While the rest of the world grapples with economic challenges, the UAE stands as a beacon of prosperity as its economy experiences a remarkable boom.

Foreign investments, businesses, and highly skilled talent are flocking to the UAE, due to its unprecedented growth.

To delve deeper into the reasons behind this trend, The Finance Story spoke with Bhavesh Raichura, a Finance Director in the UAE.

In 2005, shortly after becoming a Chartered Accountant, Bhavesh made the strategic decision to relocate to the UAE. He joined Easa Saleh Al Gurg Group, one of the UAE’s most eminent family businesses, as an Internal Auditor.

After a brief two-year tenure, he returned to India. However, in 2013, Bhavesh chose to return to the UAE, driven by a long-term vision.

Over the past decade, Bhavesh has closely observed the UAE’s development and transformation.

Here are the excerpts from the interview.

Can you provide a detailed breakdown of the key factors driving the UAE’s notable economic growth?

The UAE boasts four significant economic pillars; oil and gas, real estate, banking, and tourism. I will break down how these sectors are impacting the economy.

Real estate

- The real estate sector in the UAE has witnessed a remarkable upswing in the past 18 months, with prices soaring by 20% to 50%. This surge has led to substantial profits for developers, as every new project launched enjoys strong demand.

- Interestingly, the COVID-19 pandemic initially caused a dip in real estate prices, which in turn attracted investors seeking favorable opportunities.

- Notably, the recent launch of Palm Jebel Ali, a luxurious man-made island, saw astonishing success, with properties practically selling out within hours. Following in the footsteps of Palm Jumeirah, this project marks the next significant development in the Palm Islands series.

- These construction endeavours are setting off a ripple effect throughout the economy. With new buildings emerging, the demand for furniture, steel, and cement is soaring.

- This shift has infused the real estate sector with renewed optimism.

Banking

- Many UAE banks currently possess substantial assets. If we look back five or six years, these banks were discussing quarterly profits of $300 million, but now they’re talking about $1 billion of profits.

- The Central Bank of the United Arab Emirates has raised its Interest Rate.

Tourism

- The UAE is well-prepared for robust tourism. There are over 100,000 hotel rooms here in the four-star and five-star categories.

- During the early days of the pandemic, around one million people left the UAE. However, after the COVID-19 lockdowns, there was a surge in tourism. This summer, Dubai experienced a high influx of tourists.

- The number of conferences and events in the UAE has significantly increased.

Oil and Gas

- Oil and gas have long been the cornerstone of the UAE’s economy. Before 2013, oil revenue made up a substantial 60%-70% of the UAE’s economic income. However, today, its contribution has been reduced to around 30% due to remarkable growth in other sectors.

- Presently, the UAE produces approximately 3 million barrels of oil per day, selling at prices ranging from $90 to $95 per barrel. The current situation within OPEC, where Saudi Arabia has voluntarily reduced its oil production to 1 million barrels per day, has created a supply shortage. This move is causing oil prices to steadily rise in the UAE.

- We are now approaching the $100 per barrel mark, and there is a possibility that we might reach $120 per barrel next year. Such an increase would significantly boost the UAE’s income.

Fortunately, all four key sectors are thriving, except manufacturing, which is also picking up its pace.

Why is there a growing interest among professionals and entrepreneurs from around the world to move to the UAE?

The government is taking initiatives to maintain this status and attract even more expats.

Visa advantages

The UAE has very flexible visa policies. The introduction of the Golden Visa in 2019 was a masterstroke.

Compared to last year, this year there has been a 150% increase in Golden Visa issuances from the government.

Many people can start businesses once their visa is sorted out. I was also reading an article saying that a GCC-wide visa will open up.

Saudi Arabia, in particular, holds significant economic potential. Once expats are allowed visa-free entry, it’s likely to spur real estate purchases, business investments, and collaborations between UAE and Saudi businesses, as part of the GCC’s economic union.

Unemployment insurance scheme

I remember writing one or two articles on why unemployment insurance should be a part of the UAE economy, similar to Canada, and the U.S.

Fortunately, after COVID-19, the UAE government introduced the unemployment insurance scheme starting from 1st January 2023. Before 2018, if you’d lost your job, you would have only 30 days to pack up your bags and depart.

Now because of the unemployment insurance, you would get three months of financial assistance after an involuntary job loss.

Pension plan

There are many Social Security reforms happening in the UAE.

The government is working to create its ecosystem for pensions and other benefits so that people can choose to stay in the UAE after retirement.

