation and conclusions.

Is Big 4 reducing audit headcount due to AI?

Big 4 graduate hiring has been cut sharply as AI takes on routine, entry-level tasks once done by juniors.