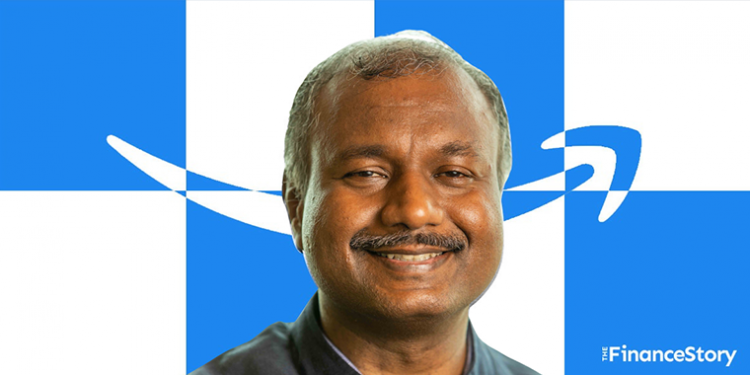

- Hi, I am Raghava Rao, a Computer Science Engineer who transitioned into the world of finance, eventually becoming the CFO at Amazon India.

- In an era of shifting companies every few years, I stayed with Hindustan Unilever Limited for nearly 20 years.

- I joined Amazon India in 2014, just after it launched its e-commerce business with a small core team.

- Since then, Amazon India has scaled rapidly, and I am lucky to be a part of the leadership team.

Navigating from engineering to finance

We were a middle-class South Indian family.

My parents passed on basic middle-class values to me as a child, “Study hard, and do well academically.” This was the foundation for long-term success. In this case, success included getting a good corporate job.

Along the way, my father set a career goal for me, that I should pursue Engineering.

(For many people in my generation, our parents played a key role in the decision-making of our careers!)

Since I was good at my studies, I was encouraged to aim for the Indian Institutes of Technology (IIT), a premier Engineering college in India. And I successfully got into IIT Bombay for majoring in Computer Science & Engineering.

Somewhere in the third year (1991), I realized that I wasn’t too interested in getting deep into technology or computer science.

This was the year when economic liberalization took place in India. Newspapers were full of articles covering the foreign exchange crisis, and the subsequent opportunity unlocked by the same.

As someone interested in business and management roles, I thought, “Why don’t I go for an MBA?”

I got selected at IIM Calcutta, again a premier MBA School in India. It taught me about business, marketing, management, and most importantly finance. I also learned to work alongside a group of talented and ambitious peers.

An internship is an essential part of the first year’s MBA curriculum. I was lucky to have gotten the opportunity at Hindustan Unilever Limited (HUL).

The supply chain project that I worked on during my internship impressed me. And that is when I set a goal: “This is the kind of company that I would want to work for!”

And guess what? They offered me a job post-MBA and thus my corporate journey started in 1994.

Two decades with HUL… Taking up eight different roles.

My first role at HUL was as a Commercial Manager at their Foods Factory division at Bareilly.

I recall one of my line managers, whom I worked with in the early years. His grasp over the entire business, and as a finance person his ability to steer the business in the right direction inspired me.

Most of all, it was the way he cared for people authentically.

For somebody fairly junior in the organization, to be able to work under the stewardship of such tall leaders influenced me deeply.

In my 20 years with HUL, I worked in eight different roles across different geographies and teams.

The width of functions that I looked after is quite broad. I handled negotiations with vendors, planned transportation and logistics, and worked with the sales and marketing team among others. I’ve worked in both a small and a large factory.

I was promoted to Head of Finance for a joint venture company called Kimberly-Clark Lever, in 2002.

Fast forward to 2006, I became the Executive Assistant to the CEO of Hindustan Unilever Ltd and GVP Unilever South Asia.

The next stop for me was Singapore.

I became the Finance Director at the largest product category division for Unilever in Asia & Africa. Working with a multicultural team was a tremendous learning opportunity for me.

After three years I returned to Mumbai, India, and spearheaded the Treasury and M&A division.

