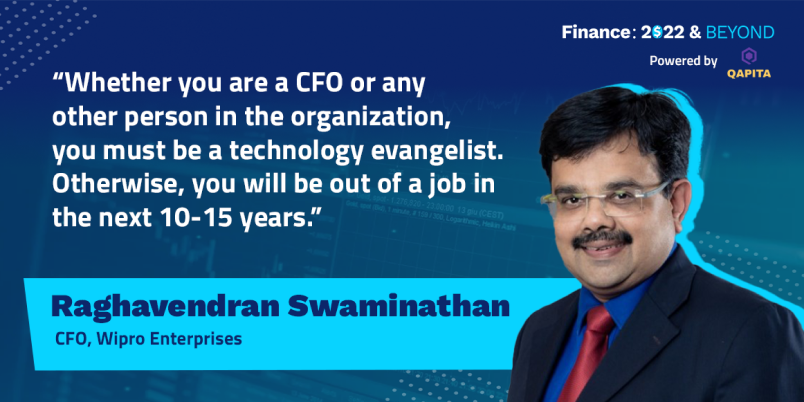

As part of our Finance: 2022 and Beyond series, powered by Qapita – CapTable and ESOP Management Platform, we spoke with Raghavendran Swaminathan, the CFO of Wipro Enterprises.

A qualified chartered accountant, he provides insights into his 18-year-long career at Wipro, the evolving role of the CFO, the buzz in the startup scene, and how the 2022 great resignation wave will affect the industry.

Edited excerpts from the interview:

18 years at Wipro Enterprises is a long time… Can you highlight what helped you build this long career?

I did not plan, but when I look back, I just followed my gut, and everything sort of fell into place.

If I were to guide people on how to climb their way to the top, I would say, the following steps are important.

Perform all core finance functions, such as treasury, taxation, controllership, FP&A, audit, etc. That, fortunately, happened to me.

But if I look at it, that is a great way to just broad base your career into five, seven, or eight functions.

Take up a couple of roles that fall outside the category of core finance functions. It could be dealing and engaging with customers, handling multiple clients, and other business-oriented functions.

The reason I say this is because when I came onto the IT side of the business, IT was just taking off (around 2004-05).

We were talking of outsourcing deals; big $150,000,000 deals.

Based on the experience, I was able to navigate myself in driving these $100 million, and $200 million clients because you have to be comfortable speaking with them, understanding their code architecture, and what Wipro could bring to the table.

Then comes your ability to communicate with your team. Make sure you convey your message precisely – both in a written format and verbally.

The C-suite requires simplifying concepts. Keep this as a mantra from early on.

Work for people who you believe can add value. Experiment with different managers.

This may sound clichéd but what is also important is that people should be working for their manager, not the organization.

You are a leader in a global company that has 40 plus brands and over 400 clients. But this world is also moving into Web 3.0, and an influencer narrative. How do you keep yourself contemporary, yet remain practical?

Anybody can be an expert on anything just by reading stuff on the Internet. I read a lot too.

My morning typically starts as soon as I wake up. I spend 15-20 minutes going through my Twitter feed.

But how you read and what you read is fundamentally what I call a catchment area.

It is important to review what you read for yourself; how relevant they are. Then you reflect and internalize it a bit more.

You go through the process of sifting all that information and using whatever is necessary for yourself and your organization. That to me is the complete cycle of how leaders should operate in a world where things are changing rapidly.

If you are not well-read, you are going to face the challenge of really taking back knowledge to the organization.

One of the things, we do at Wipro is a benchmark with the competition.

So, for example, if I am in my FMCG business, I probably covered all the analysts one on one over the quarter.

What’s actually happening? What is this company doing? What are they driving on?

So you start to kind of assimilate stuff and then two or three things which you think make sense when you go and basically kind of deep dive and figure out.

Check with stakeholders. I keep checking with the CFO of FMCG companies or industrial companies on how they manage to do what they do. Competitive advantage may be good, but it is also easily replicable.

You must be very curious and interested in what’s going on – in your field of interest, and your industry.

Do you rely on your CIO or CTO when it comes to technological advancements? What is your role in digital transformation and the discussions surrounding it?

Whether you are a CFO or any other person in the organization, you must be a technology evangelist. Else you are not going to be relevant to the organization you work for.

May sound harsh but you will be out of a job in the next 10-15 years

So, the question is, how does one become a technology evangelist?

Be curious

- My CIO might come back and say, “I want to take it to Cloud, or maybe try these five things.”

