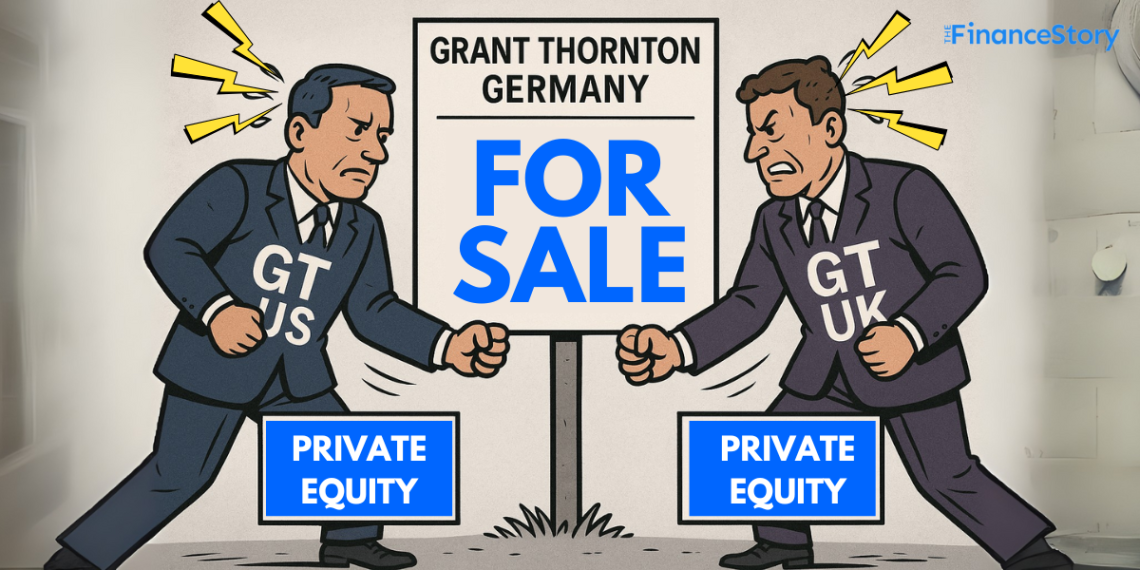

- Grant Thornton Germany, a €240 million+ revenue firm, is up for sale.

- And GT US and UK, both backed by private equity, are locked in a “fierce bidding war” to acquire GT Germany.

- Traditionally, GT member firms or as they call them, “Sister firms”, operated as collaborative peers.

- But now, under PE pressure (and billions at stake), they’re competing like rivals trying to outbid each other for control of member firms.

Wait, why is this even happening?

Grant Thornton operates as a network of independent member firms.

They share a brand, collaborate, but each firm runs independently in its own country.

That model worked well for years…until the world changed!

Rising client expectations and pressure from clients seeking end-to-end global delivery and rapid tech adoption are revealing a serious strain on the existing structure.

