-

You might think, “India’s booming! Auditors must be rolling in cash, right?💸

-

Well, well, well… NOT QUITE!

-

Indian audit industry is facing a major challenge as audit fees remain stagnant!

- Increasingly difficult for firms to attract top talent and invest in the latest technology.

Stagnant Audit Fee dilemma in India

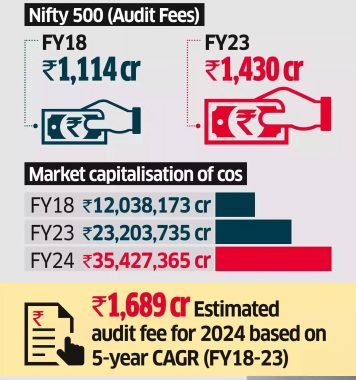

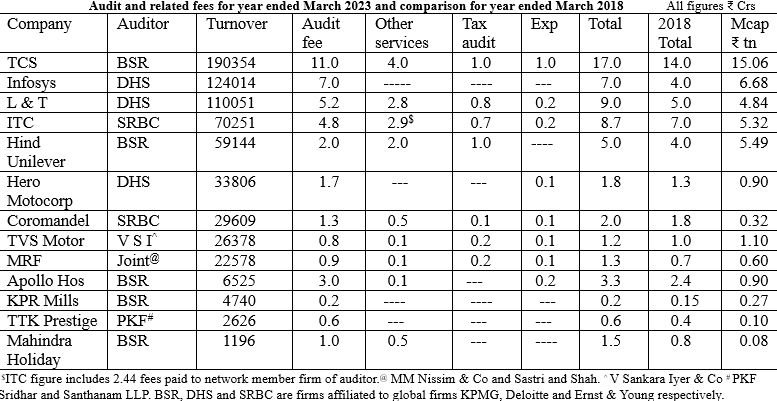

Audit fees in India have “barely” increased in real terms over the past five years.

Now let’s compare the audit fee landscape:

- UK (FTSE 100 Companies): Audit fees increased by 75% between 2018 and 2023 (CAGR: 11.82%).

- India (Nifty 500 Companies): Fees rose by just 28% over the same period. Indian auditors, despite facing similar (or even greater) complexities, struggle with under-compensation.

As per Financial Express BFSI, the audit fees collected by three of the top five audit firms in India have seen only marginal growth between FY19 and FY24.

According to data provided by Prime Database,

- India’s Market capitalisation (total value of company shares) grew by 92.75%.

- Net sales (revenue from selling goods/services) rose by 83.7%.

- Profit after tax (PAT) increased by 126.2%.

Top audit firms’ revenue growth (FY19-FY24)

In FY24, firms like EY, Deloitte, PwC, and KPMG saw significant growth in revenues and most of it came from Consulting/advisory!

- EY: Revenue grew 16-17% to ₹13,400 crore.

- Deloitte: Revenue surged 29% to ₹10,000 crore.

- PwC: Revenue increased 22% to ₹9,200 crore.

- KPMG: Saw a respectable increase in revenue by 5-10%

As per the Economic Times,

- EY Group’s income from audit services increased from ₹129.95 crore in FY19 to ₹153.78 crore in FY24, reflecting a CAGR of just 3.4%.

- Similarly, KPMG Group registered a CAGR of 3.6% in audit fee growth over the same period.

- On the other hand, firms like PwC and Deloitte have shown higher growth in audit fees, but this growth comes from a much smaller base.

While the FY24 data includes 1,049 companies, compared to 1,557 companies in FY19 (due to delays in reporting), the sample still represents most of India’s top 500 companies.

NFRA chairman Ajay Bhushan Pandey

As reported by ET, NFRA chairman Ajay Bhushan Pandey stated that –

- Despite working under intense pressure, Indian auditors receive inadequate compensation.

- He remarked that several companies are listed on the NYSE and the Indian stock exchange, and there was a significant difference in audit fees received by auditors abroad compared to those in India, despite the tasks being essentially the same.

Risks of prioritising low audit fees

Audit Committees and CFOs play a pivotal role in this fee conundrum.

One of the biggest challenges is the reluctance of Indian companies to pay a premium for quality audits.

However, lower fees lead to…

- Long-term risk management: Poor-quality audits can expose companies to compliance risks and reputational damage.

- Inadequate reporting: A low-cost approach may compromise the depth and accuracy of audits.

- Increased risks: Poor audits expose companies to regulatory penalties and reputational damage.

Instead of simply picking the lowest bidder, companies must prioritise Firms with sector expertise and robust processes.

As Sanjeev Krishan, Chairperson of PwC India, told ET, “Trust underpins all organisational actions leading to larger outcomes – it should command a premium.”

Challenges audit firms are facing

Indian auditors are now caught in a tough spot because of this.

1. Rising complexity

- Business operations have become increasingly intricate, with cross-border transactions, sophisticated financial instruments, and evolving ESG requirements.

- Regulatory oversight has grown sharper, making audits riskier and more demanding.

2. Talent crunch

- With stagnant fees, comes the consequences of losing skilled auditors.

- Without competitive pay, firms are unable to attract top talent.

- They are turning to global markets or other roles such as consulting, or finance.

3. Audit rotation rules

- Mandatory audit rotation every five years keeps fees competitive but adds pressure to win contracts through aggressive pricing, which hurts margins.

4. Cost pressures from technology

- Clients demand tech-enabled efficiency, but investing in technology – like advanced data analytics tools – requires significant upfront costs.

- But how would the firm achieve it? Low fees limit investment in cutting-edge technology and robust quality assurance processes.

Wrapping up

As per Financial Express, it was mentioned that – Several experts said that company managements usually pick up the lowest bidder without assessing the quality of services that are being offered!

At the end of the day, this fee structure reflects how Auditors and the importance of Audit are being viewed by companies!

In 2024, the Institute of Chartered Accountants of India (ICAI) put forward guidelines for audit fees. However, those were merely recommendations rather than mandatory rules.

Source: ET and Financial Express

An insightful read—balancing rising costs and stagnant fees is a critical challenge for auditors, highlighting the need for innovation and value-driven strategies.

But bhai Indian hi kanjoos hai sab, I know CAs in tier 2-3 cities jo aise hi audit report sign karte hai foe 7k-10k fees.

Isko dekh ke students bhi demotivate hote hai.