- The National Financial Reporting Authority (NFRA) and the Institute of Chartered Accountants of India (ICAI) are clashing again.

- This time over updates to Standard on Auditing (SA) 600!

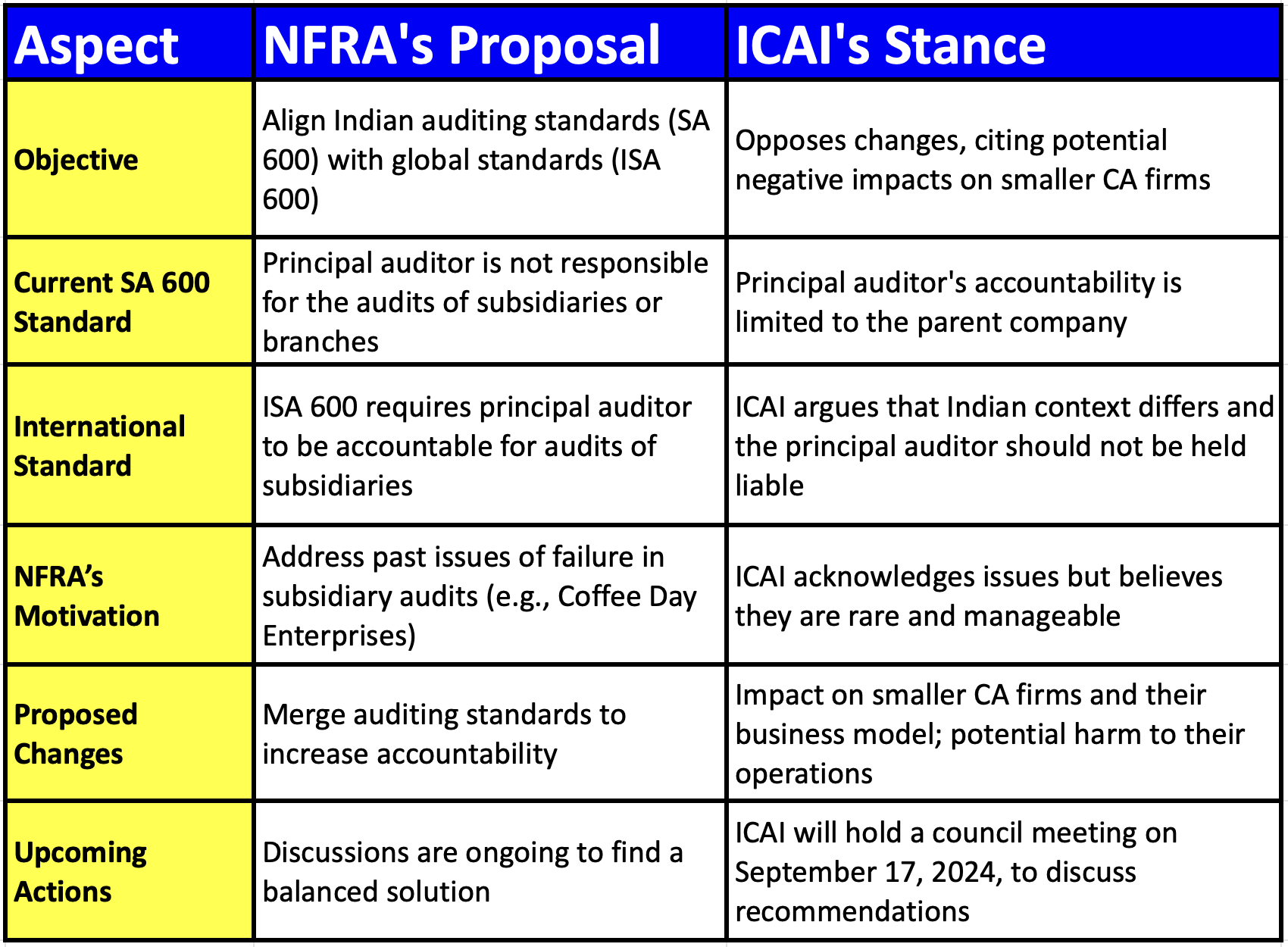

- NFRA wants to align SA 600 with the global International Standard on Auditing (ISA) 600.

- What’s the big deal?

- We turned to Robin Banerjee, CA and Chairman at Nucleon Research, to break it down for us.

