- Thousands of young finance professionals share one goal: joining the Big 4 accounting and consulting firms—PwC, Deloitte, EY, and KPMG.

- These firms offer the opportunity to learn, grow, and excel in a prestigious corporate environment.

- Over the years, the Big 4 in India has provided thousands of professionals with fair compensation and good career opportunities.

- However, their excessive hiring spree has raised concerns amongst their employees, especially the younger lot.

- Let’s have a look.

Hiring Peaked in 2022 and 2023

In the financial year 2021-22, the Big 4 and their subsidiaries in India added around 55,000 new jobs, bringing the total number of employees to over 210,000 in both tech and non-tech roles.

Over the past 12 months, they have taken it up a notch…There has been a talent poaching spree going on in the Big 4 realm.

PwC

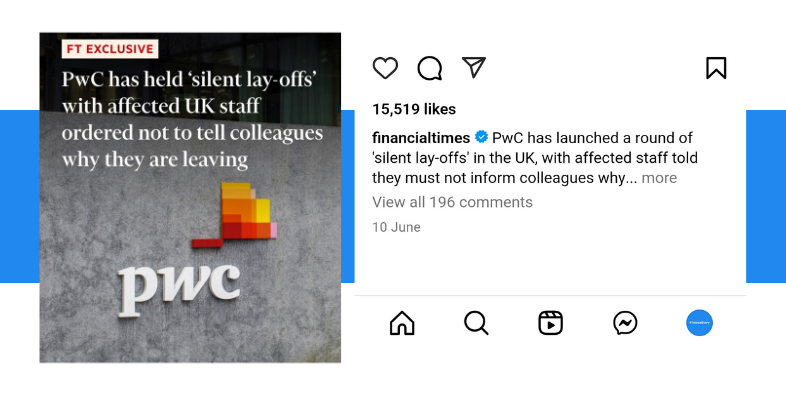

In 2023, PwC embarked on a hiring spree across Pan India, especially in advisory. This hiring spree was linked to their 150th-anniversary celebration in India and an ambition to acquire market share.

Their strategy involved competitive acquisition of Partners and teams from other Big 4 firms.

PwC India poached 15-20 Partners from KPMG.

THis move led the partners to bring their entire teams along, totalling over 150 executives in the ESG and technology risk consulting groups, according to industry insiders.

Deloitte

Deloitte is keen to dominate the consulting space and lured 150 members, including 15-20 Partners, from KPMG to its tax division.

KPMG’s Indirect Tax team also moved to Deloitte India.

It included Big names from KPMG that moved to Deloitte.

KPMG

KPMG has seen a lot of its team being poached!

However, KPMG actively pursued 17–18 Deloitte Partners and their teams from the rival’s corporate investigation and risk departments.

EY

EY India is one of the few market leaders that has a loyal team of Partners.

According to the Economic Times, the firm has opted for a more selective approach to hiring.

Here the issue arises…Unstructured Hiring and Benching

But you will be surprised that most (not all) of the Big 4s are facing benching issues – the reasons could be numerous:

- Over-hiring

- Slowdown

- Competition

- The client prefers firms outside the Big 4.

As confirmed by sources more than 1000 mid-level professionals (consultants, assistant managers, and some managers) are being left on the bench without deployment on active projects.

By the year’s end (2023), the number of benched employees has dropped but it is still significant.

This resulted in their employees lacking clear career paths and defined goals, with many even resigning.

Focus on aggressive growth and lack of deployment have surely led to frustration among employees.

FYI: Benching refers to the practice where employees, particularly in consulting and IT firms, are not assigned to any active projects or client work. Instead, they remain on the “bench,” waiting for new projects to come in.

Insider Perspectives

Without taking any names… we spoke to people from the Big 4s and here is what they have to say:

A person familiar with the firm told The Finance Story,

“To be honest, while working at EY India, I was actively deployed on 4 to 5 projects. But at this firm, the number dropped to 1 or 2.

My utilization could have been doubled, but they were not deploying me on an adequate number of projects.”

Another person said,

“This Big 4 is using the outsourcing model to expand its business. They are focusing on global companies and providing them with outsourced resources.

Their main goal is to grow their practice and achieve high numbers.

However, it is important to note that while Directors and higher-level employees benefit from this arrangement, managers and lower-level employees are simply being used as resources.

They do not have a clear career path or defined goals, which is not a sustainable practice in the long run.”

Another one added, “2-3 years ago, or even before COVID-19, no one could have imagined that Big 4 life would be so chill with no deployment on projects.”

Also read: Big 4 firms scramble to win the consulting race. Investing over $4B in AI.

Let’s talk about Appraisal

Deloitte

Deloitte follows the Indian financial year cycle from April to March, and they normally declare in May. Their yearly appraisals were announced in June 2024.

Based on market revenue, Deloitte is the leader, and annual appraisals were expected to be good. However, they weren’t as promising as it was expected…Not bad but surely not great.

For promotion cases, appraisals were between 18% to 22%, and bonuses were 20%. For promotion cases, the range of the appraisal did not even reach 25%.

Non-promotion cases saw appraisals ranging from 8% to 15%, with bonuses around 17-18%.

KPMG

KPMG followed the same cycle as Deloitte and provided great appraisals in the first week of April.

A yearly appraisal of 20-25% was announced.

Some mid-level professionals were promoted without substantial project utilization. These changes hint at potential improvements for KPMG in the next 1-2 years.

EY

EY generally follows July to June with the fiscal year-end in June (the appraisal process runs between July to September).

They declare mid-year appraisals and promotions in April, with their regular cycle ending in October.

EY’s mid-year appraisals were good, amounting to 8-10%, and annual appraisals due in October are expected to be 10-15%.

PwC

PwC follows the same cycle as Deloitte. The annual performance reviews are typically announced by the end of April. This year it was in May and it was not a satisfactory appraisal!

Yearly appraisals were okayish again. Many said the previous year appraisals were better.

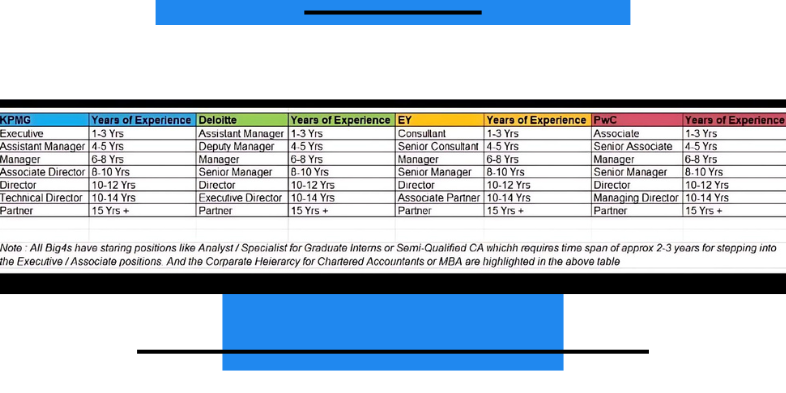

Also read: Big 4 firms in India: Inside Deloitte, PwC, EY & KPMG career prospects, growth and salaries

Final Thoughts

This year has been tough for the consulting realm, across all the Big 4s…And employees are upset!

These numbers reflect all practices, including taxation, advisory, and statutory audits.

The focus on aggressive market expansion and outsourcing models, combined with performance-based terminations, has raised concerns among employees.

To maintain its reputation and provide meaningful opportunities, the Big 4 must address these challenges by ensuring structured hiring and offering clear career paths and goals for employees.