- As global demand for accounting services increases, the US and UK present significant opportunities for Indian Chartered Accountants and outsourcing firms.

- UK, USA, Australia, Canada – Which market offers the best potential?

- How can you launch an outsourcing business? Let’s dive in!

First, let us understand what is happening in various global markets.

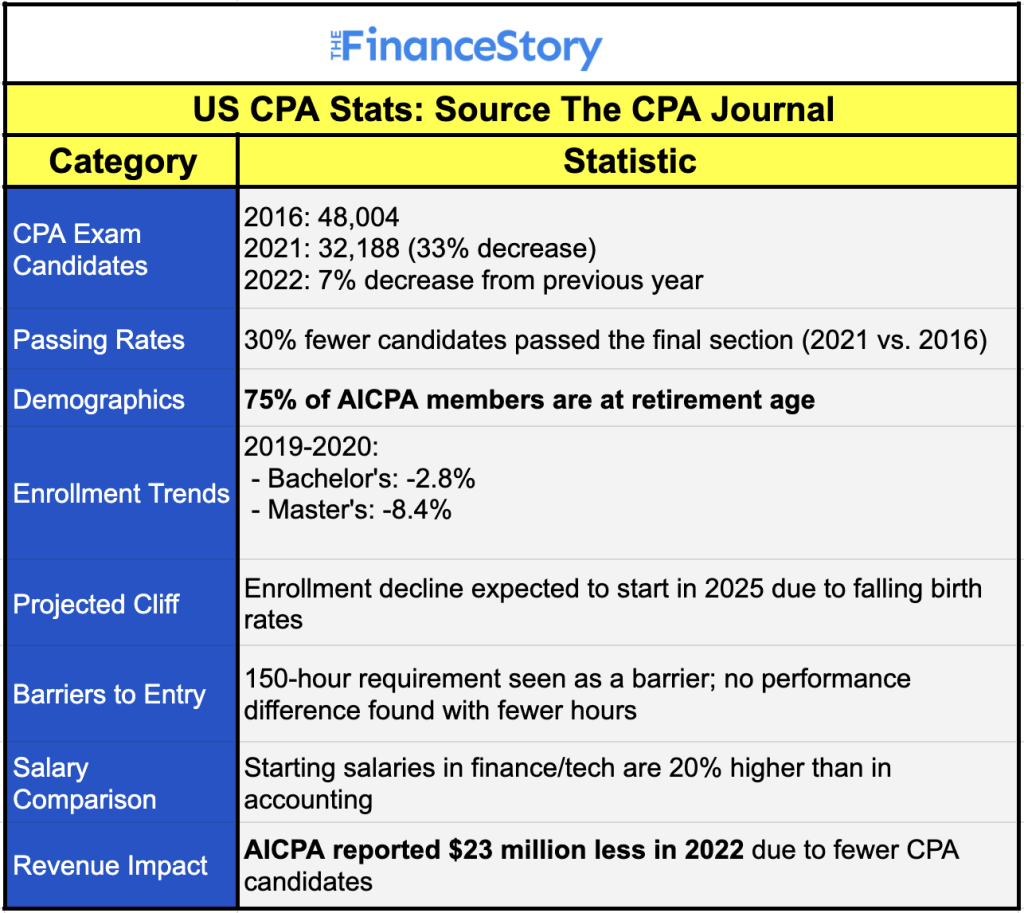

As reported by several leading media publications, the USA genuinely has a shortage of Accountants. Here are some stats by The CPA Journal.

