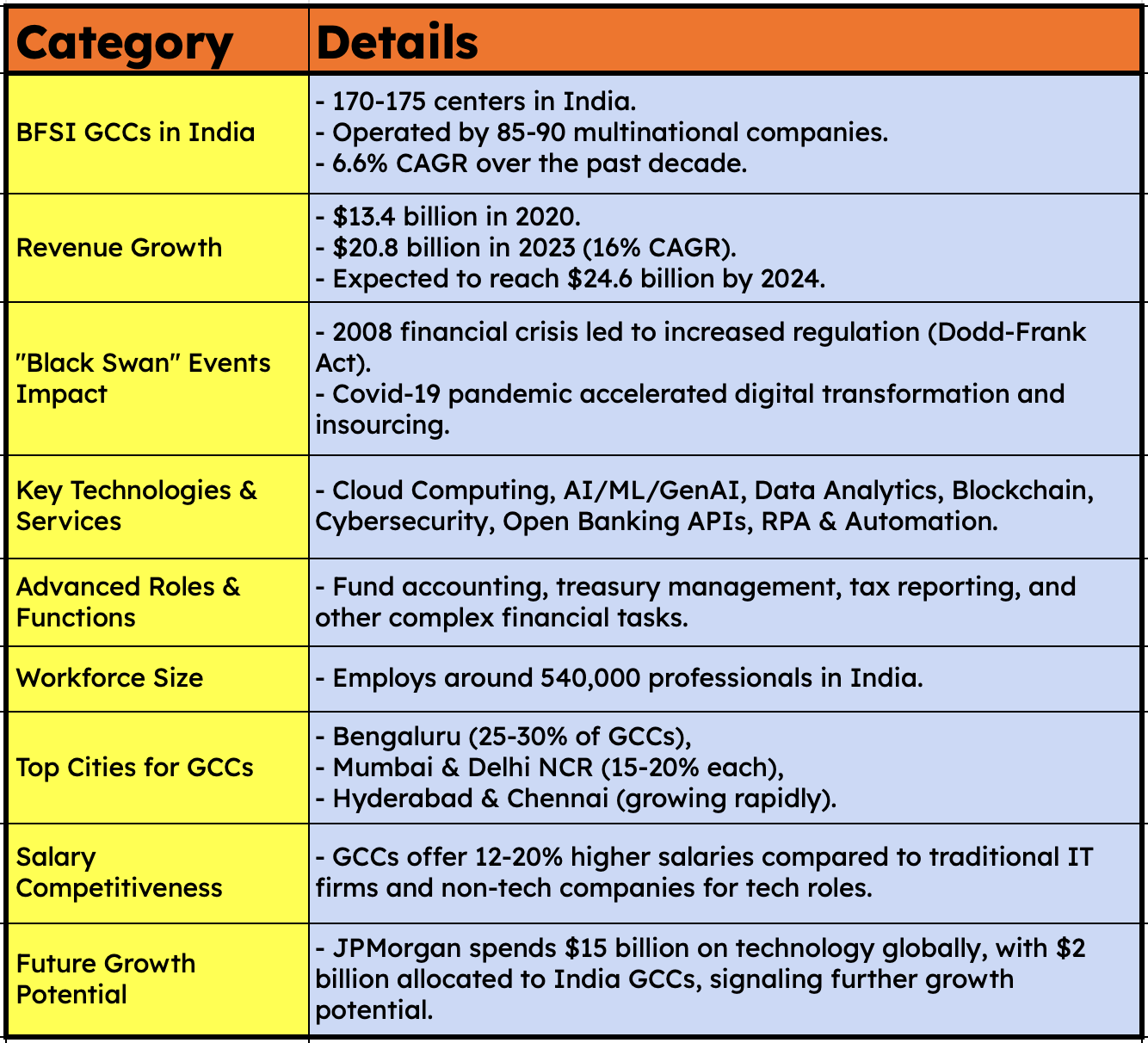

- The journey of BFSI GCCs in India has been remarkable, evolving from basic support roles to key players in the global financial ecosystem.

- A joint study by Wizmatic and EY revealed some fascinating data, as reported by the Times of India.

- Here’s a brief look at their evolution, current role, and future potential of BFSI GCCs.

Early beginnings: From back-office to strategic hubs

BFSI GCCs in India began as back-office centers handling basic tasks like customer service and IT support, aimed at cost reduction.

Premium Story

Continue reading this exclusive article

Get unlimited access to high-quality reporting on Indian business, markets and policy.