- Hi, I’m Gunjan Lalaji, a CPA US with 9 years of experience in the Americas; 7.5 years in EY’s Boston, San Francisco, and the Cayman Island offices, and 2 years in the industry.

- Given the recent news about 300,000 Accountants and Auditors in the US leaving the profession, I often get asked by Accountants and Auditors from abroad, about how they can transition to the US.

- Here I delve into the actual reasons behind this mass exodus and explore the opportunities available in the US for Indian and other expat Accountants and Auditors.

Back story: How the US happened

I began my career at Deutsche Bank India where I handled Investment Banking Operations and Fund Accounting for mutual funds.

During my 4-year stint with them, I acquired the CPA US qualification and developed a strong desire to explore the US market and work with US GAAP-related matters.

Coincidentally, EY Bangalore was auditing one of Deutsche Bank’s funds.

I identified this amazing opportunity and reached out to a team member from EY’s audit team saying, ‘Hey, I am a CPA. Do you have any opportunities related to U.S. GAAP?’

They had a significant practice in Bangalore that dealt with U.S. GAAP and GAAS standards. That’s how I joined EY’s Financial Services Audit Practice.

Eventually, EY presented all the best performers with an opportunity for a long-term rotation across various offices in the US. I cracked the interview and was selected by the San Franciso Office. In 2014 I relocated to the US.

I worked at EY San Francisco for approximately a year and a half, and everything was going exceptionally well until I encountered some Visa issues.

What now? I got an opportunity in their Cayman Islands office. It was another great experience for me.

After working in the Cayman Islands for about three years, I was offered the opportunity to work at EY Boston… Without any hesitation, I accepted the offer.

At EY Boston, I was a part of the committee responsible for overseeing the work at EY GDS (Global Delivery Services) in India. This experience greatly enhanced my understanding of the offshore market.

I thoroughly enjoyed working with everyone in that capacity.

Moving out of the Big 4

During my time auditing financial services clients, which included hedge funds, private equity, venture capital, mutual funds, funds of funds, and fintech companies, I was always curious about how the industry operated from the other side of the table.

Fast forward, after 7.5 years in the US and the Cayman Islands, I was promoted to Senior Manager and knew in a few years I could make it to a Partner.

I wondered if the path to partnership was worthwhile, but it turned out it wasn’t, at least not for me.

I quit the Big 4 and in January 2021, I joined CFGI, as a Senior Manager in Accounting Advisory where I worked on Technical accounting and was Interim CFO/Controller.

In November 2022, I joined Templum, as a Finance Controller. Templum is a fintech company for primary issuance and secondary trading of alternative assets.

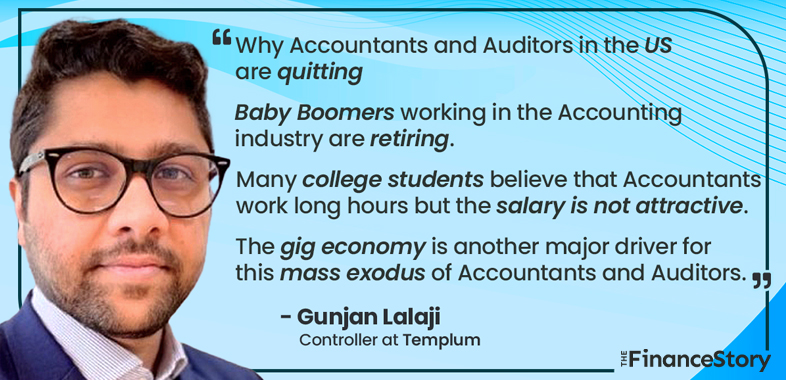

But why are Accountants and Auditors in the US quitting?

Later in 2022, I heard the news that almost 300,000 Auditors and Accountants in the US had quit their profession… As you can say, I strongly related to the sentiment as I did the same!

Here is why there is a mass departure of professionals from the Accounting and Auditing profession.