- But how you as a CFO take and narrate that story in a very simplistic form to your board/stakeholders makes a big difference.

- I think the role of the leadership, especially for a CFO, is translating that to the board, translating that to internal stakeholders.

- Read up on all the latest emerging technologies such as blockchain, AI, crypto, cloud computing, etc; here curiosity helps.

Be mindful

- Recently, we at Wipro Enterprises have been leading the biggest sales transformation globally.

- While speaking with consultants, I have noticed that one should not just adopt new technologies for their organization just to be a part of the trend.

- Figure out what is truly relevant to the task at hand and then make the decision. The set context for yourself.

Change management

- Don’t underestimate the role of change management.

- You can have the best technology, but if change management is not embedded in the DNA of the organization, it is going to be a failure because while you may have spent on the technology, you are still ruled by the old ways. Nothing would move forward.

Reverse mentoring

- Have your younger employees mentor you. You are not always the expert in the room.

- Be humble and ask questions on matters you know nothing about. It is called reverse mentoring, which has proven to be beneficial for me as well.

There is a buzz in the startup ecosystem in India with new unicorns. Will the huge influx of funds continue and the startup boom last?

Startups have become the buzzword in India. With so many unicorns emerging, a lot of people are getting inspired to start something of their own.

But they need to know one thing; nine out of 10 startups will fail. I do not want to discourage anyone but that is the bitter truth.

Still, if people want to experience the high of building something from scratch, then why not?

And if you manage to clock decent revenue, it is even better.

While it is truly hard work that matters the most, being in the right place at the right time also plays a huge role.

Now let’s talk about the increase in foreign investments in Indian startups.

Do you know one of the reasons why the US has been showering Indian startups with huge funds? If you have been following the activities of The Federal Reserve System, the central banking system of the US you would know.

Because of its low-interest rate regime, it was easier for others to borrow money and invest in these startups. If the startup becomes successful then it is easy money.

Currently, however, as the inflation rate has been running at about 7-8 percent, the Fed has started to increase interest rates.

This will cause a decline in funds from the US, but it is not going to stop altogether.

Having said that, I am excited about the fast-growing Indian startup ecosystem and what it would mean for the Indian economy.

In my traditional M&A, I would be looking at the discounted cash flow over how much cash I am making.

I am a big cash person. If you don’t have cash, you don’t get an opportunity to make it. But startups changed that for me.

I had to relearn, rethink and assess. How do I value a company which is going to bleed cash for the next three years, five years?

That is a rewiring that happened to me. And today I have a framework of how I can do that. I will look at what I call proxy indicators.

There are a lot of reports on the ‘Great resignation of 2022″ where a lot of people don’t want to come back to work in physical offices. How do you view this?

Firstly, we must understand what the driving factors of the “great resignation” are.

Around 10-15 years ago, life was predictable; people went to college, obtained a degree, found a job, and from thereon they just worked until they were 60.

Back then, people did not even care that much about their mental health or their passion besides their day job.

Now, they want to have a flexible work-life balance for the sake of their mental health, they want to pursue their passion besides their work.

Receiving a big paycheck is not the motivating factor anymore, for some people at least.

And I believe when Covid-19 struck it was sort of a wake-up call.

People are reviewing their life choices in terms of what they want to do. It is getting translated into the second axiom around it – flexibility.

Eighty percent of India is poor – a student coming from a middle-class family does not have the luxury to drop out of school to pursue a passion that is not related to academics.

So far, the great resignation has not become a reality in India, at least for now.

I feel the remote working and hybrid working model could surely put an end to the great resignation, but that is just one part of it.

What is your message to those who want to upskill themselves?

Start picking on things you want to learn, and pencil them in.

Once you have clarity, and they seem relevant to your job, try to understand them better. Then figure out whether you want to do an online course, meet people of the same interest, connect to experts on LinkedIn, or talk to your peer group or your friends.

Start building up on what is relevant for your job as you start.

Don’t give yourself unreasonable deadlines like, “In the next six months, I want to be an expert in these seven areas.” Pick two, or three things, deep dive and you would be okay with those.

What are the trends CFOs should watch out for in 2022?

I think regulations around privacy, and digital is something one should look at.

There is going to be more B2C, so understand regulations well, as this will impact your business.

The rate of change in your organization must be greater than or equal to the rate of change outside. How do you measure this for yourself in context to the business that you are operating under?

You have to disrupt yourself faster than what is happening in the marketplace and for that, like a CFO, you need to understand that dynamic very well.