- I’m Anshul Agrawal, founder of Toronto-based firm June15 Consulting.

- We help CPA firms build and scale offshore centers in India (our biggest market), the Philippines, Argentina, and Mexico (coming soon).

- Things got interesting toward the end of 2024, and I observed some interesting shifts!

Exciting trends in the accounting industry

In 2024, I started getting tons of inquiries, but from three very different groups:

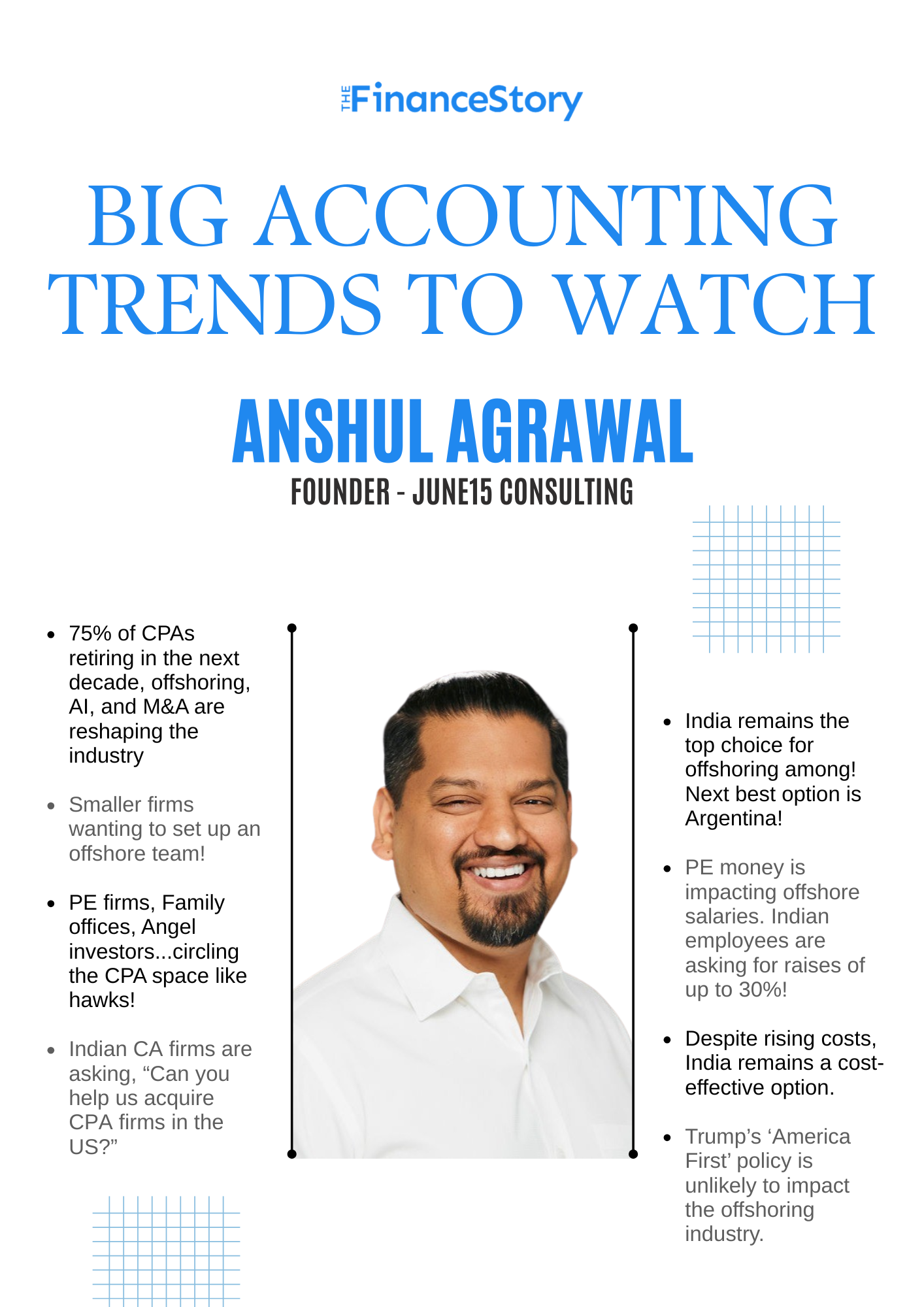

Smaller firms wanting to set up an offshore team!