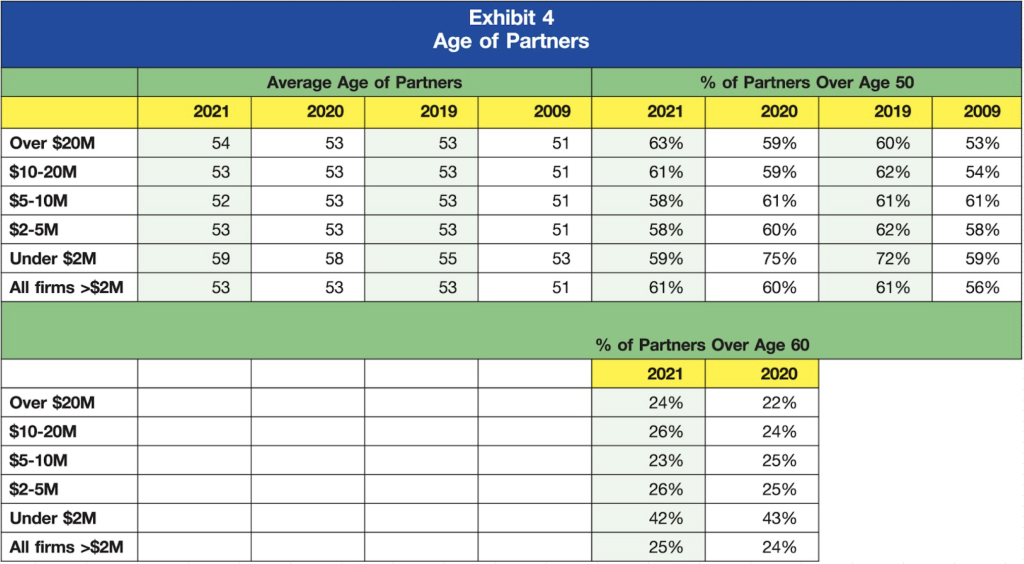

Now even if you look at the number of Partners in the US CPA Firms as per The CPA Journal, a large portion are over 50 years!

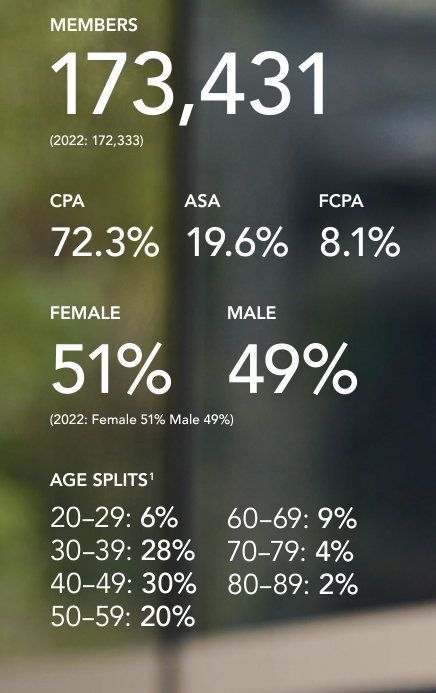

Talking about Australia, in the last 3 months we have seen a large number of finance professionals heading to Australia. Why? There is again a decline in CPA registrations and then almost 25 percent of CPAs will retire in the next 5-10 years. Here is some stats:

Now let us understand how a few industry leaders picked their markets…

Uday Ranpara, Managing Director at Unison Globus and Initor Global

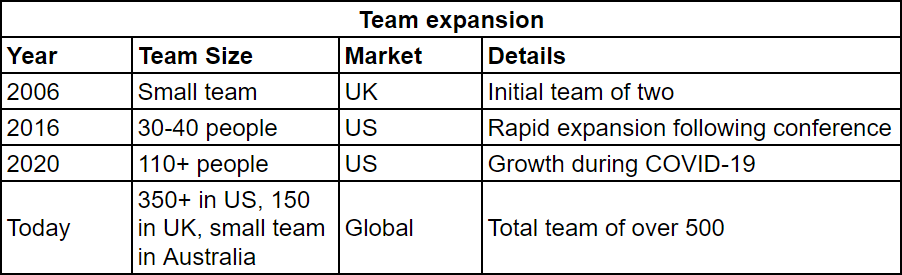

I am Uday Ranpara, the Managing Director at Initor Global and Unison Globus, a firm based in Ahmedabad, India with a global presence across the US, UK, Australia, and Canada.

We employ over 500 professionals and serve 400+ clients.

Our revenue is diverse:

- 60% from tax services

- 30% from accounting and CFO services,

- 15-20% from bookkeeping.

UK Market

- UK market, along with Europe, is experiencing rapid growth. However, expanding in Europe poses challenges, especially with language barriers.

- To truly penetrate the European market, one must be knowledgeable in languages like Spanish, French, and German.

- UK clients are conservative. Building trust takes time; it took two years before our first client referred us, but that was the key to our success.

- When Vijesh, my co-founder, met our first UK client, they asked for his passport to check his visa, reflecting India’s negative perception. Thankfully, that has changed; now it’s all about delivering value.

US Market

- Extremely high demand for qualified accounting professionals and CPAs. Thus the country is looking beyond its borders for talent, particularly from India and the Philippines.

- Although we planned to tap into the US market in 2012, it wasn’t until 2016 that I revisited it with a solid strategy in mind.

- I recall attending a CPA conference where I addressed professionals for 45 minutes. That event became a game-changer, landing us over 10 clients and sparking faster growth in the US compared to the UK.

- Between 2016 and 2020, we built a dedicated team of over 110 professionals specifically for the US market.

Australia: A Fast-Growing Opportunity

- After the US and UK, I see Australia emerging as the next fastest-growing market.