Baby Boomers retiring

First and foremost, the Baby Boomers are retiring. Accounting Professionals and many Big 4 Partners who are essentially 60 plus, (born from 1946 to 1964) are retiring in large numbers. So, this constitutes a substantial exit from the profession.

Unappealing scale

On the other hand, many college students hold a perception that accountants work long hours but the salary is not attractive in the accounting industry as a whole.

In the US, the cost of education is exceedingly high. Students end up paying almost USD 60k to 70k for a four-year bachelor’s degree course. This doesn’t seem like a cost-effective pathway considering many students take out loans.

CPA credit requirements

Additionally, a four-year bachelor’s degree only provides 120 hours of credit. In many states, there’s a requirement of 150 hours to obtain a CPA license. This is viewed as a barrier to entry because it necessitates a fifth year for a Master’s degree.

A Master’s in the US would take USD 40k to 50k out of a student’s pocket. So you can understand why students are opting out of this profession.

Pursuing other avenues

Another reason is the “great resignation” that occurred during and after the COVID-19 pandemic. Many Professionals in the US resigned to follow their passions.

Gig economy

The gig economy is another major driver for this mass exodus of Accountants and Auditors. A number of individuals now prefer working on contracts. It allows them to work for a few months and earn significantly more than a traditional salary.

For instance, last year, many Big 4 firms in the tax practice started hiring contractors.

All of these factors have contributed to this ordeal and I don’t believe this demand is going to ease up anytime soon.

To combat this situation The American Institute of Certified Public Accountants (AICPA) has formed the National Pipeline Advisory Group.

Many Big 4 firms are also outsourcing a substantial amount of work to their Global Delivery Centers (GDS) located in countries like India and the Philippines.

The US has barriers to entry: How you can tap into this Talent Gap?

As you can see, this talent shortage has led to an increase in job openings, but finding one can be quite challenging.

While in countries like Canada or the UK, you can apply for Permanent Residency, the US doesn’t allow that very easily; the US has substantial entry barriers for expats looking to work in the US.

Whether you are an entrepreneur from India or simply an employee, here are three viable pathways to tap into this opportunity.

Study in the US

The Big 4 hiring functions differently in the US, compared to India. They mostly recruit candidates from colleges offering them internships.

For example, when I was working with EY in San Francisco, and Boston, we visited numerous colleges like UC Berkeley and Boston University to recruit the best talent early on. This is a major pipeline and hiring strategy for Big 4 and other accounting firms.

So, you can come to the US for a Master’s in Accounting, Finance, MBA, or a related field and then start working here. Again, see if it is worth it!

Internal transfer

The next option is through intracompany transfer, where the Big 4 or any MNC company transfers you to their offices in the US. This is what got me to the US. But again luck plays a role here!

Serve the US market from India

If you are a practicing CA in India and want to explore this opportunity I suggest you set up an outsourcing practice/arm.

Having worked at EY, I have witnessed the outsourcing landscape evolve over the years.

I have many connections in India who are already involved in outsourcing work. In the US, I have seen many accounting firms collaborating with outsourcing companies, especially in the tax sector.

You can also freelance and work for the US market getting paid in dollars!

- Start by joining CPA firm networks. Some regional firms offer this kind of opportunity. This can give you the tools and techniques you need to attract clients.

- Attend networking events and create awareness about your skills and capabilities, showing that you can help solve various problems and automate processes.

- Find someone who can vouch for you and your services – this is essential.

Conclusion…

Overall, the talent gap is going to persist. But the answer to whether it will last for a long time or a short-term period is tough.

What I can assure you is that automation will absolutely catch up with the Accounting and Auditing profession.

We have already transitioned from doing things manually to automatically with the help of tools like Alteryx, Power BI, and QuickBooks.

As time goes on, we will need fewer people to do the repetitive work, and more time will be spent on tasks that are subjective in nature.