I’ve lost count of how many times I’ve heard this in the past: “Only big CPA firms can set up offshore teams, right? Smaller firms have to go through agencies or outsourcing models!”

Fast forward to 2024, and now, firms are saying, “We just need a two-person team in India.” They’re reaching out to me for advice on making it happen.

Right now, I’m in talks with 10 firms—just waiting for the busy season to end before they dive in.

Firms are setting up their own offices in India, Mexico, Argentina, or the Philippines.

India and Argentina are leading the charge, but India dominates the landscape by far!

Last year a four-person CPA firm built an India team—now they’re scaling fast.

Why?

- Technology has leveled the playing field. Even small teams can now run a global practice with minimal effort.

- Over the past year, extensive education efforts have driven significant traction

- Accountants love control (let’s be real, they’re control freaks). With direct teams, they run the show.

- Having your offshore team makes you more attractive to private equity. The private equity playbook is straightforward: Acquire a firm that isn’t outsourcing or using AI and automation, then introduce both to unlock efficiency and growth.

Investors keen to buy smaller CPA firms

I’m talking about:

- Private equity (PE) firms

- Family offices

- Angel investors

…circling the CPA space like hawks!

They are coming to me and they are like, “I am here looking to buy two or three accounting firms.”

Why now? Because a massive wealth transfer is underway – 75% of CPAs are retiring in the next decade. Those firms need to go somewhere.

Investors are capitalizing on this by acquiring inefficient firms, rolling them up into larger entities, and eventually selling to a bigger buyer.

CPAs acquiring other CPA Firms!

Last week, I spoke with a young entrepreneur in his early 20s who had already started his firm, acquired another, and planned to buy four more firms every year for the next few years.

Just imagine the scale of that!

Indian CA firms looking at acquiring CPA Firms

We’re also seeing a surge of non-CPAs entering the space, actively acquiring CPA firms. This trend is poised to be one of the biggest shifts in the industry over the next two to three years.

Indian CA firms are asking, “Can you help us acquire CPA firms in the US?”

If you’re an Indian CA firm or business house, this is a huge opportunity to explore. The CPA industry is going global, and that’s exciting.

Even though M&A services aren’t part of our firm’s offerings, as an accountant, it’s been exciting to watch this trend unfold.

This will be one of the biggest shifts in the next 2–3 years.

What types of CPA firms are buyers targeting?

I don’t think there’s an ideal size for a firm.

- Private equity is targeting the bigger end of the market—$5 million and up.

- Then there are buyers looking at typically in the $1M–$5M range.

- Emerging interest → Many are now eyeing firms under $1M.

Best bet? Smaller CPA firms in the $1M–$2M range.

Why?

- Few buyers chasing them.

- Often just 4-5 people, led by a retiring owner.

- They care most about client continuity, not just the highest offer.

Show them you have the capital and a plan to take care of their clients, and you’ll stand out.

Ideal process for acquiring a US CPA Firm

Acquiring a CPA firm isn’t complicated, but strategy matters.

Here’s how to do it right:

Secure funding

Funding isn’t a major hurdle.

You can finance 80% of the acquisition cost through government-backed loans.

In the U.S., SBA loans (Small Business Administration) help small businesses secure funding by reducing lender risk.

Canada has similar programs, offering up to 80% financing with no collateral, purely based on cash flow.

For the remaining 20%, you can bring in investors or invest some of your own money.

Find the right firm

- Retiring owner or a young founder looking for capital?

- Remote-first, hybrid, or traditional brick-and-mortar?

- Service lines, technology stack, and client base—do they fit your vision?

Define the value you bring

- Why should the owner sell to you?

- Are you leveraging global talent, AI, automation, or new service lines?

