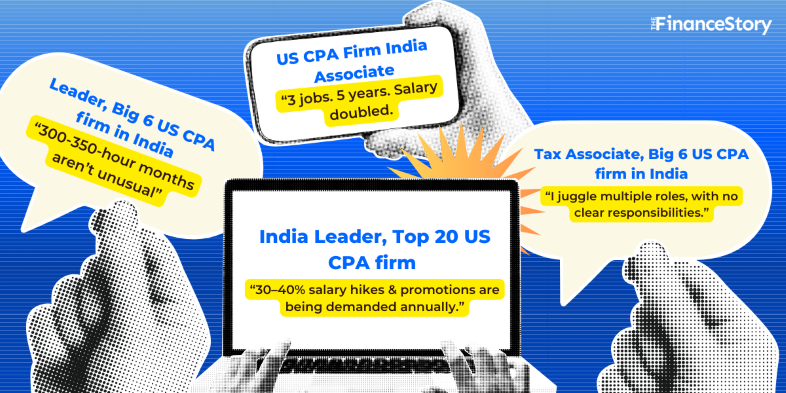

- Offshore leaders of U.S. CPA firms in India are growing frustrated with employees’ nonstop job-hopping and 30-40% salary hike demands.

- Talent, on the other hand, feels overworked, undertrained, and exploited.

- We spoke to both firm leaders + employees to uncover what’s really happening inside U.S. CPA firms operating in India.

First, some good things about the Indian talent

In 2025, we spoke to US leaders from accounting and consulting firms and they couldn’t stop raving about their India teams.

One National Practice Co-Leader said, “What I love about our global teams, especially India, is their passion and eagerness to learn.”

Another added, “Finding this level of expertise in the U.S., and so quickly, would have been nearly impossible.”

However…Despite the talent in India being good, several Indian leaders had a bone to pick with their teams.

Where offshore leaders are struggling

Growing obsession with job titles

One leader, who requested anonymity, explains:

“In the U.S., most accounting firms operate with just five or six clearly defined titles, each with well-understood responsibilities:

Staff → Supervisor → Manager → Director → Partner

In India, however, there are often three or four titles at the manager level alone:

Associate Manager → Assistant Manager → Manager → Senior Manager

This is less about capability and more about appeasing egos.”

Everyone is racing to grab the next big title as quickly as possible. And yet? They often don’t fully understand what those roles actually involve.

Salary inflation and constant renegotiation

Leaders openly admit that employees in U.S. CPA firms in India earn well.

Yet a growing number of professionals feel “they are being taken advantage of.”

One leader says, “A lot of employees come to us every year saying, ‘I’ve done my market research and I’m underpaid.’”

He continues, “They’re demanding 30–40% salary hikes and promotions every single year.”

