- EY has delayed the start dates for about 200 new graduate hires in its EY-Parthenon strategy consulting arm.

- Their joining is now pushed from this fall to mid-2025.

- This is the second year in a row EY has delayed start dates.

To give context – What is Big 4 Management Consulting?

The Big 4’s has various teams providing consulting BUT strategy consulting services are most closely aligned with the services of McKinsey, BCG, and Bain.

The majority of the Big 4’s strategy units originated through the acquisition of boutique consulting firms:

- EY Parthenon: the result of EY’s acquisition of The Parthenon Group in 2014 (Founders are William Bill Achtmeyer and John C. Rutherford; former Bain & Company directors.)

- Monitor Deloitte: the result of Deloitte’s acquisition of Monitor

- Strategy&: the result of PWC’s acquisition of Booz & Company

- KPMG’s Global Strategy Group (GSG)

What is happening at EY Parthenon?

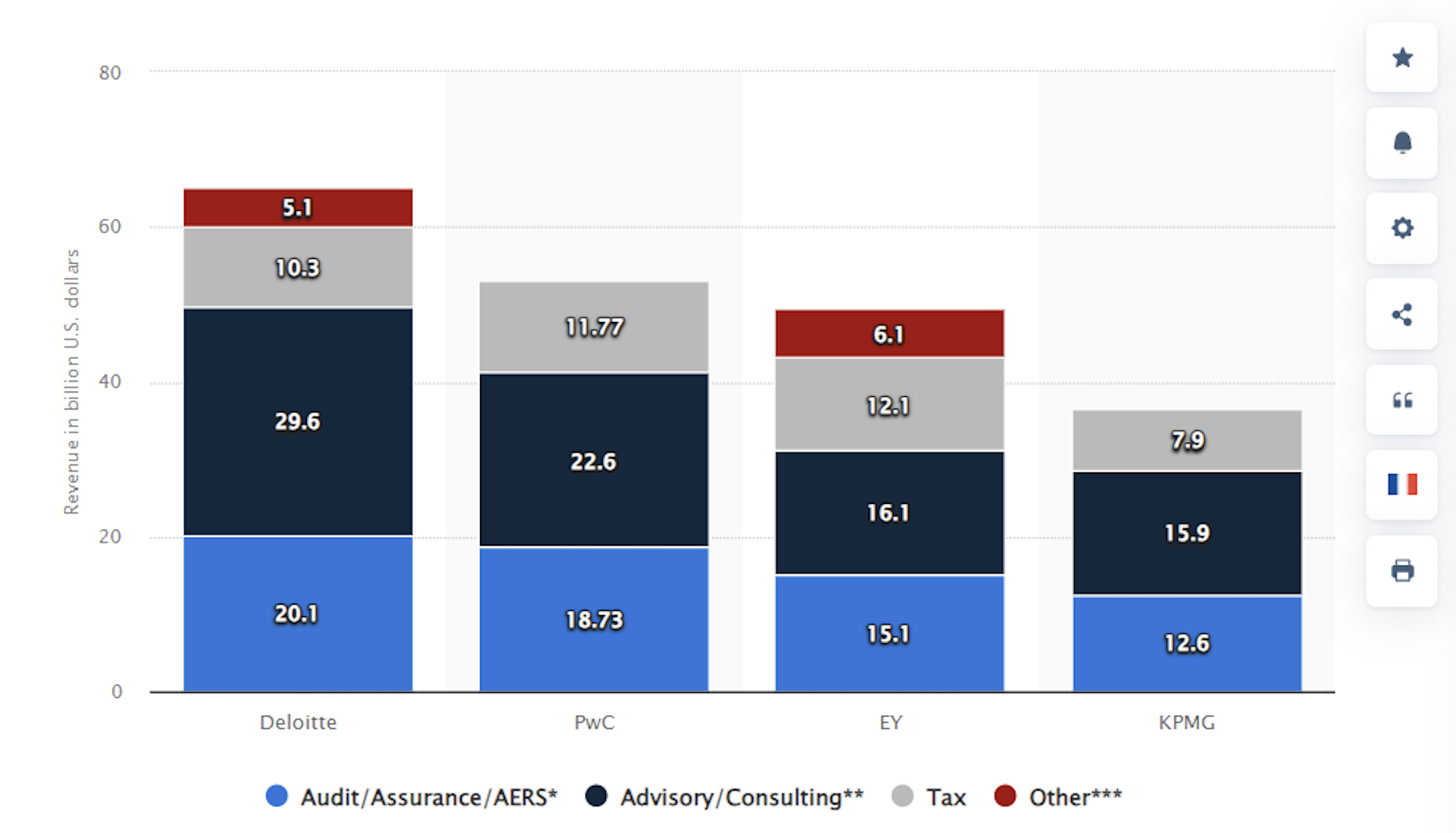

Extension of joining dates of over 200 new hires. Why?