Medical insurance

All employees receive health insurance from their employer in the UAE, be it private sector or public sector.

Some of the best doctors and hospitals are readily available here which attracts top talent from even developed countries.

Notable infrastructure development

The UAE has always been known for its outstanding infrastructure.

When I first arrived in 2004, areas like Jumeirah Lakes Towers (JLT) and Dubai Marina didn’t exist. Eventually, Dubai became an even more inviting host, attracting people from all over the world.

Another pivotal part of their infrastructure plan is the Etihad Rail project. The government has invested a massive AED 50 billion into this project, which is set to revolutionize the logistics sector in the country.

It will connect various regions within the UAE as well as extend its reach to Oman and the Saudi borders.

These factors collectively make the UAE an attractive destination.

What opportunities exist for finance professionals?

Hiring is on the rise in the UAE, with about 10 recruiter calls reaching out to me every month.

The UAE is set for multiple public listings, as family businesses and government entities in Dubai and Abu Dhabi plan to go public.

These developments call for skilled investment professionals familiar with real estate, equity markets, funds, and complex financial structures.

Corporate tax, effective since June 1, 2023, is generating significant interest. Though the regulations are in place, challenges persist in interpretation, planning, restructuring, and compliance.

As businesses adapt, there will be a rising demand for experienced tax professionals, including in-house tax managers and third-party tax consultants.

Opportunity abounds in this economy, provided you connect with the right individuals.

What is your outlook on the future of the UAE’s economy?

Dubai’s government recently slashed its debt by AED 29 billion following the establishment of its public debt management office.

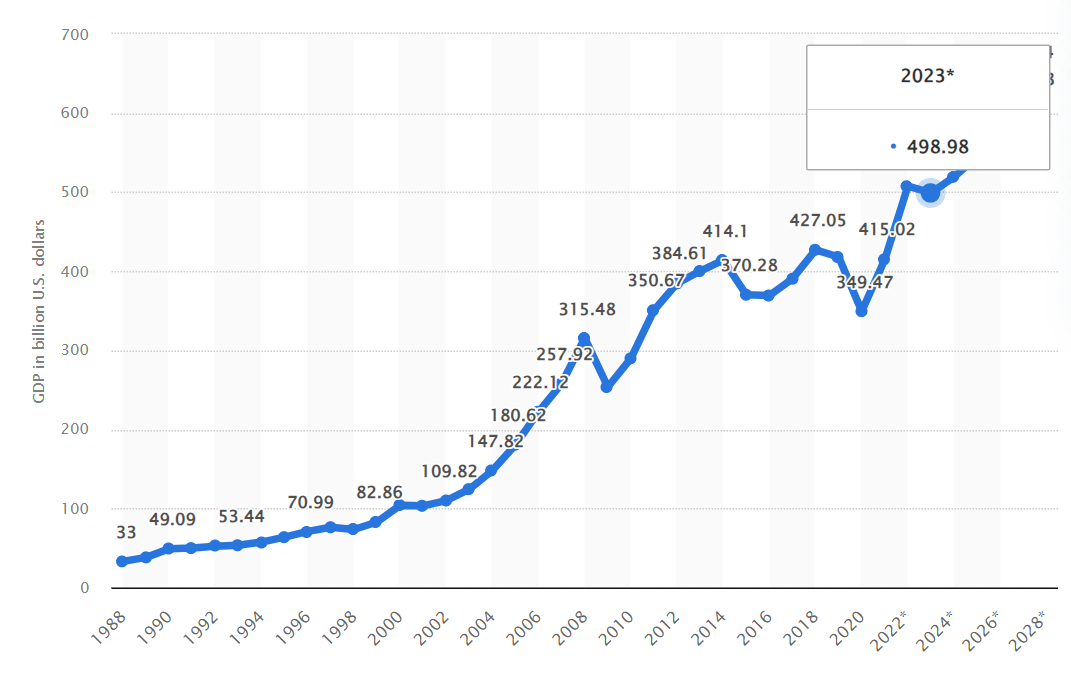

In 2023, the UAE boasts an impressive 25% debt-to-GDP ratio, combined with a zero-tax environment and attractive salary structures.

In 2022, we achieved a remarkable 7.8% annual growth rate. Although this year’s projection stands at 3.9%, I hold the confidence that we will surpass this figure.

The government is poised to outperform this projection, thanks to unexpected factors such as surging oil prices and heightened real estate activity.