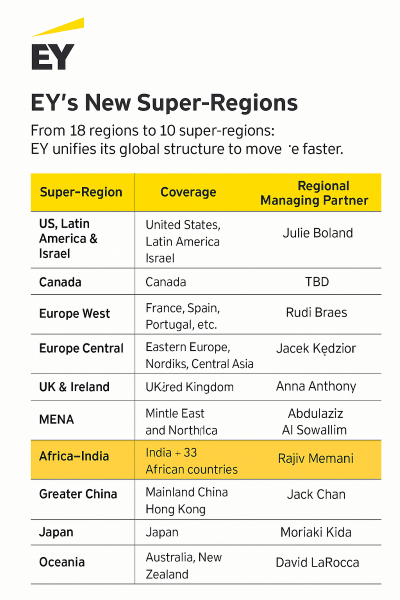

- In a leaked memo in March 2025, EY laid out its next big move: Starting July 1, 2025, EY will say goodbye to 18 regions—and hello to 10 “super-regions.”

- The most talked-about? The new Africa–India super region will be led by Rajiv Memani.

- As the new Regional Managing Partner of Africa–India, Rajiv will now oversee 33 countries and tens of thousands of professionals.

Wait, what’s going on?

Until now, EY operated in a complicated 18-region structure — spread across the Americas, EMEIA (that’s Europe, Middle East, India, Africa), and Asia-Pacific.

India had its region.

Africa had its own.

So did the UK, China, Canada, Israel, Latin America — you get the idea.

But starting July 1, 2025, that changes.

EY is collapsing those 18 regions into 10 massive “super-regions.”

- US, Latin America & Israel

- Greater China

- Canada

- UK & Ireland

- Europe West

- Europe Central (East, Southeast Europe, Central Asia, Nordics)

- MENA

- Africa, India

- Japan, Asia East & Korea

- Oceania

Who’s leading the charge?

Yes, earlier there were too many layers (continental heads, regional heads)…

Now, each super-region will be led by a new Regional Managing Partner…And will report directly to the global HQ.

But why the new EY model….

The idea is clear: move faster, serve better, and act like one global firm.

- The old middle layer of management (called “continental heads”) will disappear.

- Each big region now has one leader called a Regional Managing Partner (RMP)

- RMPs report directly to global HQ

- Talent can now move easily across borders.

Also read: KPMG India CEO confirms: “Ownership change complete….wrt Project Himalaya”

| Region | Coverage Area | Leader |

|---|

| India & Africa | India, and 33 Sub-Saharan African nations | Rajiv Memani |

| MENA | Middle East + North Africa (including Egypt, Morocco, Algeria, Tunisia, Libya) | Abdulaziz Al-Sowailim |

So, what does the new EY structure mean?

Leadership Unification: For instance, both India and Africa now report administratively to Rajiv Memani, meaning shared strategy, investments, and talent decisions.

No change in Financial Reporting: Each country (India, Kenya, South Africa, etc.) continues to report its revenue through its existing legal and statutory structure.

That means revenue and financial results are still tracked country by country, not pooled together in one legal entity.

Improved synergy, not Accounting Merger: The purpose is to enhance cross-border coordination and client offerings, not to consolidate finances.

Example: Imagine technology specialists in India being easily redeployed to support a digital transformation project in Africa—without needing separate regional contracts or approvals.

Another big shift…

EY Financial Services (FS), which used to operate as a parallel global business line, is being folded into the super-regions.

Global FS coordination will remain under Omar Ali.

Will we see layoffs at EY?

EY’s global shake-up, set for July 1, 2025, is laser-focused on cutting middle management—think continental heads and overlapping regional roles that are now seen as redundant.

Recently, EY’s UK and Ireland offices slashed 30 partners and downsized their legal division.

Are job cuts expected in EY India due to this restructuring?

EY India has no layoffs planned.

In fact, they added 18,000 staff from 2022 to 2023, even as EY US trimmed around 3,000 jobs.

Still, India falls under the EMEIA cluster, which faces major role consolidations and reshuffles ahead.

Insider whispers suggest:

- Tech consulting and global IT/on-site service teams are feeling the pressure as the new super-region structure rolls out.

- So, Layoffs “might” be brewing in EY India’s Global Delivery Services (EY GDS), especially hitting mid-level managers.

Are other Big 4s restructuring as well?

Yes!

KPMG Mergers

This year, KPMG combined 13 separate country offices across Southern, Eastern, and Western Africa into one unified regional cluster.

It’s part of KPMG’s global strategy to streamline operations by merging smaller firms—typically those with less than $300 million in revenue—into bigger, more efficient units.

The goal? To cut down from over 120 country units in 2023 to just 32–40 worldwide by the end of 2026.

Other moves

- May 2024: KPMG UK and KPMG Switzerland merged to form a $4.4 billion entity, creating a single legal and financial unit.

- August 2024: KPMG Saudi Levant (Saudi Arabia, Jordan, Lebanon, Iraq) merged with KPMG Lower Gulf (UAE, Oman).

PwC mergers: PwC is also pulling out of over a dozen countries to exit low-performing markets and cut ties with risky clients.

Also read: PwC US revamped advisory division. Plans thousands new hires!

Wrapping up…..

Janet Truncale took over as EY’s Global CEO in July 2024.

And since then, she’s been focused on making the EY more united, profitable, and future-ready.

From Africa to India, New York to Shanghai, EY’s new super-regions will reshape how thousands of professionals work and how clients are served.

It is surely a bold move.

FAQs

Who leads the EY Africa-India super-region?

Rajiv Memani, the Regional Managing Partner behind EY India’s strong growth, leads the Africa-India super-region.

Earlier, Ajen Sita was the EY Africa Regional Managing Partner, overseeing EY’s operations across the African continent, including Sub-Saharan Africa.

Why did EY combine India and Africa into one super-region?

Simple. Both are fast-growing emerging markets with huge potential. EY wants to unlock synergies—sharing talent, resources, and strategies seamlessly across borders.

Will India and African offices still report separately on revenue?

Absolutely. This isn’t about merging the books. Each country keeps its own financials. The super-region is about aligning growth plans and service delivery—think collaboration, not consolidation.