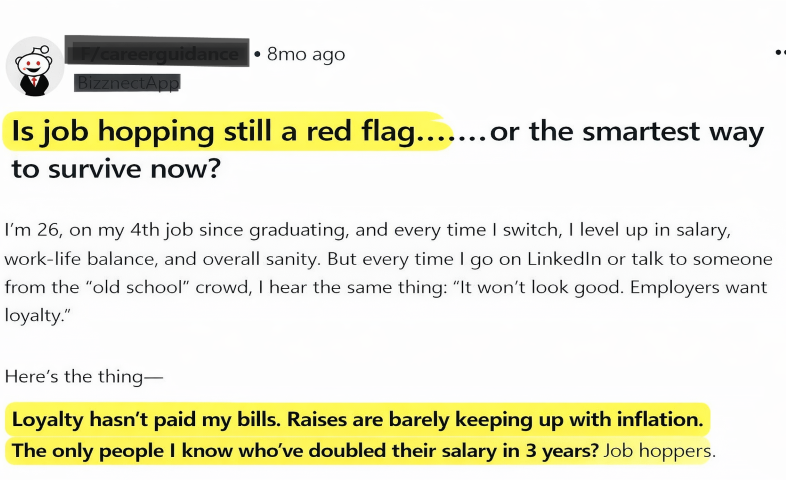

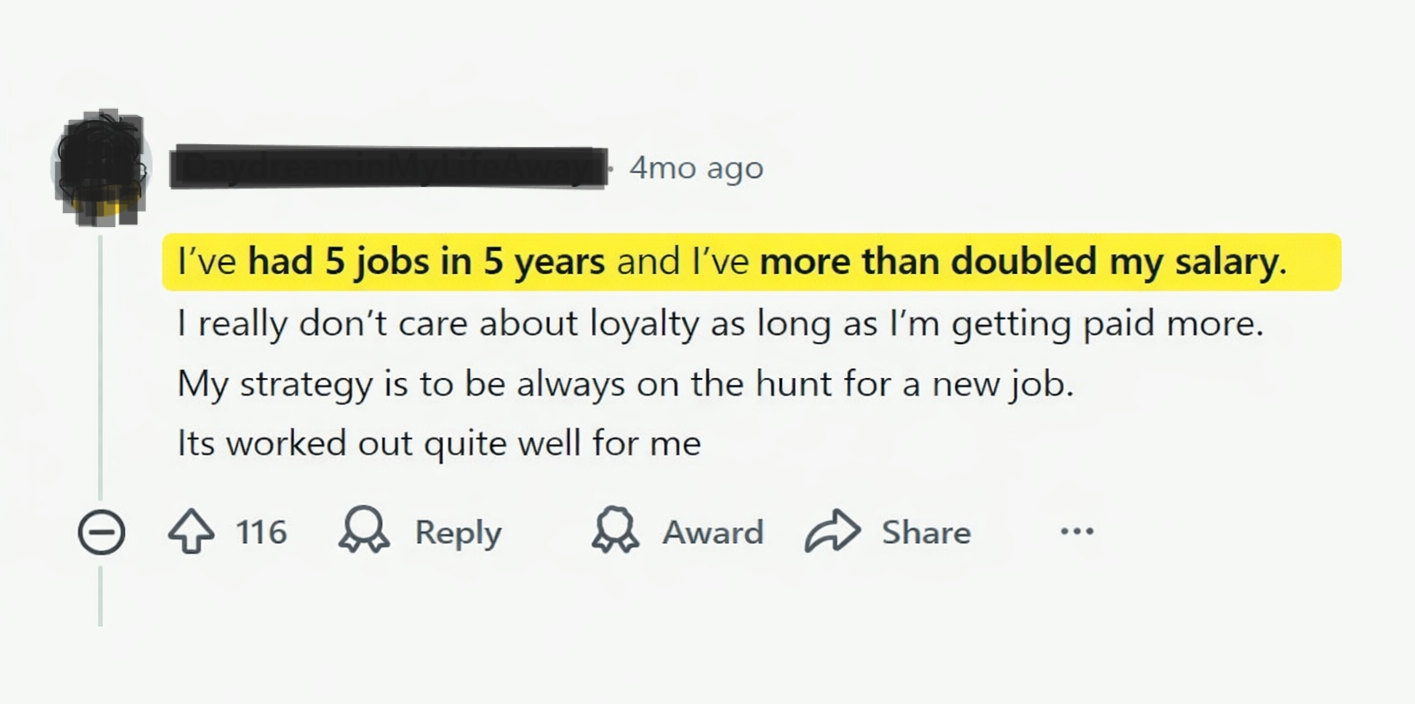

Job hopping is the new normal

One Bengaluru-based U.S. CPA firm leader puts it bluntly:

“Most CVs I see show a job change almost every other year.

New U.S. accounting firms are popping up every few months, each offering slightly better pay than the last.

Even high performers are jumping ship constantly.”

From the firm’s perspective, this is hard to sustain.

Training new hires takes time and money, whether it’s:

- Firm culture

- U.S. processes

- Technology

- Or client expectations.

When people leave just as they become productive, the entire investment cycle breaks!

And yet, basic professional skills are still missing

This is where leaders get visibly uncomfortable.

Several pointed to:

- Weak communication

- Poor attention to detail

- Lack of confidence in client-facing situations

“One of our biggest issues is that many team members can’t clearly articulate what they do,” one leader says.

