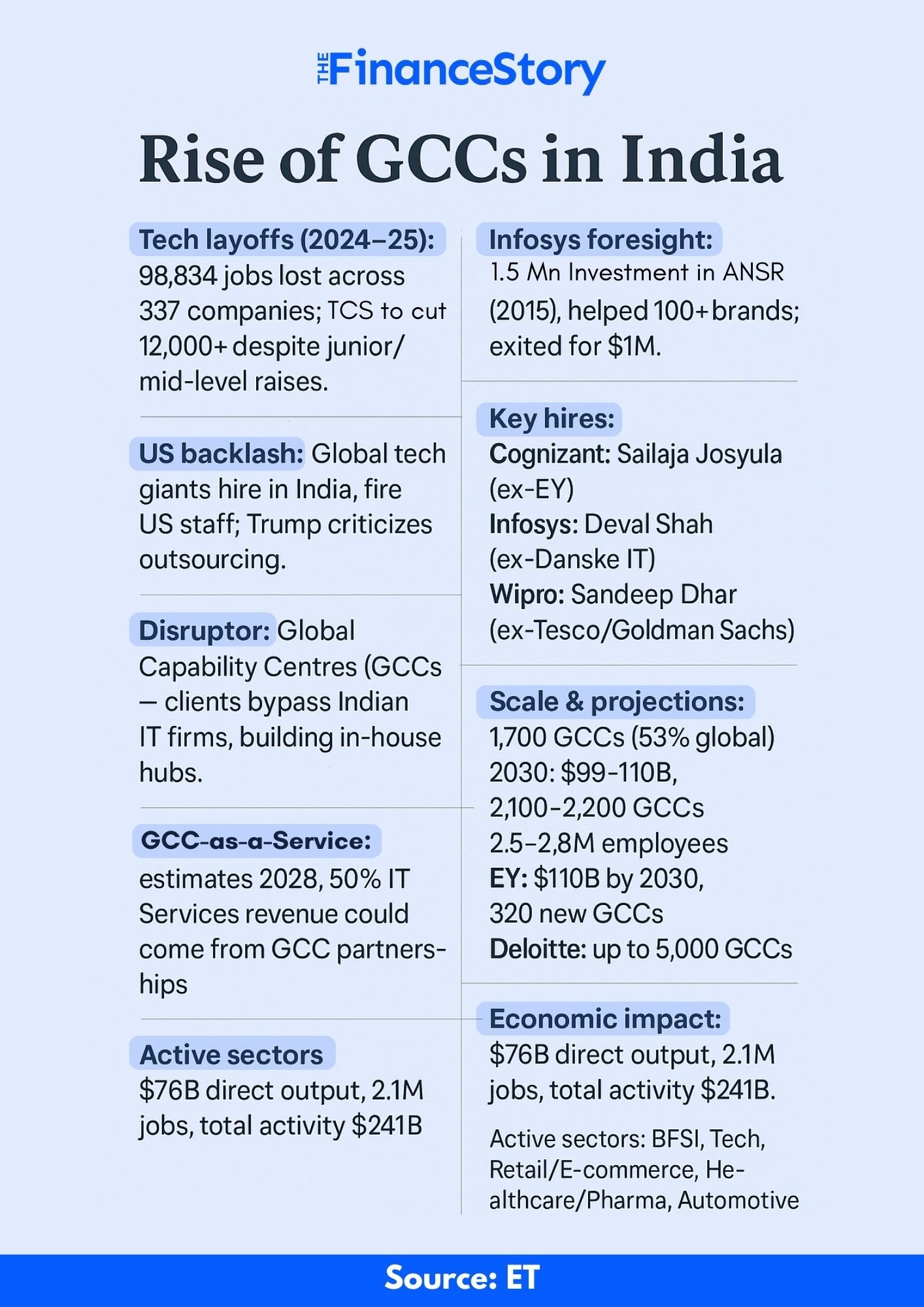

- According to Economic Times, 2024-2025 saw 98,834 tech employees lose their jobs across 337 companies in India.

- Even Global Tech giants are investing heavily in Indian talent while firing US employees, and Donald Trump is not happy!

- Sure, AI is part of the reason, but there’s another, quieter disruptor at play: Global Capability Centres (GCCs).

The silent shift

For decades, the business model for India’s IT giants was simple: Global corporations outsourced large chunks of work to Indian vendors like TCS, Infosys, and Wipro.

Now, those same clients are cutting out the middlemen (Indian IT Giants) and instead setting their own tech and operations hubs in India to do the work directly, faster, and cheaper.

The result? Indian IT firms are losing contracts, while GCCs are poaching top talent.

GCCs aren’t new…

They’ve been around in India for over 25 years.

But the last decade has seen their numbers surge, and the pandemic only accelerated the trend.

Infosys Vishal Sikka saw it coming

As reported by the Economic Times, in 2015, Infosys itself invested $1.4 million in ANSR.

ANSR is a global firm founded by Lalit Ahuja, in 2004. It has helped set up GCCs for over 100 global brands, including Target, Lowe’s, and Anheuser-Busch InBev.

They also represented a competitive threat to the traditional outsourcing model.

And here’s the irony…

Today, the same IT firms are losing contracts to GCCs!

To quote an example: By 2017, major clients like UBS had already shifted from 70% outsourced work to 60% handled internally.

Yes, Infosys exited the ANSR investment, selling its entire stake to Accel Partners for only $1 million.

Interestingly, recent analysis suggests Sikka’s early move wasn’t an aberration; he may have been ahead of the curve.

Also read: Deloitte’s Romal Shetty says: India’s next biggest job creator? GCCs

Donald Trump not happy either…

U.S. President Donald Trump has recently criticised major tech companies like Google, Microsoft, Apple, and Meta for outsourcing jobs to countries such as India.

