- Hi, I am Uday Ranpara, a chartered accountant who has ventured beyond traditional roles.

- In 2006, I embraced the UK Tax and Accounting outsourcing market, which turned out to be a game-changer.

- Now, in 2024, I serve as the Managing Director at Unison Globus and Initor Global, leading a team of over 500 employees and serving 400+ clients across the US, UK, and Australia.

Entering the UK outsourcing space

I started at Johnson & Johnson in 2003 and was a qualified Chartered Accountant by 2004, with my career taking off.

But in 2005, I realized this wasn’t my true calling.

Despite everyone’s surprise and concern; “You’re doing so well!”—I felt a strong pull toward teaching.

I left my job, returned to Ahmedabad, and became a full-time faculty member, even though it meant earning less than half of my previous salary.

That year, I met CA Vijesh Zinzuwadia, founder of Zinzuwadia & Co., who suggested we team up.

I joined his practice as a Partner, and after my first assignment in Mumbai, he knew I was the right fit.

In 2006, when we were planning our next move, I expressed my disinterest in routine audits.

Vijesh proposed starting a Tax and Accounting outsourcing firm focused on the UK market—a new, emerging field.

I agreed, and that’s how our journey began.

Thanks to Vijesh, the rest is history.

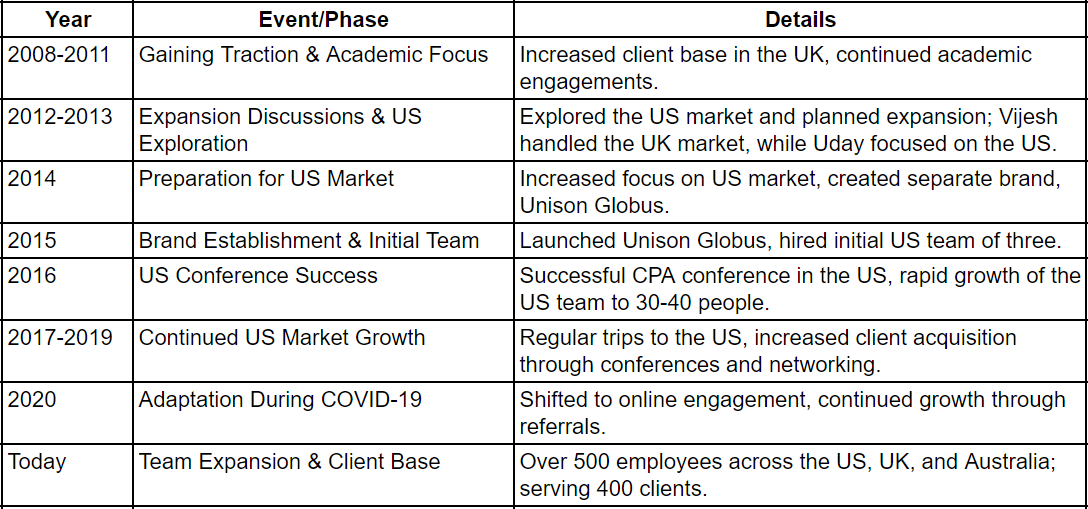

Our growth journey 2006-2024

2006

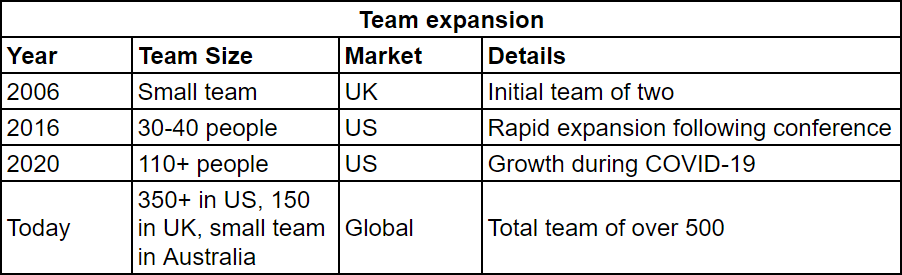

When we started with Initor Global in 2006, it was still early and nothing was concrete.

We decided not to incur the expenses of forming a company just yet. Instead, we focused on finding clients first.

Vijesh went to the UK and got our first client. The journey began and continued from there.

2007

We had just one client, which we were serving with a team of two people.

I was the one reviewing the work, and that’s how we operated.

Back then India was not properly marketed and it was tough to win clients.

2008 – 2011

By 2008, we began gaining traction in the UK.