EY-Parthenon leadership cited: Slower-than-expected growth in advisory revenue, thanks to:

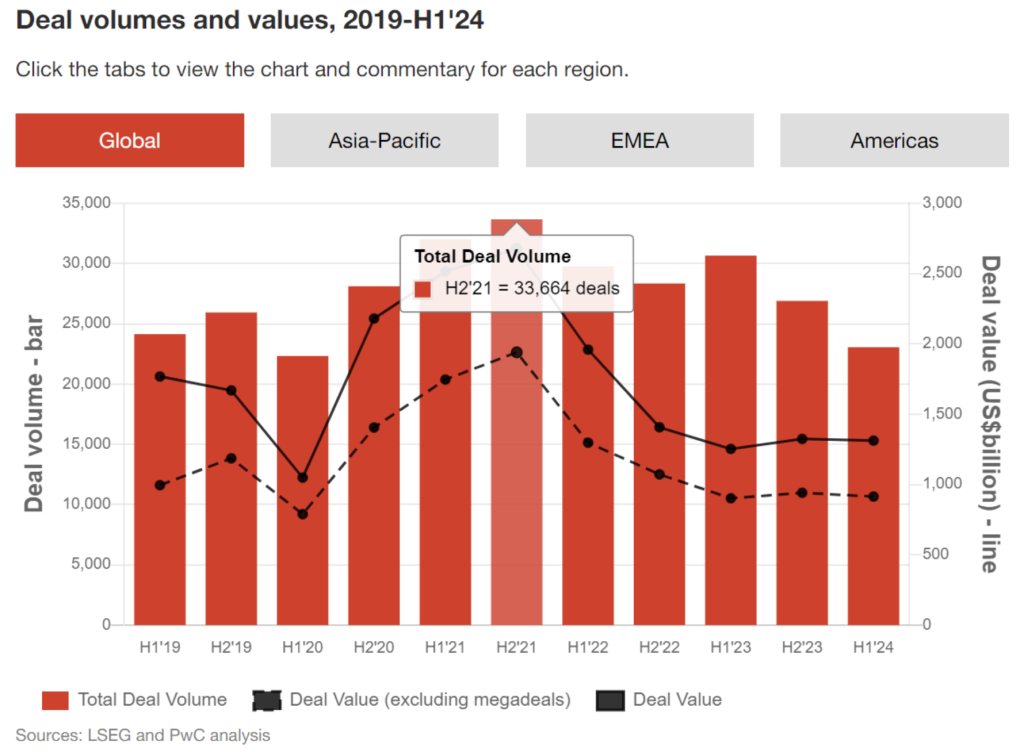

- Disappointing M&A landscape

- Slowdown in the Private equity markets

Deal numbers have dropped to a nine-year low by the end of Q3 2024.

To soften the blow

To soften the blow

- Stipends for New Hires range from $12,000 to $35,000, ensuring that recruits are not left without support during the extended waiting period.

- EY emphasized that the delay is intended to give new hires meaningful and high-quality assignments. The firm aims to ensure a stronger foundation for professional growth and career trajectory by aligning start dates with improved market conditions.

- EY has scaled back its internship program. This strategic move is designed to avoid over-hiring and better balance the firm’s workforce demand with current business needs.

What other consulting companies are delaying start dates?

As first reported by the Wall Street Journal these firms have postponed start dates for some new MBA recruits to 2024:

- McKinsey & Company

- Bain & Company

- Boston Consulting Group

Firms like EY, Deloitte, and PwC continue to recruit graduates without raising starting salaries.

The Big 4 and other leading consulting firms are maintaining flat salary levels.