“Some struggle to introduce themselves professionally to U.S. clients. These aren’t minor issues. They directly affect client trust.”

Also read: The Finance Story’s Mumbai Networking Event: Outsourcing, Offshoring, Fractional CFOs

The employee side: a very different reality

Before jumping to conclusions, it’s important to understand that the picture isn’t one-sided.

So we spoke to employees as well, and their version of reality looks very different!

Hours billed > quality of work

A major issue they highlighted was that: Input (in terms of hours billed) often takes precedence over output or the quality of the work.

A Tax Associate at a Big 6 U.S. CPA firm explains that,

“The main focus is pulling as many client hours from the U.S. as possible to show strong offshore metrics.

During crunch periods, we’re expected to work across multiple clients simultaneously.

That sounds like ‘great exposure’, but there’s very little training or context provided. Quality inevitably suffers.”

Training is not a priority

Multiple employees pointed out that there is almost ‘No’ emphasis on:

- Improving communication skills

- Critical thinking,

- Or long-term development

One Associate says, “I personally know senior managers who struggle to draft grammatically sound client emails…But as long as hours are billed and revenue flows in, leadership seems satisfied.”

Lack of role clarity from management

Employees say vague titles like Assistant Manager or Senior Manager come with overlapping and conflicting expectations.

“We’re expected to act as preparers, reviewers, project managers, and client coordinators all at once,” one employee explains.

“There are no clear boundaries, and that’s a leadership design issue.”

Overwork and burnout in offshore accounting

Hours are intense, especially at the preparer and reviewer levels.

Another Big 6 firm Associate claims,

“At our firm, peak-season hours of 300–350 hours per month are common.

And now that Private Equity has come on board, long hours are no longer limited to busy seasons. Off-season demands are rising as well.”

He continues, “I have personally seen colleagues’ health deteriorate due to constant overwork. Others left the profession entirely because the pressure became unmanageable.”

Salary expectations are totally reasonable

One of them concludes: “When you take all of this into account, it’s reasonable for employees to expect compensation that reflects their efforts.”

Notably, several employees said they’d accept lower pay for sustainable workloads.

Also read: GT UK fires 100 support staff: Grapevine says work offshored to India

Ugly truth: Private Equity & offshore expansion

Hiring is booming, and salaries are rising across all the US CPA Firms in India.

But have you paused to ask: Why is this happening, and how will it impact my career?

Here’s the reality: Private equity is pouring money into CPA firms to grow fast and exit in 2-5 years.

How will they achieve this?

- Expand headcount in India,

- Boost EBITDA

- Prepare for 2-3x exit

Expanding offshore headcount has become a due diligence checkbox…And India sits at the centre of that playbook!

Sometimes massive hiring (e.g., “1,000 new employees”) is just to make the firm look attractive for a due diligence checkbox. Employees might be put on PIP (Performance Improvement Plans) or let go once the PE firm exits.

Also read: U.S. Tax Partners at Armanino discuss the future of India-U.S. collab

Wrapping up…

India will remain the hub for high-end accounting and tax work. The talent depth is real.

But from the U.S. standpoint, access to the right talent at sustainable cost is a key business proposition. Rising attrition, inflated titles, and 30–40% annual hikes are already pushing firms to diversify.

That shift has begun. South Africa, the Philippines, Mexico, and Eastern Europe are scaling fast.

As private equity exits arrive, expect a correction.

The question isn’t whether India stays relevant; it’s what survives once the PE money leaves.

FAQs

Why are US CPA firms offshoring so much work to India?

India remains the leader for complex, high-end accounting and tax work, while offshore expansion helps US firms fill talent gaps.

Which US accounting firms tackle talent shortage by expanding operations in India?

Big 6 and mid-sized US CPA firms are setting up GCCs in India, driving unprecedented demand for skilled talent.

Will US CPA Offshore Accounting work shift from India to the Philippines/SEA/SA?

Some transactional and client-facing roles may move to lower-cost countries like the Philippines, but India remains the undisputed leader for complex, high-end technical work.