-

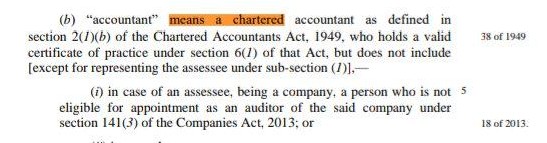

The Income-Tax Bill, 2025, defines “accountant” only as a Chartered Accountant.

-

CMAs and CSs tried and failed to get included.

-

Parliament backed ICAI, supported by EY’s analysis and NFRA’s opinion.

-

If passed, the rule will apply from April 1, 2026, and CAs will continue to dominate tax audit rights.

What is the Income-Tax Bill, 2025?

The Income-Tax Bill, 2025, is the government’s effort to completely overhaul the Income Tax Act, 1961, which has been in force for over 60 years. The aim is to:

-

Modernise India’s tax framework

-

Make laws more streamlined, digitally compatible, and compliance-friendly

-

Align with global best practices and India’s fast-changing economy

The draft version of this bill was first introduced in early 2024, and it’s still under parliamentary review as of mid-2025.

One of the most controversial clauses?

Clause 515(3)(b), which locks in CAs as the only professionals who can conduct tax audits.

- ICMAI (Cost Accountants’ body)

- ICSI (Company Secretaries’ body)

- Tax audit certifications

- Compliance validations

- Governance reviews

How did Parliament respond?

To resolve the turf battle, the Lok Sabha panel led by Jay Panda did something unusual.

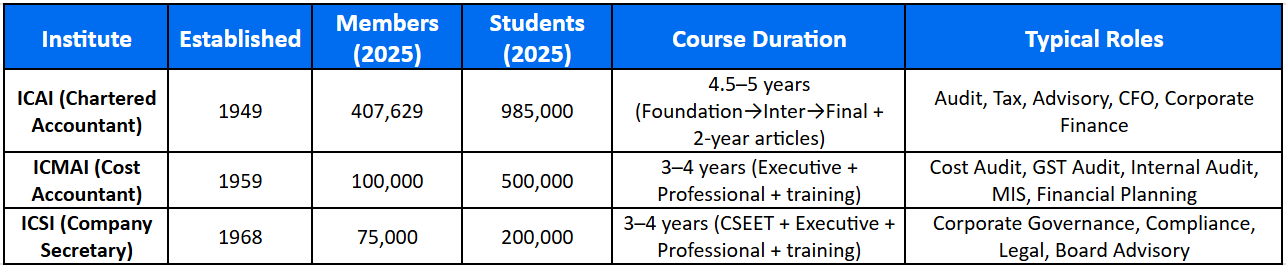

Big 4 firm Ernst & Young (EY) was to “study and compare the syllabus and expertise” of all three institutes: ICAI, ICMAI, and ICSI.

What did EY say?

The report hasn’t been made public.

But multiple sources suggest that EY found ICAI’s training in tax, audit, and compliance to be the most comprehensive.

As a result, the committee decided to retain the CA-only definition in Clause 515(3)(b).

In short:

- No change from the old Income-tax Act

- No role for CMAs or CSs in tax audits

- ICAI retains its monopoly on tax audit powers

Also read: This Company Secretary from India started his career from scratch in the UAE

NFRA backs ICAI!

Despite past clashes, NFRA believes ICAI’s curriculum includes advanced modules on tax, audit, and forensic investigation, as per ETCFO.

CAs are seen as meeting international standards for statutory audits, and involving other professionals might “fragment the audit ecosystem” and complicate oversight.

FAQs

Q1: Who is currently allowed to conduct tax audits in India?

A: Only Chartered Accountants (CAs) are legally authorized to conduct tax audits and sign tax audit reports under the Income Tax Act, 1961.

Q2: Can Cost Accountants (CMAs) or Company Secretaries (CSs) conduct tax audits?

A: No. Neither CMAs nor CSs have the legal authority to conduct tax audits or sign tax audit reports as per current laws and the draft Income-Tax Bill, 2023.

Q3: What is the Income-Tax Bill, 2023?

A: It is a draft legislation aimed at overhauling the Income Tax Act, 1961. Among other changes, it defines “accountant” for tax audits exclusively as Chartered Accountants.

Q4: Why were CMAs and CSs excluded from the right to conduct tax audits?

A: The Lok Sabha Select Committee, after reviewing objections and a comparative syllabus study by EY, decided that only CAs have the necessary specialized training in tax law, audit, and compliance.

Q5: Has there been any official confirmation on this?

A: Yes. On July 21, 2025, the Lok Sabha Select Committee finalized its recommendation to retain the exclusive right for CAs to conduct tax audits.

Q6: Can this decision change in the future?

A: Changes can happen if the Parliament amends the law, but as of now, the draft bill and committee recommendations firmly restrict tax audit rights to Chartered Accountants.

Q7: When will these rules come into effect?

A: The provisions are expected to become effective from April 1, 2026, if the Income-Tax Bill, 2023, is enacted as proposed.

Q8: What role did Ernst & Young (EY) play in this process?

A: EY conducted a confidential comparative study of the education and training curricula of CAs, CMAs, and CSs to help the Lok Sabha Select Committee decide who should be authorized to conduct tax audits.