- India’s digital forensics market is projected to grow from $300–350 million to $1.39 billion by 2029–30.

- Amid this surge, one segment is seeing exceptional traction: Managed Forensic Services (dominated by Big 4s), once a niche now holds a 27% market share!

- However, the industry faces a critical talent shortage of 90,000 professionals.

- As per Deloitte–DSCI report: Indian Digital Forensic Market Report 2025

Digital forensic market?

Yes, it is a ₹11,800 crore market in the making!

The global digital forensics market is growing at 11% CAGR, driven by sectors like:

- BFSI

- Government

- Healthcare

- Telecom

- Critical infrastructure

But, India’s market is speeding ahead with an impressive 40% growth rate.

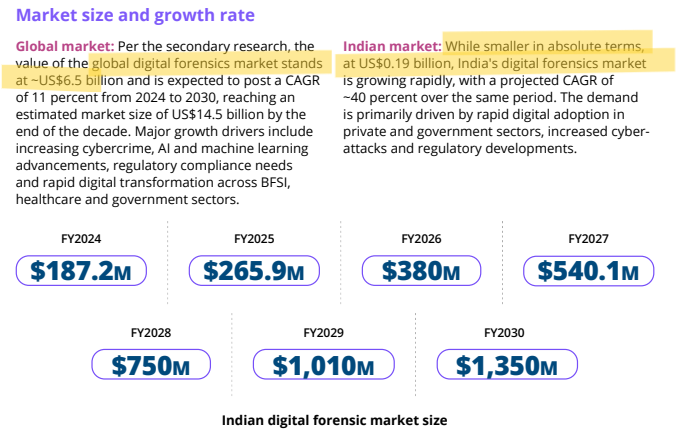

| Metric | Value |

| Current Market Size | ~$300–350 million |

| Projected FY30 Size | $1.39 billion |

| Annual Growth Rate (CAGR) | ~40% |

| Talent Gap | 90,000+ professionals |

| Dominant Customer | Government (81% share) |

| Top Segment | Mobile Forensics (51%) |

What’s driving the growth? A Cybercrime Tsunami

India is facing an unprecedented rise in cybercrime — a 5,800% increase in just five years.

-

2019: 26,049 cybercrime complaints

-

2023: Over 15.5 lakh cases

-

Jan–Apr 2024: 740,957 cases — over 7,000 incidents per day

As Deloitte’s Nikhil Bedi puts it, digital forensics has moved from a “reactive tool to a strategic capability.”

And for most organizations, outsourcing that capability via MFS is now the default.

Core Forensics Solutions

Hardware solutions

Holds a significant share of approximately 20% of the Indian digital forensics market.

Software solutions

Account for 54% of the Indian digital forensics market, covering everything from data extraction to automated evidence analysis.

Managed Forensic Services: Fastest growing

With upfront infrastructure costs becoming a barrier, more organizations are opting for Managed Forensic Services (MFS) — now accounting for 27% of the market.

These services offer:

- Incident response

- Forensic audits

- Litigation and compliance support

- Proactive breach assessments

Big 4s and global firms lead MFS today—but Indian providers and SMEs are quickly rising with faster, more affordable forensic solutions.

Discovery and data management services, predominantly provided by the Big 4 consulting firms, are emerging as a key area within the digital forensics landscape.

Also read: EY Forensics and Integrity Services introduces Learning-as-a-service for working professionals

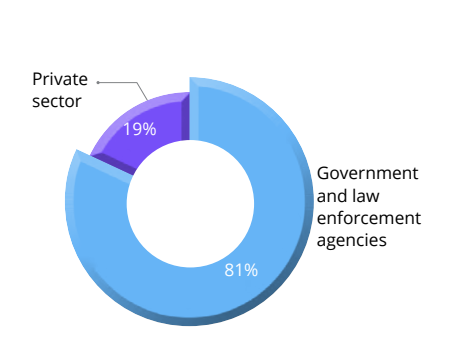

Public sector is the biggest clients

The Indian government and public agencies account for 81% of digital forensics demand, led by:

- Central investigation agencies

- State-level cybercrime units

- Regulatory and tax authorities

In contrast, private sector adoption (19%) remains low due to:

- High costs of tooling

- Limited in-house capacity

- Reliance on outsourced forensic service providers rather than building in-house teams

Healthcare and manufacturing are emerging fast, especially with the digitization of patient records and Industry 4.0 initiatives.

How big is India’s Digital Forensics market?

| Region | Share | Key Drivers |

| West India | 32% | BFSI & enterprise demand (Mumbai, Pune) |

| South India | 30% | Tech hubs (Bengaluru, Hyderabad) |

| North India | 28% | Central agencies, NCR-led demand |

| East India | 10% | Emerging adoption zone |

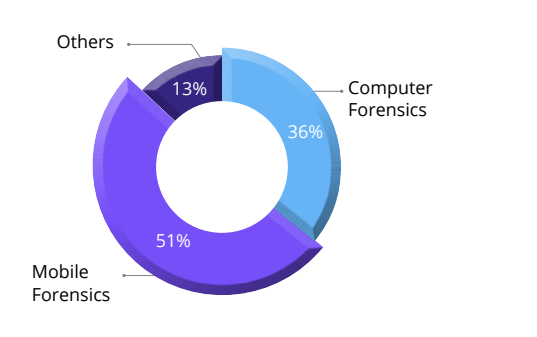

Core domains

Computer forensics focus with a 36% market share.

Mobile forensics accounts for 51% of the total market: With over 750 million smartphone users and one of the fastest-growing digital payments ecosystems, India has seen mobile devices become key evidence sources.

Others 13% include Cloud forensics, IoT forensics, network forensics and cryptocurrency forensics, which are steadily gaining focus.

- Network forensics is expected to have a significant market share in the future.

- Cloud forensics is becoming increasingly relevant for investigating cyber incidents in remote working models and cloud-based environments.

- IoT Forensics on the Rise: Every connected device — from smartwatches to smart factories — is a potential source of digital evidence. Forensics teams are now preparing for the IoT data explosion.

- E-Discovery & Legal Tech: With more corporate and legal records going digital, e-discovery has become essential for compliance, litigation support, and internal audits.

Challenges ahead

India’s digital forensics market is set to surge—driven by rising cyber threats, stricter compliance demands, and the growing shift toward outsourced forensic services

Despite booming demand, the industry faces three major hurdles:

- Severe talent shortage: India needs over 90,000 trained professionals in digital forensics.

- High tooling costs: Most tools are expensive, proprietary, and dominated by foreign firms.

- Lack of Indian vendors: Few domestic players offer end-to-end solutions, unlike global leaders like Cellebrite, MSAB, and Magnet Forensics.

Also read: Forensic Auditors in India may soon need to be Chartered Accountants?

Wrapping up…

As cybercrime surges and digital ecosystems scale, India has a once-in-a-generation opportunity to lead the next frontier in cyber defence.

The opportunity? ₹11,800 crore.

The challenge? 90,000 unfilled roles.

As nicely mentioned by Vinayak Godse, CEO, of DSCI in his report, “The potential to shape a globally competitive digital forensics industry is within reach. But we need investment in talent, R&D, and partnerships.”