What are the Indian Auditing Standards?

What is SA 600?

The SA 600 series focuses on auditing subsidiaries and group companies, including joint ventures and sister companies.

Picture this: If the parent company is large, it may have many subsidiaries or branches, sometimes up to 100.

The Principal auditor, (auditor of the parent company) may not have the bandwidth to be able to audit all the subsidiaries.

So, who will conduct the audits for these branches or subsidiaries?

Traditionally the principal auditor has relied on other auditors to handle the audits of these subsidiaries or branches.

(Many times the auditors of subsidiaries are smaller CA Firms!)

After those audits are completed, the results are used to prepare the balance sheet and profit accounts for the holding company.

Finally, the Principal auditor provides an opinion on whether the parent company’s accounts are accurate.

To what extent will the principal auditor be responsible for audits of subsidiary companies and branches?

The Indian standard, SA 600, indicates that the principal auditor cannot be held accountable for any errors or issues in the accounts of the subsidiaries or branches of the parent company.

In International Accounting Standards – (ISA) 600, which apply to the US, mainland Europe, and Australia, the main auditor is responsible for auditing subsidiaries and branches as well. This means they are also accountable for the work done by other auditors as well.

NFRA wants to revamp SA 600…

NFRA is stirring the pot.

They want principal auditors to be accountable not just for the parent company.

They’re pushing for auditors to also take responsibility for all subsidiary companies

What prompted NFRA to propose the changes to SA 600?

Initially, ICAI was the only organization regulating not only the profession and education of chartered accountants but also maintaining proper auditing standards.

However, in 2018, NFRA was created under the Companies Act 2013. Why? Supervise the auditing and the Indian Accounting Standards and oversee the activities of ICAI.

Once NFRA came into power, it began reauditing the financial statements of several companies, mostly, large and listed.

They found 4-5 cases where the principal auditor failed to report issues in the audits of subsidiary companies, which were deemed inappropriate.

A recent example: NFRA reaudited Coffee Day Enterprises’ accounts for 2018-2019:

- They found the parent company lent money to 6 out of 7 inactive subsidiaries.

- Total amount involved: INR 3,535 crores.

- The parent company was valued at INR 1,800 crores.

- To put it simply, this was money laundering.

NFRA’s order against Coffee Day Enterprise’s auditor BSR & Associates. The penalty was hefty; INR 10 crores to be precise.

NFRA approached the principal auditor BSR & Associates – about why they didn’t check suspicious transactions from subsidiaries.

The principal auditor likely replied that it wasn’t their responsibility…This was a pivotal moment that triggered the current dispute!

ICAI opposing NFRA’s decisions. Why?

At a macro level, it seems logical but you need to understand India.

India has around 5,000 companies regularly traded on the stock market.

Most of these are audited by the Big 4 or Big 20 firms.

However, many of these companies have numerous subsidiaries and branches, which are usually audited by smaller CA firms.

And guess how many small CA firms there are in India? 97,000!

Now if NFRA revises SA 600 to align with the International Standard on Auditing (ISA) 600. This will happen?

- If the Principal auditor is one of the Big 4 or Big 10, they might prefer to handle the audits of their subsidiary companies themselves or pass them to their affiliated firms.

- So, what happens to the smaller CA firms or auditing firms in India?

ICAI requests:

- Since India’s ecosystem is somewhat different compared to developed nations, the parent auditor should not be held accountable for the audits of its smaller subsidiaries.

- ICAI claims that NFRA is taking away small CA Firms’ bread and butter.

- It also proposed that they will improve their processes, and implement additional checks and balances.

Also read: NFRA hits BSR & Associates with a massive ₹10 crore penalty

Have the two regulatory bodies reached a decision yet?

To discuss potential recommendations for NFRA on how to improve the situation, ICAI will hold a council meeting on September 17, 2024.

In your view, what would be the best way to resolve this issue?

India is currently the 5th largest economy in the world by GDP and may become the 3rd largest in about two years.

We cannot achieve greatness if our financial statements are not reliable!

There is no doubt that both ICAI and NFRA want the best for India and are committed to ensuring high-quality audits.

- One suggestion is to apply the SA 600 revision to the top 1,000 companies first.

- After gaining experience, NFRA could gradually expand to the next 1,000 or 2,000 companies over the next two years.