- On 1st August 2024, we wrapped up our first-ever Disrupt Series in Mumbai.

- 115 ambitious finance professionals joined us – some even flew in from Chennai, Hyderabad, Bangalore, and Ahmedabad.

- It was a surreal and humbling experience for us.

- Here is how the event unfolded.

What motivated us to host an event?

The Finance Story has been receiving requests to host networking events since early 2023.

So in November 2023, we took our first small step and hosted our first-ever event (more of a meetup) in Dubai and had 45 folks joining us.

Then on 23rd May 2024, we held a CFO focussed Networking & Fireside chat in Bangalore. This time we took it up a notch, by having a more structured approach and a proper panel. 60 finance professionals joined us!

This gave us confidence that our networking events are becoming a valuable addition.

Next up, was the Mumbai event!

When pondering on the topic of our Mumbai event we decided to go with the prevalent topic: Offshoring and Outsourcing.

The goal was to have a maximum of 75 participants, but within 7 days of our official announcement, it was not only full but we received a total of 110 applications.

All our events are on an application basis which means that you have to apply and if you meet the criteria, we accept your application.

Why do we do this? To add value to all the attendees. Our audience base is mostly mid to senior professionals.

The crowd was amazing, supportive, and super energetic.

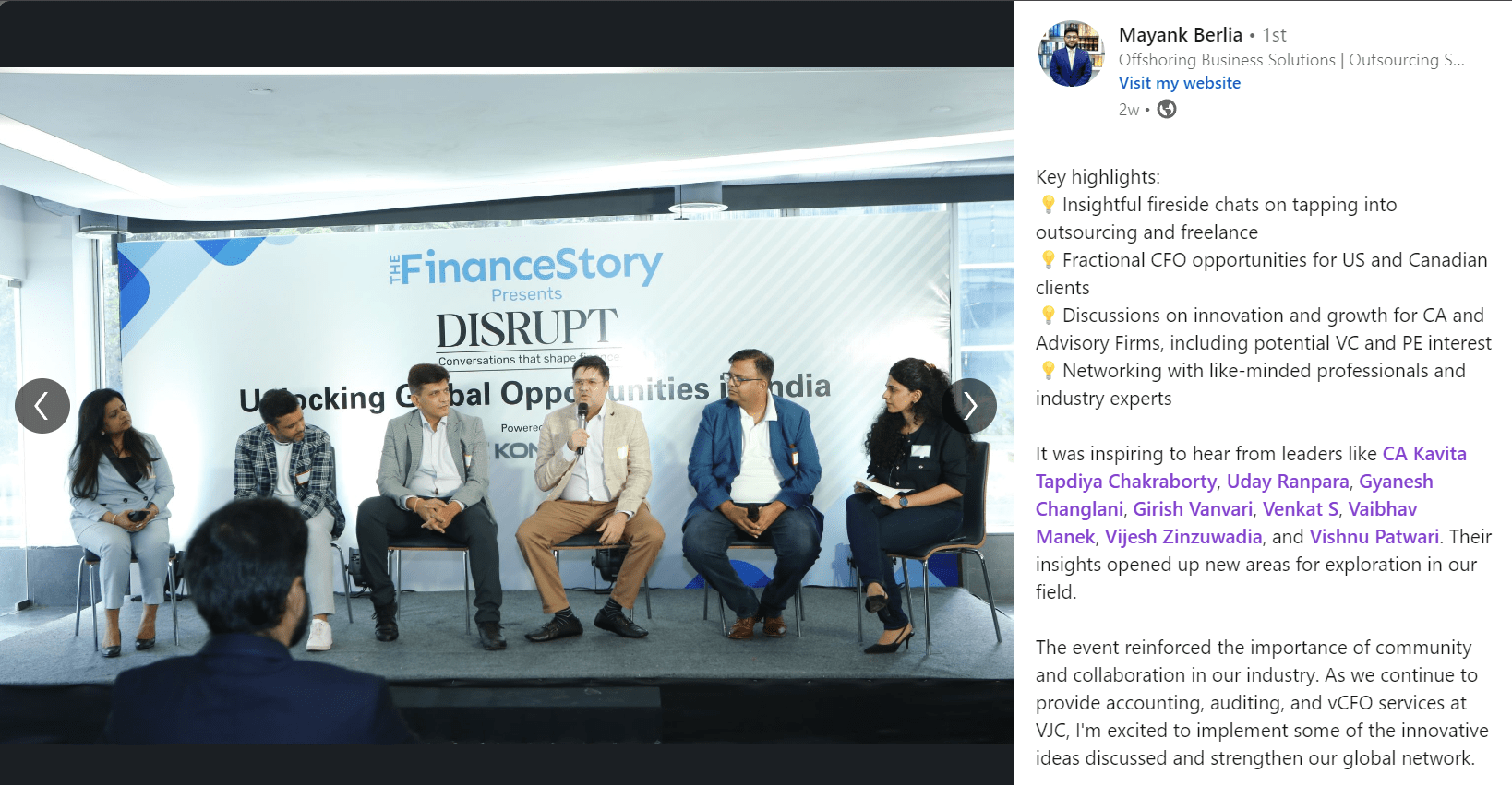

About our Panellists

When planning our event, we were adamant about featuring two panels, each comprised of speakers with proven experience in the field.

CA Kavita Chakraborty, Founder at Konnect Books & Taxes

- Began freelancing in 2010 from her living room, post-sabbatical

- She now leads 160+ professionals and makes a revenue of around USD 3 Million

- Expertise: FAO, CFO services, Taxation, and B2B services for CPA firms

Uday Ranpara, Managing Director at Unison Globus & Initor Global

- Started with Johnson & Johnson in 2003

- Co-founded Initor Global in 2006, expanding to the UK, US, and Australia

- Leads 500+ team members

Vijesh Zinzuwadia, Co-Founder at Unison Globus & Initor Global

- Launched his CA Firm in 1998, now runs Zinzuwadia & Co. with 50 members