Enters…Private Equity

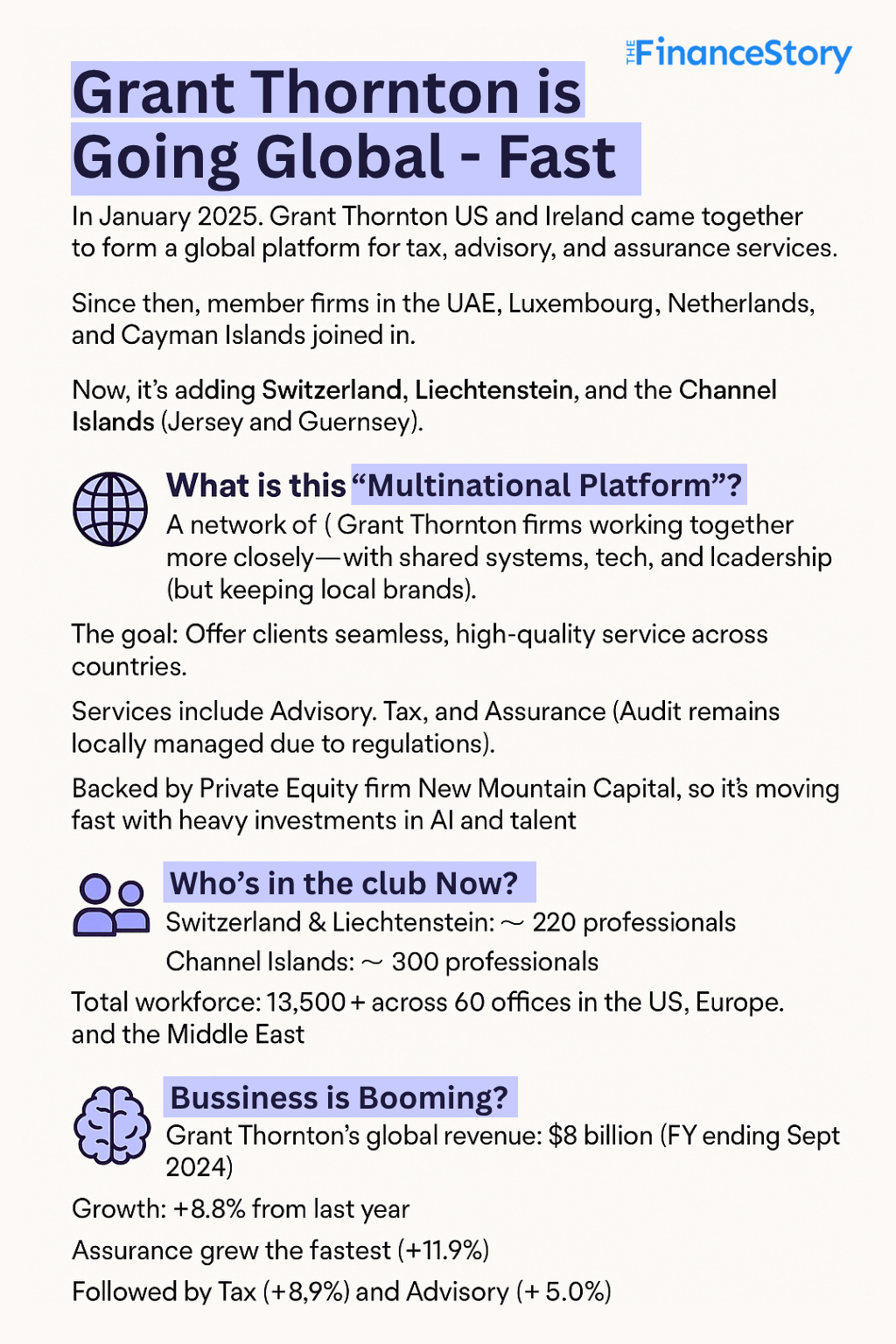

In 2024, Grant Thornton US sold the majority of its stake to PE firm New Mountain Capital.

With billions to deploy, Grant Thornton US strategy is clear:

- Acquire key firms across the GT network

- Merge operations

- Standardise everything

- Build a global advisory juggernaut

Also read: Grant Thornton Bharat eyes Private-Equity stake sale?

Here’s what happens next…

Grant Thornton US, riding the PE wave, has gobbled up firms across Europe and the Gulf.

It started with GT US acquiring the advisory and tax business of GT Ireland.

This gave birth to something new, the Grant Thornton Multinational Platform.

In just six months, the platform added:

- Grant Thornton UAE

- Grant Thornton Netherlands

- Luxembourg

- Cayman Islands

And in June 2025:

- Switzerland & Liechtenstein (220 professionals)

- Channel Islands (Jersey & Guernsey) 300 professionals

(This isn’t a traditional merger: Only advisory and tax services are combined!)

Yes, GT US tried to buy GT UK

Yes, GT US tried to buy GT UK

But….

Grant Thornton UK slammed the door, rejected a buyout offer from Grant Thornton US…And brought in its own PE backer, Cinven!

Sparking a fierce rivalry.

Now the battlefield has shifted to Germany

Germany isn’t just any market — it’s Europe’s economic engine and a hub for multinationals.

(Germany is the third-largest economy in the world!)

With 2,000 employees across 10 offices, is one of Germany’s fastest-growing audit and advisory firms serving international businesses across the upper mid-market.

This acquisition would give the buyer full control and access to a highly profitable and strategically located firm.

Grant Thornton Germany revenue (€ Millions)

| Service Line | FY 2022/23 | FY 2023/24 | YoY Growth |

|---|---|---|---|

| Total Revenue | €212 M | €249 M | +18% |

| Tax | €96.7 M | €116 M | +20% |

| Audit & Assurance | €66.8 M | €77 M | +15% |

| Advisory | €40.7 M | €41 M | 0% |

| Legal | €7.6 M | €15 M | +88% |

| Employees | ~1,800 | ~2,000 | +10% |

Update….

On September 10, 2025, there was an announcement of a strategic partnership.

Not GT US or GT UK…But turns out international private equity giant Cinven got a share of GT Germany’s pie.

Cinven’s investment enables Grant Thornton Germany to,

- Expand service lines

- Boost tech capabilities

- Adopt cutting-edge technologies like AI

- Enter new market segments

- Strengthen collaboration with Grant Thornton UK

- Tap into cross-border opportunities in tech investment and international client service

Despite changes in ownership, Grant Thornton Germany will maintain its independence.

Wrapping up…

According to the Financial Times, GT firms in Spain and India are watching closely, and some are even open to being acquired.

In fact, Financial Times (FT) quoted Grant Thornton Bharat CEO Vishesh Chandiok as saying,

“We are open to acquiring a material interest in our US or UK firms as and when their private equity owners decide appropriate.”

FYI: GT Bharat is growing fastest of all GT firms, up 25%!

FAQs

Q: Is Grant Thornton backed by private equity?

Yes, Grant Thornton has received private equity backing across several regions.

- Grant Thornton U.S. sold a majority stake in its advisory arm to New Mountain Capital in 2024.

- Grant Thornton UK sold the majority stake to private equity firm Cinven, estimated to be valued at £1.5 billion!

Q: Is Grant Thornton Bharat (India) planning to raise private equity money?

Grant Thornton India (Grant Thornton Bharat) is open to the idea of selling a minority stake to private equity.

The firm needs the external funding to fuel its aggressive growth strategy, which includes technology upgrades and mergers.

However, CEO Vishesh Chandiok told Financial News London that there’s no formal mandate currently.