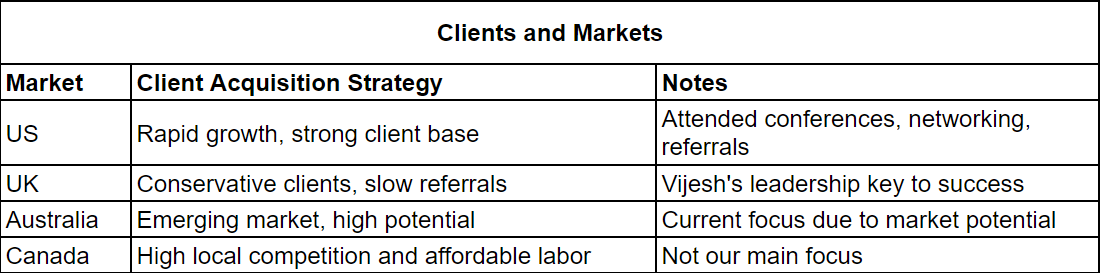

UK clients are conservative. It’s not like you start working with them, and within two months, they will be singing your praises and referring clients. No, they take their time.

It took two years for our first client to give us a referral, but that was the start of our success.

From 2006 to 2010, I focused on academics, delivering lectures and forensic training across India and becoming a visiting faculty member at IIM Ahmedabad, Nagpur, and Lucknow.

Meanwhile, our UK business, largely managed by Vijesh, was steadily scaling up.

2012-2013

Vijesh and I were discussing expanding our outsourcing services when he made a pivotal suggestion: “Uday, now that you’ve had your moment in the spotlight, can we focus on business?”

I agreed, and we decided to tackle something new.

With Vijesh having firmly established our presence in the UK, he would continue there, while I would focus on the US market.

In 2012, we made our first trip to the US to explore the market and connect with potential clients…What we found was a vast opportunity just waiting for us.

2014

After our 2012 US visit, we were still very much focused on the UK because it was growing rapidly at that time.

However, we realized that two years had passed since our US trip, and we needed to get serious about the ever-growing US market.

2015

By 2015, we had built a strong brand Initor Global in the UK, thanks to Vijesh…but we were unsure about the US market.

To mitigate risks, we decided to create a separate brand for the US market, leading to the birth of Unison Globus.

I then focused on the US market with a solid business plan.

For US outsourcing we hired 3 people and throughout 2015, we worked with just those 3 people.

2016

In July 2016, I went to the US with a solid plan and spoke at a CPA conference for 45 minutes. The session was a hit and significantly boosted our visibility.

By the end of 2016, our team had expanded to 30-40 people, and our US outsourcing business was growing much faster than our UK operations.

2017-2019

We replicated our success by traveling to the US once or twice a year, attending conferences, meeting new people, and speaking at events.

This strategy proved effective, helping us attract new clients and grow our business.

2020

Then came COVID-19, halting our travels and in-person meetings.

With conferences shifting online, we quickly realized the importance of social media and increased our engagement there. Despite the challenges, we continued to gain new clients through referrals.

By 2020, our US team had grown to over 110 people.

2020 onwards…everybody’s talking about India.

2021

We aimed for 100% growth and planned accordingly; hired, marketed, and trained to reach that goal.

Despite some resignations affecting our numbers, we came close and achieved 97% growth. This shows how our planning, hiring, and training align with our growth targets.

Fast forward to today…

Today, our team has grown to over 500 with 350 in the US, 150 in the UK, and a small team in Australia, alongside Zinzuwadia & Co.

From starting with a single client, we’ve expanded to over 400 clients.

Our revenue is diverse: 60% from tax services, 30% from accounting and CFO services, and 15-20% from bookkeeping.

Although the growth rate is expected to decrease as we grow, we’re targeting a 65 to 70% increase this year.

Our success? Clear roles and responsibilities:

- CA Nikhil manages our CA Firm operations

- I lead the US, UK and Australian markets; we have a team expert in each market

- Vijesh as a strategic key advisor

We’re committed to continuing our growth story.

Strategies for acquiring clients in the outsourcing market

Attending conferences and events

When we first targeted the US for client acquisition, attending and speaking at events proved highly effective.

- Engage: Hosted by the American Institute of CPAs (AICPA) and The Chartered Institute of Management Accountants (CIMA) in Las Vegas.

- Accountex: A leading event in the UK.

- Thomson Reuters Conferences: Renowned for industry insights.

- Each US state has its AICPA chapter with its own events, similar to ICAI’s wings in India.

How to Network

- Start Conversations: Greet others with a simple “Good morning” or “Hi, how’s your day?” This builds familiarity and makes future interactions smoother.

- Focus on Solutions: Rather than pushing sales, offer solutions and explain your services.