- Just recently, Vijesh, visited Australia to meet clients. He mentioned the enormous market potential there, which is ripe with growth opportunities.

Canada

- For the time being, I’m placing Canada on the back burner.

- The country is experiencing significant migration from Asia, leading to an influx of inexpensive and skilled labour.

- Given the competitive pricing in the Canadian market, our focus remains on the US, UK, and Australia.

Start with?

- US market is huge and offers the most potential for starting an outsourcing business.

Important to keep in mind

There are two major misconceptions about outsourcing:

- Outsourcing is a fast track to wealth. It is surely not! Competition is intense. While you might see revenue growth, your expenses will likely increase at a similar pace.

- It can be done part-time while running your CA Firm. Do not treat your outsourcing venture as a side gig. It won’t work! Commit fully for 2-3 years. You either go all in or don’t bother.

Vaibhav Manek – Co-founder and Partner at KNAV

When most of us think of outsourced work in the US, we typically picture services like bookkeeping, taxes, and basic fractional CFO or FP&A support.

However, I believe that there’s so much more beyond these basic services, extending further up the value chain!

Founded in Mumbai in 1999 by four CAs, KNAV has expanded to seven countries, starting in the US and India and later growing into the UK, Canada, the Netherlands, Singapore, and most recently, the Philippines.

At KNAV, we focus on three major service pillars:

- Audit

- Tax

- Advisory

Sector trends we observe

- Audit is following with a solid 10-15% increase

- Taxation is also making strides with 15-20% growth.

- But the real star of the show is Advisory – growth rates of 25-30% across various countries!

Corridor model

By “corridor,” I mean specific regions like the US-India, UK-India, Indo-Singapore, Indo-Canada, UAE, Riyadh, Australia, and Japan.

ICAI has signed MRAs with various countries—to explore those corridors.

UK: Requires a deep understanding of cultural and business practices

US: US audits are complex, demanding significant expertise due to talent shortages, high attrition, recruitment challenges, and tech hurdles.

There’s a surge in M&A, with large Private Equity funds acquiring controlling stakes in major firms, as partners retire and older firms struggle.

It’s a great opportunity – perform well, and you’re valued; fall short, and you’re out.

Japan: Japanese clients require a specific approach and building trust takes 2 to 4 years and multiple meetings. But once they give you work, they are there for life. It’s a loyalty business. We know clients who only work with one firm in India when they come from Japan. It’s a loyalty business.

UAE: New tax regulations are shaping the business environment.

Saudi Arabia: Rapid business expansion and development. Driving demand for skilled accountants.

Australia: There’s a noticeable talent shortage in Australia, with very few professionals handling real corporate finance work, audits, or taxes. They have a dearth of real practising professionals. This gap presents opportunities.

Note

- When expanding internationally, it’s crucial to define a problem statement and stick to your core purpose.

- Instead of trying to operate in numerous countries, I recommend focusing on mastering one corridor before expanding to another.

- You can’t target 20 or even 5 countries at once. Focus on one, then expand, building expertise in each while understanding both the opportunity and culture.

- Choosing the right market is vital. While every country has its share of experts, the real value lies in concentrating on specific international corridors where advisory services are underdeveloped.

Kavita Chakraborty – Founder, Konnect Books & Taxes

I’m CA Kavita Tapdiya Chakraborty, the founder of Konnect Books & Taxes, an international bookkeeping and accounting tax firm based in Pune, India.

I started from a small room as a freelancer and grew my firm to a team of over 190 professionals.

Last March, Konnect crossed the $2.5 million mark in revenue, and we’re on track for 100% growth this year!

How Konnect Has Leveraged The Global Opportunity

I recall getting my first client in September 2008 from the US.

From June 2010 to 2014, my team primarily focused on bookkeeping, serving regions like the US,UK Singapore, without any formal team or sales and marketing strategies.

Everything changed in 2015 when I made a bold decision to exclusively target the U.S. market, even surrendering my certificate of practice (COP) to do so.

(Kavita is a Chartered Accountant from India and hence gave up her COP to focus on providing outsourced services!)

As of today we focus on – US, UK and Australia markets.

Which market to start with?

Start in one market be it US or UK and then expand. It takes 5 years to grow and scale.

Girish Vanvari – Founder at Transaction Square

I am Girish Vanvari, the founder of Transaction Square, an advisory firm based in Mumbai that specializes in providing M&A advisory, valuation services, and tax structuring.

Landscape of Outsourcing

Outsourcing has evolved significantly. Initially limited to bookkeeping and tax services, I’ve noticed a substantial shift towards providing advisory services.

This trend is expected to continue growing, especially for professionals looking to establish a more robust service model.

