- The day is finally here. Hon’ble Finance Minister Ms. Nirmala Sitharaman presented the Union Budget 2025-26 on 1st February.

- It was not only a relief for the middle class but also a reflection of India’s continued push towards Viksit Bharat.

- Uday Ved, Partner & Taxation Leader KNAV, and Vaibhav Manek, Country CEO at KNAV India have broken down the key takeaways for you.

Core themes of this budget include

The budget distinctly outlines priorities for a better India, with a strong emphasis on:

- Ease of Doing Business: Reducing regulatory complexities and fostering a business-friendly environment.

- Tax Simplification & Litigation Reform: Ensuring a more transparent and efficient tax system.

- Enhancing Investments & Exports – Attracting FDI and strengthening India’s position in global trade.

- Empowering Key Sectors – Focus on agriculture, MSMEs, women entrepreneurs, and overall economic upliftment.

New Income Tax Bill on the Horizon

A major announcement is the upcoming New Income Tax Bill, set to be unveiled next week.

The Government aims to modernize India’s tax laws, replacing the Income Tax Act of 1961 with a simplified, transparent, and efficient tax framework.

The top priorities are:

- Streamlining TDS/TCS processes

- Improving assessments

- Expanding the tax base

Notable initiatives include

MSME Growth: Enhanced investment and turnover limits to strengthen Micro, Small and Medium Enterprises and improve financial access

Artificial Intelligence: The Union Budget 2025-26 is allocating INR 500 crore to advance AI, robotics, and cybersecurity.

Additionally, five National Centres of Excellence for Skilling are set to be established.

This will,

- Transform education through personalized learning and skill enhancement.

- Equip India’s workforce with cutting-edge, industry-ready skills.

Key highlights of Direct Tax proposals

- New Income Tax Bill to be announced next week

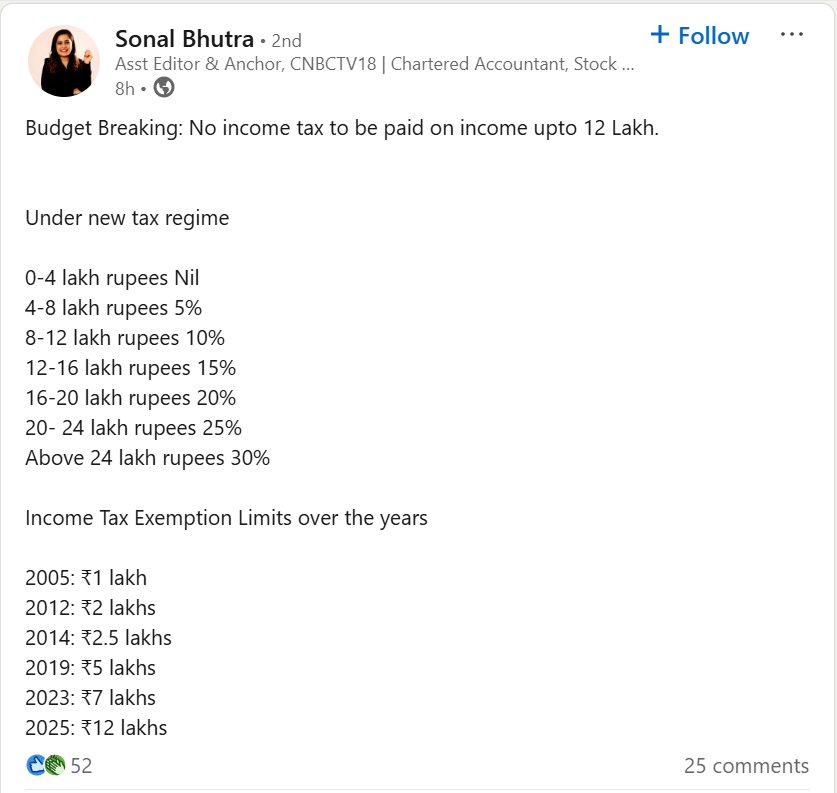

- New tax regime in 2025-26: No tax on income up to ₹12 lakh (excluding capital gains/special income) under the new regime. This results in a total saving of ₹1,10,000 for taxpayers earning ₹24 lakh. The measure benefits the middle class, leading to a ₹1,00,000 crore revenue loss for the government.

- IFSC tax concessions: The sunset date for tax benefits on IFSC operations and fund relocations extended to March 31, 2030.

- TDS/TCS rationalization: The TCS limit on liberalized remittance scheme (LRS) payments increased from ₹7 lakh to ₹10 lakh.

- MSME tax benefits: Higher investment and turnover limits may impact Section 43B compliance when making payments to MSMEs.

- Amalgamation loophole closed: Prevents indefinite carry forward of losses in cases of multiple mergers.

- Extended return filing window: Updated return filing deadline extended to 4 years, making it easier for taxpayers to pay dues without scrutiny.

- Significant Economic Presence (SEP) changes: Non-resident businesses engaged solely in purchasing goods for export will no longer fall under SEP rules, aligning with tax treaties.

- Startup tax incentives: Sunset clause for tax benefits extended to 2030, supporting Make in India.

International Tax proposals

- Transfer Pricing (TP) reform: Litigation eased by considering arm’s length pricing over a 3-year block, with Safe Harbour Rules expanded.

- Presumptive taxation for non-residents: Foreign firms providing services to domestic electronics manufacturers will benefit from simplified tax compliance, boosting India’s manufacturing sector.

All in all…

Key drivers of India’s development – Agriculture, MSMEs, Investments, and Exports – have been given a strong push, with significant measures aimed at driving growth.

The budget aims to uplift the common man with middle-class incomer, women, youth, and farmers.

The overarching theme of this budget is People, Economy, and Innovation, with substantial investments allocated towards infrastructure, entrepreneurship, technology, and healthcare – ensuring India’s economic momentum continues on a high-growth trajectory.

Overall impact

These measures aim to simplify tax compliance, reduce litigation, and enhance savings for the middle class.

The CBDT has also released FAQs to clarify tax provisions, marking a shift toward certainty and transparency.

With fiscal deficit reduced to 4.4% of GDP (from 4.9% in FY25 and 5.6% in FY24), India strengthens its economic position and investment climate, both domestically and globally.