- Shifted focus to specialized inbound/outbound investments in 2005

- Built Unison Globus and Initor Global into a team of 500+ professional

Vijesh who is the brains behind Zinzuwadia & Co. and the founder of Unison and Initor was also kind enough to join us in Mumbai. It was amazing.

Gyanesh Changlani, Fractional CFO, North America

Next up, we sought a Fractional CFO who operated more as a solopreneur, and Gyanesh fit this profile perfectly.

- Engineer-turned-finance professional and an MBA graduate

- Ex-Toyota Dubai

- Experience in equity research

- Now a sought-after Fractional CFO for the US and Canadian firms

Vishnu Patwari, Founding Executive Managing Director, BDO RISE

- Career began at JPMorgan Chase, then PwC

- Joined BDO in San Francisco, and led the launch of BDO RISE in India

- Scaled the offshoring business to 2500 employees in just 4 years

Jignesh Kenia, Founder at Signal Ventures

- Ex-CFO of UTV Broadcasting

- 20+ years of experience in the media industry

- Currently shaping corporate strategy and digital transformation at Times Network

- As well as an investor in 105 startups

S Venkat Raman, Co-Founder, Practus (formerly MYCFO)

- Focuses on performance and cash flow improvement

- Aims to make Practus the first global consulting firm born in India

- 250 employees with offices in Atlanta and Mumbai

Girish Vanvari, Founder, Transaction Square

- Started with Arthur Andersen, and later led KPMG India’s tax practice

- Founded Transaction Square in 2018, now boasts 400 employees across 13 offices in India and Dubai

Vaibhav Manek, Co-Founder & Partner, KNAV

- Co-founded KNAV 25 years ago, now present in 7 countries including the UK, Singapore, and Canada

- Focus: Cross-border services, high-end advisory, corporate restructuring

- Headquarters: US and India

- Best part? KNAV is ranked as the Top 300 Accounting Firms in the US.

Panel One: Decoding Opportunities in Offshoring, Outsourcing, and Fractional CFO Space

Outsourcing Market Opportunities

Global Talent Shortage: Uday kicked off the discussion with a reality check—there’s a serious talent drought in the US. Imagine this: the country needs 200,000-300,000 CPAs every year, but only 50,000-60,000 are signing up. For Indian professionals and firms, this gap is a golden ticket to the big leagues.