- Be Patient: Many clients convert into business after a year or more from initial meetings.

Referrals

Referrals have been a game-changer for us, contributing to nearly 85% of our returning clients.

Our analysis shows that 57% of clients referred us to at least one additional client last year, highlighting our growth momentum.

However, this doesn’t happen overnight. Building a strong referral network takes time.

Hire a business development team

Every three years, it’s crucial to shake things up. Sticking to the same old game plan can leave you trailing behind.

Take marketing, for instance. What worked in 2016 – delivering sessions to CPAs no longer holds the same power.

While I managed sales effectively on my own for a while, scaling up required a shift.

To stay ahead, we needed to invest more and bring in the right business development talent.

Partnerships as a growth strategy

Imagine partnering with a CPA firm in the US or UK.

Here’s how it could work:

- Propose that you become the offshore unit

- CPA Firm will handle marketing and client acquisition while you handle delivery

- Share the profits from the business

It’s a straightforward win-win.

Challenges in the outsourcing space

Finding the right leaders

Managing a 50-person team feels like working with family, but scaling to 500 changes everything.

You need a clear structure with top-level managers overseeing smaller groups to prevent chaos.

Finding the right managers becomes crucial—they must possess leadership, technical skills, and loyalty to keep the organization running smoothly.

Competition

When you start something new, you enter a completely blue ocean where you’re alone, and you build everything from scratch.

As people notice you, they begin to come over, and soon the blue ocean becomes a red ocean, filled with competitors.

Many companies are getting into outsourcing and it is competitive.

Quality concerns

The downside of increased competition is the risk of negative experiences.

Let’s say a CPA firm chooses to work with an outsourcing company that is cheaper but fails to deliver quality services.

This not only affects that particular firm but also harms the reputation of outsourcing as a whole.

Margin pressures in B2B outsourcing

Outsourcing is now essential, not a luxury hence new CPA firms are setting up offshoring units in India daily, increasing competition.

Big firms with deep pockets lure away experienced talent with higher salaries, challenging us as outsourcers.

Operating on a B2B model (CPA firms generate revenue and then allocate a portion of it to us) means we get a smaller share of the revenue, squeezing our margins.

Overview of various markets

US

Recently, I read that there is a shortage of 300,000 CPAs in the US market, indicating a growing demand.

UK and Europe

The UK market is also growing rapidly, as is the rest of Europe. However, breaking into the European market requires overcoming language barriers, as you need to know Spanish, French, German, and more.

Australia

Australia is currently the fastest-growing market after the US and the UK.

I was recently on a call with Vijesh, who is in Australia for a business trip. He mentioned that it’s a huge market with tremendous potential.

Canada

As for Canada, I would put it on the back burner for now.

There is a lot of migration to Canada from Asian countries, and they are getting affordable labor there.

Therefore, my focus is primarily on the US, UK, and Australian markets.

How to start a tax and accounting outsourcing business?

Decide your target clients: B2B or B2C?

Understanding your market is foundational.

Are you in a B2B or B2C space?

For the first three years of our U.S. journey, we made a conscious decision to focus solely on B2B.

Only after establishing ourselves in that space did we consider expanding into B2C.

Structure your pricing well

- Calculate costs: Focus on actual costs like rent, utilities, and salaries—ignore your time for now.

- Start modestly: Begin with a markup of 10-25% to stay competitive and build traction.

- Scale up: As you grow, increase your markup to 50%, and eventually to 100%.

- Adjust as needed: Test your pricing, see what works, and make adjustments.

Plan for hiring

Factor in training costs, as it takes 3-6 months to prepare new hires.

Wrapping up

It is a struggle for new entrants. Why? Everyone wants to jump into outsourcing!

However the opportunity is genuinely HUGE.

The world knows India is the place… so if you start in 2024 it’s giving the confidence that you will be able to deliver and deliver properly.

My advice is simple: don’t be scared. Go for it.

But…

- Outsourcing is not a fast track to wealth due to dollar and pound payments, you’ll still face high costs.

- Do not treat your outsourcing venture as a side gig. It won’t work! Commit fully for 2-3 years.

- To scale, hire experts and trust them with roles you can’t manage alone. For instance, if you are not good at Business Development, hire someone else!

Hi, how can we connect 8826688527

Thanks Amit, pls introduce yourself. Thanks

how to apply for UK tax

What is the scope for data analytics outsourcing from US UK. How to reach out to generate leads for this kind of work

What is your plan on use of AI in tax?

And if you could comment on the services related to 1120 tax compliance, state tax compliance and State Amended return.

How do we connect with you.. Alternatively

You can call me on +91 8978884799.

Inspiring story of your journey