When you take up roles one after the other, each role builds on the foundation of the previous roles and the process continues. That’s what happened to me at HUL.

20 years and not a moment of boredom! It was a journey worth cherishing.

Becoming the CFO of Amazon India

By 2014, I was in search of shifting to an industry that lies at the center of the digital era.

An opportunity came knocking at my door, to be a Financial Director at Amazon India. How did I decide if it was the right move for me?

One value that was common in both my current and prospective organizations was their ‘focus on the consumer.’

Both of them were highly meritocratic, multinational organizations and taught me the importance of operating through influence and not necessarily direct control.

The differentiating factors for these two were risk appetite and how fast they were moving.

For Amazon, the risk appetite is quite high. They move quickly, fail quickly, recognize their mistakes quickly, and adapt to their new direction.

Amazon has been inventing and fearlessly exploring the places traditional businesses haven’t gone before.

I made the transition to Amazon India, in 2014 and joined a small team. It was very much like a traditional startup but we grew astonishingly fast.

Eight years went by and I became the CFO or you could say Finance Partner to the business leaders that are looking over each of Amazon India’s verticals.

Very recently I have been appointed as Head of Finance for the Emerging Markets of Amazon.

How do I switch to finance after engineering?

Chartered Accountants and Engineers start their journey from different directions.

Irrespective of your background, if you want to be a CFO, you need to be good with numbers, and analysis (which you could argue that engineers are already good at).

You need to also be good at understanding the technical aspects of financial accounting, taxation, corporate law, or governance. I think in this area, CAs have an advantage over engineers.

Ultimately, when you become a financial leader, it is Irrelevant whether you started your journey as a CA or an engineer.

You need to understand other functions of the business such as,

- Marketing

- Technology

- What the core business is

- Who is the customer

- What is your product or service

- Who is your competition

- What is happening in the world of compliance, geopolitics, and economics

So I would say what’s important is, learning the relevant skills as you climb up the ladder. And when both of you reach senior-level positions in an organization, you need to adopt a long-term perspective or strategy.

What makes a good CFO

If you want to be a successful CFO, you need to understand the business well, It is non-negotiable.

Some organizations call it ‘understanding the business’, and some call it ‘understanding how you serve a customer’ they both mean the same thing.

Interpersonal skill: Working and collaborating with different people, and learning to lead them is the backbone of the CFO role. You need to inspire people, earn their trust, give constructive feedback, set a vision, provide solutions, and help your team grow.

And all of these wouldn’t be possible without strong interpersonal skills.

Reflect on these questions:

- How do you handle differences of opinion?

- How do you disagree with somebody logically?

- How do you negotiate?

- How do you handle disappointment?

- How do you react when you’ve made a mistake or failed?

- How do you manage your time?

- What kind of brand or personality are you building?

One way to learn these skills is by observing people who are more experienced than you are. That’s what I did. But you have to be patient.

It won’t happen overnight, it’s a long journey.

Power of Prioritization: We might find ourselves in a situation where the number of working hours is limited, but your list of tasks is huge. In that case, clear your head and figure out a plan for the next day, week, or month, based on what is on priority.

Apart from keeping these skillsets in mind, I read books, maybe a newspaper article or something every day to keep myself updated.

There are no shortcuts to success

To quote Jeff Bezos, “I knew that if I failed I wouldn’t regret that, but I knew the one thing I might regret is not trying.”

When you’re young, and at the early stage of your career, do things that might not work out. The advantage of being young is that even if things don’t work out, the experience will make you much stronger.

Never be afraid of failure and think of life as a long learning journey.

Do I regret anything?

Not really, but if I could go back in time and do something differently I would become an entrepreneur. Let’s hope this part of the journey lies ahead for me.

I would also love to be a finance partner to the sales team of an organization, it’s something that I have not done in my career yet.

I would also love to be a teacher, maybe I would become an author at some point in time if fate allows it.

Looking to accelerate your career in finance? Fill up this form to talk to an industry expert