What’s next for Indian IT Giants?

Infosys, Wipro, and Cognizant have all launched “GCC-as-a-Service” offerings: setting up, running, and eventually transferring GCC operations to the client.

To fuel the new offerings, firms have hired GCC leaders:

- Cognizant: Sailaja Josyula (ex-EY)

- Infosys: Deval Shah (ex-Danske IT)

- Wipro: Sandeep Dhar (ex-Tesco and Goldman Sachs India)

Industry estimates suggest that by 2028, over half of IT services revenue could come from GCC partnerships.

Wrapping up…

Wrapping up…

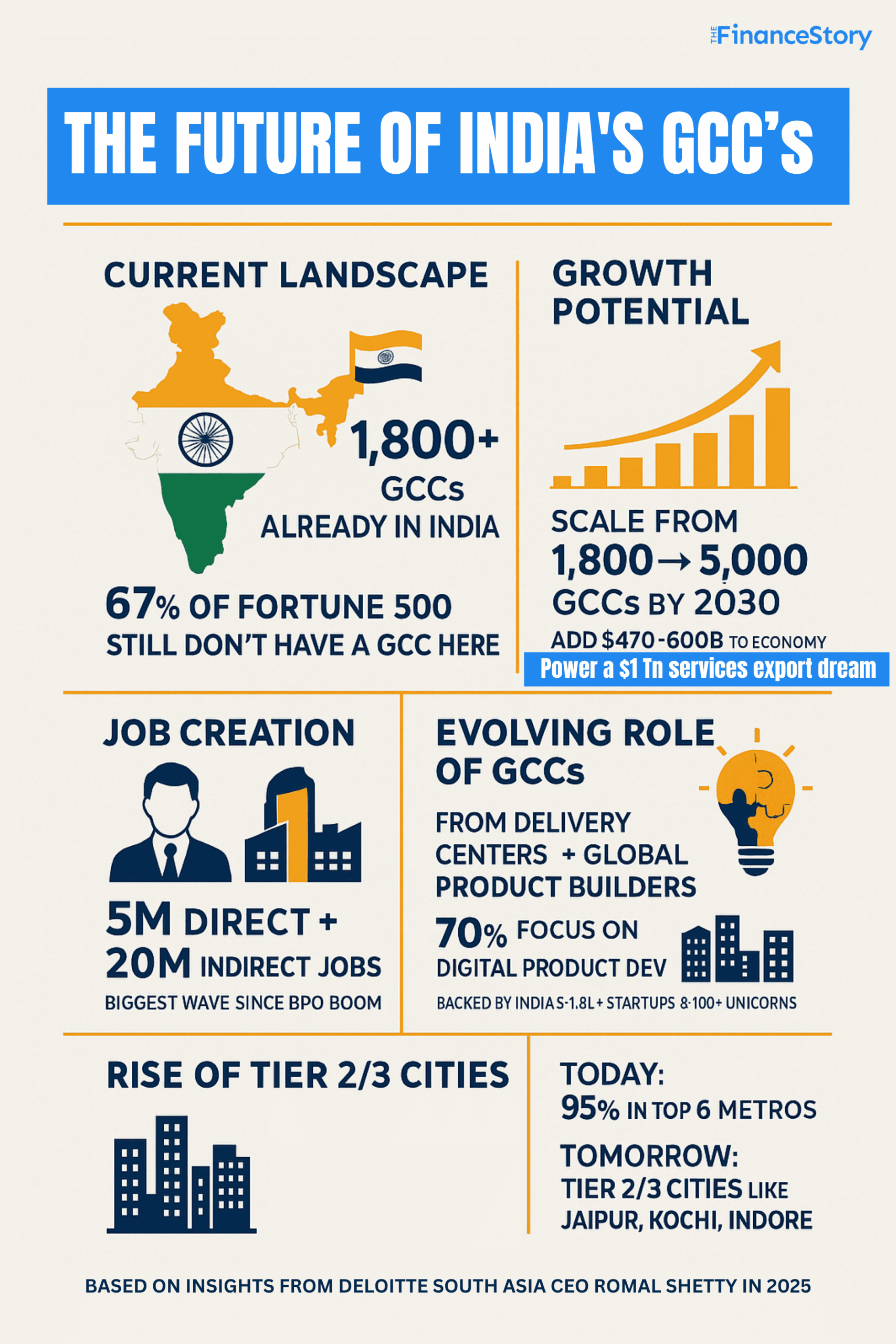

India is home to around 1,700 Global Capability Centers (GCCs), which account for 53% of all GCCs worldwide (Economic Times), as of 2025.

According to the Nasscom–Zinnov projection, by 2030, India’s GCC ecosystem is expected to become a $99–105 billion market, housing 2,100–2,200 GCCs and employing 2.5–2.8 million people.

In short, while GCCs are disrupting (or reshaping) traditional IT models, they are simultaneously powering India’s economy and creating high-value opportunities for talent.

Also read: Uttar Pradesh GCC Policy introduced: Aims to hit its $1 trillion economy!

FAQs

How big is the GCC market in India right now?

There are over 1,700 GCCs in India as of 2025, accounting for 53% of all global GCCs.

EY outlook: $110B market by 2030, up from $46B in 2023, with 320 new GCCs by 2025.

Deloitte’s Romal Shetty: India could see up to 5,000 GCCs by 2030.

Which sectors are most active in setting up GCCs?

- Banking, Financial Services & Insurance (BFSI)

- Technology & Software

- Retail & E-commerce

- Healthcare & Pharmaceuticals

- Automotive & Manufacturing