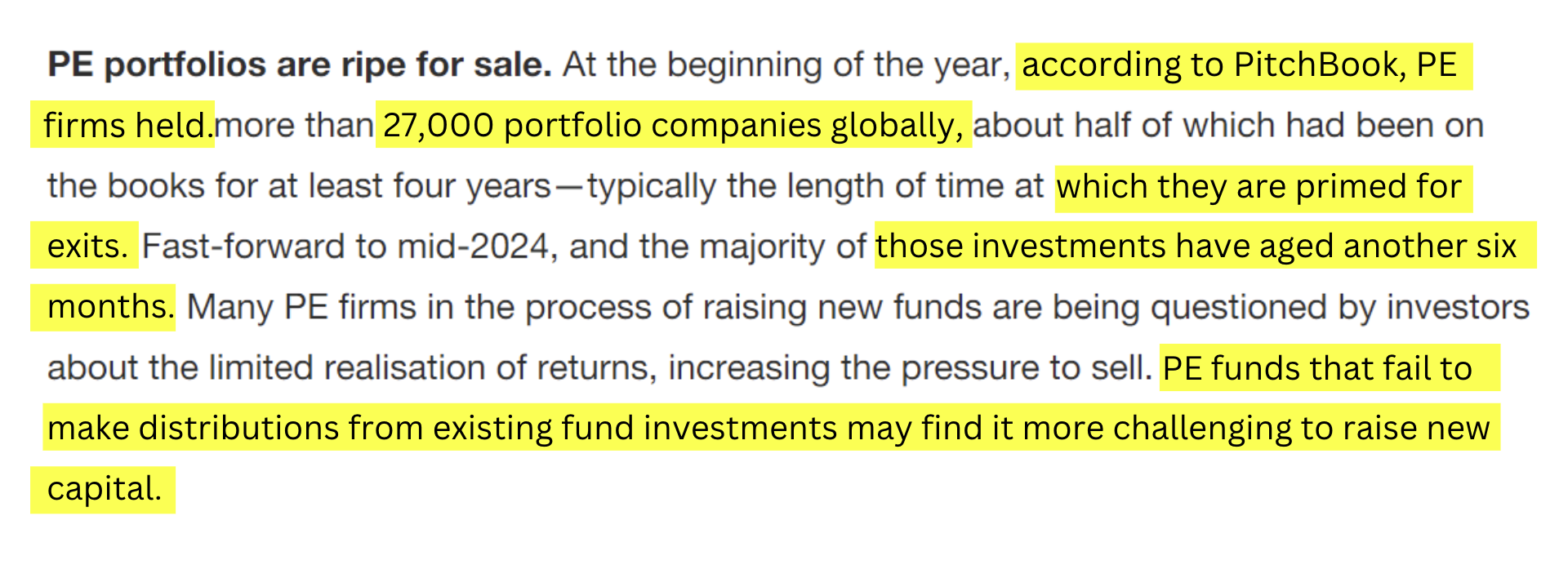

But from stats Big 4s advisory is making the most revenue?

As per Statista, the management consulting industry is valued at roughly $1 trillion worldwide, with US about one-third (374 billion U.S. dollars in 2023) of that revenue.

Now if you look at the revenues ( as per Kristian Rayner, Contingent Workforce Leader)

- Big 4 firms (EY, PwC, Deloitte, and KPMG) generated a total revenue of $200 billion in 2023. And the growth in advisory services is significant!

- Big 3 strategy consulting firms – McKinsey, Bain, and BCG – together accounted for $32 billion in revenue.

- Kristian points out that – despite these significant revenues, profit margins can be quite narrow at times due to high operational costs and market competition.

However,

- 2020, the US consulting market experienced its first revenue decline, dropping by 5%

- Significant rebound, with revenues increasing by 13% in 2021 and 14% in 2022.

- Growth slowed to 5% in 2023

With the constant fluctuations, the consulting industry is shifting to a more cautious approach to hiring, stepping back from the previous frenzy.

Will 2025 be a better year for management consultants?

Optimistic, with a potential rebound in private equity activities and market conditions improving as interest rate fluctuations stabilize.

Paul Knopp, CEO of KPMG US, told The Financial Times that he predicts a potential rebound in private equity activities as interest rate directions become clearer.

Fiona Czerniawska, CEO of Source Global Research, told The Financial Times that many firms still have strong pipelines of future work, although the realization of this work has been slower than expected.

Also read: EY called out by grieving mother: Her 26-year-old daughter overworked to death

Consulting in India…

- M&A Growth: Mergers and acquisitions (M&As) in India rose 13.8% in the first nine months of 2024, reaching $69.2 billion, up from $60.8 billion in 2023.

- Increase in Transactions: 2,301 deals were signed from January to September 2024, compared to 1,855 in the same period last year, according to Bloomberg.

- Key Drivers: The increase was driven by Indian companies and private equity (PE) firms, fueling M&A market recovery.

As per the Economic Times, these are the stats of the Big 4 management consulting sector (strategy, operations, and high-end digital advisory services):

- Strong Growth of 25-30% across all firms over the past two years.

- Big 4 firms have nearly 300 partners traditionally led by McKinsey, BCG, and Bain.

- These firms collectively employ between 5,500 and 6,000 consultants.

- Revenue Generation of Big 4 Consulting approx over ₹3,500 crores in revenue, with EY leading the pack.

Is consulting Dead?

Of course not! The industry will only expand however compiling insights from various leaders reflects a consensus on:

- Need for strategic agility in the consulting industry.

- Embrace digital transformation and AI

- Sharpen niche capabilities and expertise will be crucial for success.

- Explore New Growth Areas: Consulting firms should actively seek out emerging markets and opportunities for expansion.