Post-Pandemic Shift: The pandemic might have locked us indoors, but it threw open the doors of remote work. Clients, once skeptical about offshoring, are now nodding along, realizing that quality work knows no borders. More opportunities for offshore providers? You bet!

Specialized Services: The demand for specialized services, especially in US taxation, is skyrocketing.

Captive Centers and Partnerships: Vishnu dropped a gem here: US CPA firms are increasingly open to setting up shop in India. Whether it’s their own office or a trusted partnership, the message is clear—India is where the action is!

Client Acquisition Strategies

Networking: Uday swears by the power of networking, and he’s got the results to prove it. He spoke at a CPA conference and acquired 10-12 clients in the bag.

Value-Added Approach: Vishnu advises playing it cool—no hard sell. Instead, sprinkle a little value here and there with articles and insights. Stay on top of your clients’ minds, and when the time’s right, they will come to you.

Nurturing Relationships: Kavita has a great analogy: Sales is like dating. What works for you might not work for someone else. Her strategy? Focus on a few clients, make them happy, and watch your business grow from $500 to $50,000. Now that’s some serious ROI!

Leveraging Online Platforms: Gyanesh is proof that freelancing platforms like Toptal.com are a goldmine for landing high-quality clients.

Dedicated Business Development: Uday knows time zones can be a deal-breaker, so he’s got business development teams working round-the-clock, ensuring no client is left behind. Talk about global hustle!

Challenges for New Entrepreneurs

Time to Profitability: Uday’s advice to newbies? It might take 3-5 years to hit profitability, so patience isn’t just a virtue—it’s your best friend.

Initial Investment: The panelists agreed: starting up isn’t cheap. You’ll need to shell out for office space, tech, and top talent. But hey, no pain, no gain, right?

Building Credibility: Standing out in a crowded market is tough, especially when you’re the new kid on the block. But build credibility, and the clients will come knocking.

Talent Acquisition and Retention: Gyanesh pointed out that finding and keeping top talent is no walk in the park. His solution? Flexible work arrangements and above-market compensation. Because happy employees make happy clients!

Skills and Qualifications

Relevant Qualifications: If you’re looking to offer specialized services, having a CA or CPA on your team is non-negotiable.

Communication Skills: The panel couldn’t stress this enough: Communication is key. And when your clients are halfway across the world, strong English skills can make all the difference.

Emotional Intelligence and Leadership: Kavita believes that emotional intelligence isn’t just nice to have—it’s essential. Spotting and nurturing this trait in your team can be the secret sauce to success.

Market Trends and Future Outlook

Private Equity Interest: Uday dropped some exciting news—private equity firms are catching on to the accounting outsourcing boom.

Industry Consolidation: Vishnu predicted a wave of consolidation in the industry, driven by PE acquisitions. Keep an eye out, the next big merger could be right around the corner!

Growing Market Size: The outsourcing market is about to get a lot bigger. Vishnu mentioned that Global Capability Centers (GCCs) are expected to grow from 2,500 to 10,000. If that doesn’t scream opportunity, we don’t know what does!

Technological Advancements: The future is digital, and the ability to leverage technology for seamless service delivery will separate the winners from the also-rans.

Advice for Entrepreneurs

Gain Experience: Vishnu’s advice? Don’t rush it. Get some experience under your belt at an established firm first. It’ll give you the industry know-how and confidence to strike out on your own.

Deliver Quality Work: Consistency is key. Deliver high-quality work, and you’ll build a reputation that clients trust.

Specialize: Don’t try to be everything to everyone. Specializing in a particular service or industry can set you apart from the crowd.

Team Building: As your business grows, building a strong team becomes crucial. Kavita emphasized the importance of promoting from within and nurturing your homegrown talent.

Stay Updated: Keep your finger on the pulse of technological advancements and regulatory changes. Staying ahead of the curve will keep you competitive.

Focus on Networking: Networking isn’t just about making contacts—it’s about building relationships. Put in the effort, and it’ll pay dividends down the road.

Panel Two: Climbing the Value Chain: From Accounting to Advanced Technical Expertise

Key Topics Discussed:

Building and Scaling Professional Services Firms

Outcome Over Advice: Venkat set the tone with a powerful insight: it’s not just about giving advice; it’s about delivering outcomes.