- Can you increase efficiency and margins?

Choose your investment model

- PE-style flip? Buy, optimize, and sell at a premium.

- Long-term play? Build a lasting firm to pass down.

- Roll-up strategy? Acquire multiple firms and scale.

Make an offer & close the deal

- Structure a deal that aligns with both parties’ goals.

- Ensure a smooth transition—maintain client trust.

Also read: KPMG GCC India leader unveils big shifts & billion-dollar opportunities

Do you need to be a U.S. citizen or a licensed CPA to buy a CPA firm?

No! Non-U.S. firms are actively acquiring CPA firms.

However, U.S. regulations typically require majority ownership to be held by licensed CPAs. Understanding these rules is key to structuring your acquisition properly.

Typical valuation multiples for CPA Firm acquisitions?

It varies, but CPA firms generally sell for 1.2 to 1.5 times revenue.

Key factors that drive higher multiples:

- Hybrid or fully remote firms – Command a premium

- Minimal owner dependence – Easier to transition

- Firms with a robust IT and cloud infrastructure can command higher acquisition multiples. However, I have noticed that a lot of CPA firms are still not using cloud-based services, which is mind-boggling to me.

- Diverse service offerings – Higher pricing power

How do Indian CA firms connect with US CPA firms for acquisition?

So, if you’re serious about buying, you’ve got to tap into multiple sources:

- Your network

- Other accountants

- Lawyers

- Brokers: If you go through a broker, they will typically have a list of firms ready to sell

- Online databases

- Online portals: Marketplaces like Canary.Accountants and M&A platforms list CPA firms for sale, with free and paid databases available.

- Network of investors: There are a lot of people who fund these acquisitions, such as SBA loan providers and angel investors. They often have lists of firms looking for buyers.

Also read: India’s GCC revenue $64.6 Billion Up By 40% – Rising opportunities Tax Firms

Challenges in acquiring a US CPA Firm

Building & Maintaining Trust

Look at the typical demographic of a small-town CPA firm owner in the US.

- They are likely male, in their 60s.

- And their clients are practically their friends. They play golf with their clients.

If they sell their firm to you, they need to be 100% sure that you’ll take care of their clients, because those clients will tell them if you don’t.

Imagine them on the golf course, hearing, “Hey, who did you sell me to? This person has no idea what they’re doing!” That’s the last thing they want in their retirement.

So, the biggest challenge is this:

How do you build and maintain that trust? How do you reassure them?

“Hey, I may not live here. I’m from a country far, far away. But you can trust me. I will take care of your clients and preserve the relationships you’ve built.”

Fierce competition

- Plenty of retiring CPAs, but not all are eager to sell.

- More buyers than sellers—so why should they choose you?

- Differentiation is key: Trust, relationships, and a seamless transition.

Value you bring

When a CPA firm owner asks, “Why should I sell to you?”, what’s your answer?

- Global talent? Sure, but that’s not enough.

- AI & automation? Makes the firm more efficient.

- New service lines? Adds revenue streams.

Wrapping up…

With CPAs under pressure to improve margins, firms that have already optimized for efficiency and scalability will fetch better valuations.

The big questions to ask before you buy….

- Why do I want to buy a firm?

- What am I bringing to the table?

- How will I make this firm better and more profitable?

- What’s my endgame, sell or build?

As an Accountant with extensive professional experience, I bring over 30 years of expertise in Financial Management, Accounting, Budgeting, and Taxation within the Indian regulatory framework. My knowledge has been cultivated through hands-on involvement with a diverse array of clients and vendors across various sectors, encompassing financial reporting to headquarters, income and expense analysis, banking operations, statutory compliance, capitalization of fixed assets, product costing and the establishment of internal controls to safeguard available resources and enhance their performance. Additionally, I have managed various audit processes, including Statutory Audits, Tax Audits, Inventory Audits, Bank Audits, 5S Audits, and Internal Audits as mandated by the Indian Companies Act and other statutory regulations. I am proficient in utilizing accounting software such as SAP and Tally ERP effectively.