Niche skills focus

In India, we have an abundance of accounting talent, and our educational system produces highly qualified accountants annually.

However, we need to focus on developing niche skills in areas such as business strategy, financial modelling, and valuation. Many professionals still view these areas as difficult, leading to a gap in demand for such skills.

Market Potential for High-Quality Outsourcing

Indian firms have the potential to compete globally, but we need to enhance our offerings and address niche areas.

Those willing to invest in niche skills will stand out, especially in advisory and transaction services.

Vishnu Patwari, Executive Managing Director at BDO RISE

Almost every firm in developed countries is eager to outsource work to India!

They face a severe shortage of white-collar finance and accounting professionals, which opens a gateway for collaboration.

At BDO RISE, I’ve had the unique opportunity to scale the organization from zero to 2,500 people in just four years.

This growth has given me a front-row seat to the shifting dynamics of the global workforce.

Future Projections:

- During my research, I discovered that by 2030, India is expected to be the only country with an excess of skilled workers.

- In contrast, every other country will grapple with a shortage of finance and accounting professionals. This presents a remarkable opportunity for growth.

- Increase in GCCs: Although there are currently 1,600 GCCs, projections suggest this could rise to 10,000 shortly, making the landscape for expansion vast.

Explore Opportunities with U.S. CPA Firms

- I’ve realized that there’s immense potential in approaching U.S. CPA firms. By proposing to establish their offices in India, you can help bridge the gap.

- The pandemic highlighted the truth that work can be done from anywhere. This has led many firms to reconsider their operational models.

- Opportunities for Smaller Firms: While the Big Four firms have the resources to invest and take risks in India, many smaller U.S. firms lack the knowledge or resources to initiate business here. This gap presents a valuable opportunity.

Engagement with U.K. Firms:

- Numerous Indian firms already have collaborations with U.K. companies. However, opportunities still abound.

- While engaging with U.K. firms may seem challenging, there’s potential for growth if I can effectively demonstrate my understanding of both Indian and U.K. business cultures. This positioning can make me a valuable partner in these ventures.

Other Regions:

- Expanding Horizons: It’s not just the U.S.; firms from Australia and the Pacific region are also seeking to outsource work to India.

- Rising Demand for Offshoring Centers: There’s a consistent demand from firms looking to partner with experts who can help establish offshoring centers in India.

Point to note

“Establishing operations in India is no small feat. Even with the backing of one of the largest U.S. firms, I faced considerable challenges in setting up BDO’s offshore unit here,” I often remind myself.

India presents a complex landscape—particularly concerning its legal structures and cultural nuances.

Despite these challenges, I firmly believe that the potential remains largely untapped, and that’s what makes this journey so exciting!

Ajay Sethi, Managing Partner ASA

I established ASA in 1991. Today ASA has evolved into a leading professional services firm in India, boasting an impressive team of over 1000+ members and 33 partners.

We joined the Baker Tilly Network.

ASA also has international desks in:

- US, France

- Germany

- Japan

- Switzerland

- UK

Global markets

We started to understand the global business landscape just five years into our firm.

Interestingly, although we didn’t tie up with any international networks in our early years, 70% of our clients today are foreign companies.

When we first entered the international market, Japan was our initial focus.

To succeed with international clients, it’s essential to approach the market strategically:

- Cultural Adaptation: Understanding cultural nuances is key. For example, in Japan, honesty and straightforward communication are highly valued.

- Skill Alignment: Don’t chase international clients solely for higher margins. Ensure your firm’s expertise—whether it’s in foreign exchange, tax, or another area—aligns with the specific needs of these markets.

- Networking: Build strong local connections through chambers of commerce, professional networks, and industry events. Partnering with local professionals or firms can provide crucial insights and entry points.

- Long-Term Relationships: Securing international clients takes time and investment. Plan multiple visits, nurture relationships, and establish trust to create lasting partnerships.

- Targeted Expansion: Start with one or two countries where your skills match market demand. Gradually expand from there, either independently or by partnering with a global network.

Nexdigm

Nexdigm operates directly in the USA, Poland, UAE, and India.

Nexdigm is a global business advisory firm that offers integrated solutions across accounting, business consulting, tax, and advisory services.

Wrapping up…

With India’s diverse talent pool and the willingness to work hard, you can expand your footprint globally.

However, the key is to harness our strengths and continually adapt to market demands.

- Now you have to understand one thing – that yes the world is looking at India for accounting …But the margins are shrinking.

- Hiring talent in India is also getting expensive.

- Now even Several mid-sized CPA Firms are setting up satellite offices in India and hiring at a 30-60% premium.