He shared how his firm commits to delivering a whopping 5x ROI to clients within 12 months. That’s more than just consulting! The takeaway? Focus on implementation, not just ideas.

Scaling with Culture: While growth is exciting, the panel agreed that maintaining company culture is non-negotiable. Because, let’s face it, you don’t want to end up as the giant soulless corporation that forgot its roots.

Talent Acquisition and Retention

The “Figure It Out” People: Girish made a compelling case for hiring agile and versatile people over those with a resume full of degrees but a rigid mindset. His solution? Think outside the box—recruit interns and fresh talent from colleges.

Paying for Talent: Venkat didn’t mince his words here. Startups might be exciting but don’t expect top talent to work at a discount. Competitive compensation is key, and as Venkat puts it, “You get what you pay for!”

International Expansion and Acquisitions

Going Global: Vaibhav from KNAV shared the inside scoop on their international expansion, including an exciting acquisition of a 72-year-old firm in Singapore. He emphasized the importance of having clear objectives when it comes to acquisitions—whether it’s for client lists, talent, or specific capabilities.

The Cost of Expansion: Venkat shared his experience with Practus’ journey to Atlanta. The lesson? International expansion is no walk in the park—it’s expensive and time-consuming, often taking years to establish a successful presence.

Pricing Strategy and Cost Management

Value Over Cost: When it comes to pricing, Venkat and Vaibhav are all about competing on value, not cost. Their advice? Move up the value chain and become a trusted advisor. When clients see the value you bring, pricing becomes secondary.

Cost-Efficiency Matters: On the flip side, Girish argued that clients won’t pay for inefficiencies. His strategy? Use technology and hire versatile talent to manage costs effectively. Because at the end of the day, everyone loves a good deal!

Brand Building and Marketing

Consistency is Key: Venkat shared a simple yet powerful truth: brand building isn’t about grand gestures; it’s about doing the small things consistently. He pointed to his partner, Deepak Narayanan, who regularly shares meaningful content on LinkedIn. This consistent effort plays a crucial role in building the brand over time.

Patience is a Virtue: Venkat reminded everyone that brand building is a long-term game. Competing with the Big 4 might seem daunting, but remember—they’ve had centuries to build their legacy. Younger firms need to be patient, consistent, and optimistic, knowing their brand could one day reach similar heights.

Keep It Simple: Girish chimed in with some content advice—don’t get too technical. “Who would be interested in changes in IndAs, or in-depth case law analyses?” Instead, he emphasized storytelling. That’s why The Finance Story resonates so well with readers—it’s all about the stories.

Angel Investing

What Investors Want

Jignesh who is an angel investor in 105 startups explained was clear that – Investors want rapid growth—think 2x or 3x annually.

But service businesses usually grow linearly, making them more attractive to VC or PE investors at later stages.

His suggestion – Add technology!

Raise money from a VC / PE Firm

Girish shared a personal dilemma: The offers from big-name investors like KKR and Blackstone can be tempting as you would get access to a massive audience and global firms.

But taking on investors would have meant sticking to a strict business plan, growth targets, and profitability goals—possibly at the expense of his professional integrity. That’s why he chose to stay independent.

What are the Future Opportunities to tap into?

Advisory Services

KNAV’s co-founder Vaibhav pointed out that advisory services are where the real opportunities lie, both in India and internationally.

He noted that advisory has grown from 15-20% to 30-40% of global revenues in many firms.

His advice? Specialize in high-end advisory services rather than trying to do everything. Passion and purpose are key—when you love what you do, it doesn’t feel like work.

Compliance in the Age of AI

Girish raised a flag on the disruption of knowledge-based work by AI. He advised professionals to focus on either tech-enabled compliance work or high-level judgment-based advisory. That’s where the growth will be!

Digital Transformation

Jignesh highlighted digital transformation as a massive opportunity.

Helping clients automate processes and implement decision-making tools could be a game-changer for your firm.

Wrapping up…

The accounting and finance outsourcing industry in India presents significant opportunities for entrepreneurs and professionals.

Driven by global talent shortages, increasing acceptance of remote work, and the growing complexity of financial operations, the demand for these services is likely to continue growing.

The future of accounting and finance outsourcing appears bright, with India well-positioned to play a central role in meeting global demand for these services.