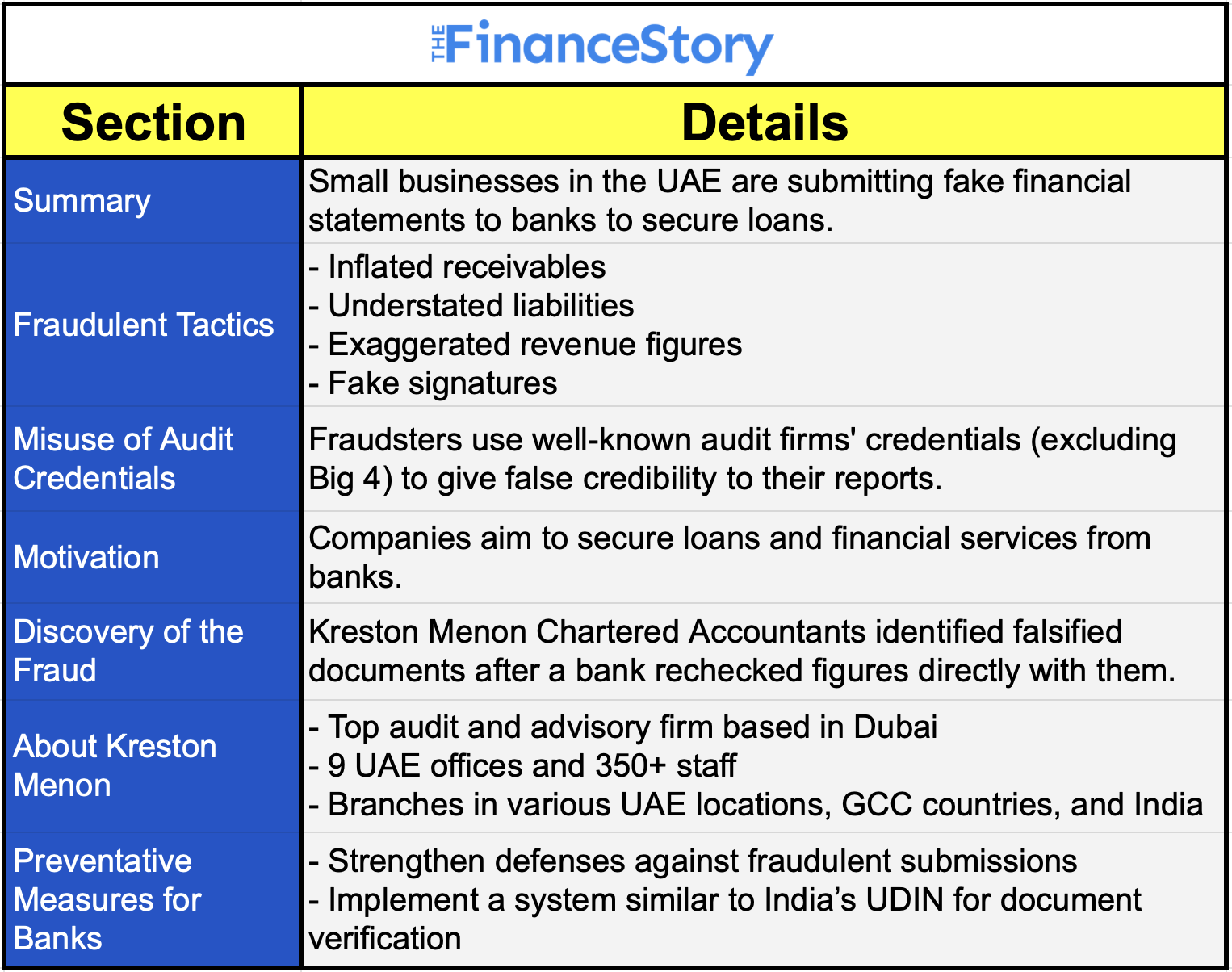

- The UAE banking sector is facing serious threats!

- Some small businesses are submitting fake financial statements to secure loans.

- Fraudsters are misusing the credentials of reputable audit firms to pull off these scams. Here’s the breakdown.

Fake financial statements submitted to UAE banks

The UAE banking sector is dealing with an alarming rise in bogus financial statements from small businesses.

To present a more favorable financial picture of the business to banks, businesses are altering elements including,

- Inflated receivables

- Understated liabilities

- Exaggerated revenue figures

- Fake signatures

Misuse of reputable audit firm credentials

Small businesses are creating these bogus reports, but they’re using the credentials of well-known audit firms, except for the Big 4, to not raise suspicion.

Discovery of the fraud

The issue came to light when a bank decided to recheck figures provided by a prospective client with Kreston Menon directly (who was allegedly stated as the auditor).

Raju Menon, Chairman and Group Managing Partner at Kreston Menon Chartered Accountants informed Gulf News.

The firm discovered that the financials were falsified, and the documents didn’t originate from any of their offices. “We’ve uncovered a serious issue, and I hope these cases aren’t widespread,” Menon explained.

Also read: UAE Ministry fines 29 companies over AED 22 million, here’s why

The motivation behind this?

It’s simple; they want to use these falsified financials to secure loans and other services from banks.

About Kreston Menon

Kreston Menon, formerly Morison Menon, is a 30-year-old leading auditing and advisory firm headquartered in Dubai, UAE.

They have a footprint in the UAE with 9 offices and over 350 staff.

Kreston Menon has branches in Abu Dhabi, Sharjah, Ras Al Khaimah, Jebel Ali Free Zone, Dubai Airport Free Zone, Hamriyah Free Zone, KIZAD, and DMCC as well as in other GCC Countries and India.

How can banks protect themselves?

Menon is raising the issue with the Ministry of Economy and may involve the police.

Nonetheless, banks must strengthen their defenses against fraudulent submissions by,

- Implementing a system similar to India’s Unique Document Identification Number (UDIN).

- UDIN is an 18-digit code issued for each certified document.

- This verification mechanism would allow banks to quickly verify the authenticity of financial documents, reinforcing trust and preventing future fraud.